to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

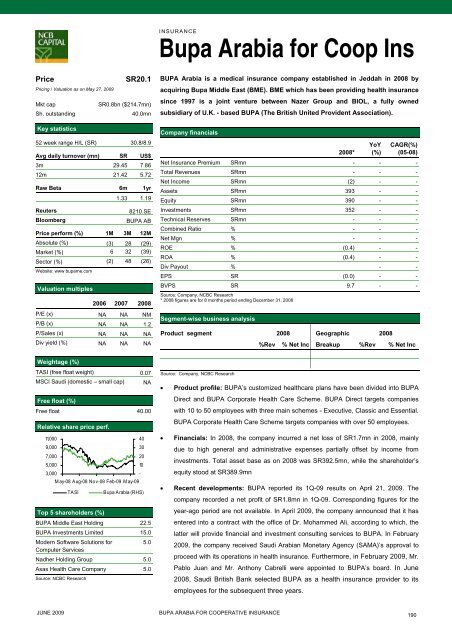

INSURANCEBupa Arabia for Coop InsPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR20.1SR0.8bn ($214.7mn)40.0mn52 week range H/L (SR) 30.8/8.9Avg daily turnover (mn) SR US$3m 29.45 7.8612m 21.42 5.72Raw Beta 6m 1yr1.33 1.19ReutersBloomberg8210.SEBUPA ABPrice perform (%) 1M 3M 12MAbsolute (%) (3) 28 (29)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (2) 48 (26)Website: www bupame.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) NA NA NMP/B (x) NA NA 1.2P/Sales (x) NA NA NADiv yield (%) NA NA NABUPA Arabia is a medical insurance <strong>com</strong>pany established in Jeddah in 2008 byacquiring Bupa Middle East (BME). BME which has been providing health insurancesince 1997 is a joint venture between Nazer Group and BIOL, a fully ownedsubsidiary of U.K. - based BUPA (The British United Provident Association).Company financials2008*YoY(%)CAGR(%)(05-08)Net Insurance Premium SRmn - - -Total Revenues SRmn - - -Net In<strong>com</strong>e SRmn (2) - -Assets SRmn 393 - -Equity SRmn 390 - -Investments SRmn 352 - -Technical Reserves SRmn - - -Combined Ratio % - - -Net Mgn % - - -ROE % (0.4) - -ROA % (0.4) - -Div Payout % - -EPS SR (0.0) - -BVPS SR 9.7 - -Source: Company, NCBC Research* 2008 figures are for 8 months period ending December 31, 2008Segment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncWeightage (%)TASI (free float weight) 0.07MSCI Saudi (domestic – small cap) NAFree float (%)Free float 40.00Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)40302010Bupa Arabia (RHS)BUPA Middle East Holding 22.5BUPA Investments Limited 15.0Modern Software Solutions for5.0Computer ServicesNadher Holding Group 5.0Asas Health Care Company 5.0Source: NCBC Research-Source: Company, NCBC Research• Product profile: BUPA’s cus<strong>to</strong>mized healthcare plans have been divided in<strong>to</strong> BUPADirect and BUPA Corporate Health Care Scheme. BUPA Direct targets <strong>com</strong>panieswith 10 <strong>to</strong> 50 employees with three main schemes - Executive, Classic and Essential.BUPA Corporate Health Care Scheme targets <strong>com</strong>panies with over 50 employees.• Financials: In 2008, <strong>the</strong> <strong>com</strong>pany incurred a net loss of SR1.7mn in 2008, mainlydue <strong>to</strong> high general and administrative expenses partially offset by in<strong>com</strong>e frominvestments. Total asset base as on 2008 was SR392.5mn, while <strong>the</strong> shareholder’sequity s<strong>to</strong>od at SR389.9mn• Recent developments: BUPA <strong>report</strong>ed its 1Q-09 results on April 21, 2009. The<strong>com</strong>pany recorded a net profit of SR1.8mn in 1Q-09. Corresponding figures for <strong>the</strong>year-ago period are not available. In April 2009, <strong>the</strong> <strong>com</strong>pany announced that it hasentered in<strong>to</strong> a contract with <strong>the</strong> office of Dr. Mohammed Ali, according <strong>to</strong> which, <strong>the</strong>latter will provide financial and investment consulting services <strong>to</strong> BUPA. In February2009, <strong>the</strong> <strong>com</strong>pany received Saudi Arabian Monetary Agency (SAMA)’s approval <strong>to</strong>proceed with its operations in health insurance. Fur<strong>the</strong>rmore, in February 2009, Mr.Pablo Juan and Mr. Anthony Cabrelli were appointed <strong>to</strong> BUPA’s board. In June2008, Saudi British Bank selected BUPA as a health insurance provider <strong>to</strong> itsemployees for <strong>the</strong> subsequent three years.JUNE 2009BUPA ARABIA FOR COOPERATIVE INSURANCE190