to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

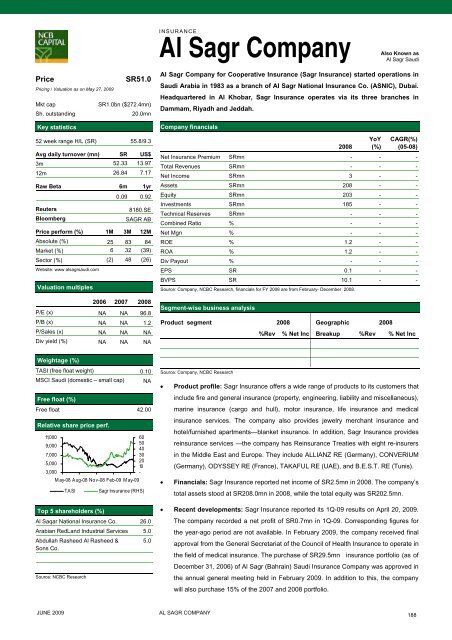

INSURANCEAl Sagr CompanyAlso Known asAl Sagr SaudiPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR51.0SR1.0bn ($272.4mn)20.0mn52 week range H/L (SR) 55.8/9.3Avg daily turnover (mn) SR US$3m 52.33 13.9712m 26.84 7.17Raw Beta 6m 1yr0.09 0.92ReutersBloomberg8180.SESAGR ABPrice perform (%) 1M 3M 12MAbsolute (%) 25 83 84Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (2) 48 (26)Website: www alsagrsaudi.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) NA NA 96.8P/B (x) NA NA 1.2P/Sales (x) NA NA NADiv yield (%) NA NA NAAl Sagr Company for Cooperative Insurance (Sagr Insurance) started operations inSaudi Arabia in 1983 as a branch of Al Sagr National Insurance Co. (ASNIC), Dubai.Headquartered in Al Khobar, Sagr Insurance operates via its three branches inDammam, Riyadh and Jeddah.Company financials2008YoY(%)CAGR(%)(05-08)Net Insurance Premium SRmn - - -Total Revenues SRmn - - -Net In<strong>com</strong>e SRmn 3 - -Assets SRmn 208 - -Equity SRmn 203 - -Investments SRmn 185 - -Technical Reserves SRmn - - -Combined Ratio % - - -Net Mgn % - - -ROE % 1.2 - -ROA % 1.2 - -Div Payout % - - -EPS SR 0.1 - -BVPS SR 10.1 - -Source: Company, NCBC Research, financials for FY 2008 are from February- December 2008.Segment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncWeightage (%)TASI (free float weight) 0.10MSCI Saudi (domestic – small cap) NAFree float (%)Free float 42.00Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)605040302010-Sagr Insurance (RHS)Al Saqar National Insurance Co. 26.0Arabian RedLand Industrial Services 5.0Abdullah Rasheed Al Rasheed & 5.0Sons Co.Source: NCBC ResearchSource: Company, NCBC Research• Product profile: Sagr Insurance offers a wide range of products <strong>to</strong> its cus<strong>to</strong>mers thatinclude fire and general insurance (property, engineering, liability and miscellaneous),marine insurance (cargo and hull), mo<strong>to</strong>r insurance, life insurance and medicalinsurance services. The <strong>com</strong>pany also provides jewelry merchant insurance andhotel/furnished apartments—blanket insurance. In addition, Sagr Insurance providesreinsurance services —<strong>the</strong> <strong>com</strong>pany has Reinsurance Treaties with eight re-insurersin <strong>the</strong> Middle East and Europe. They include ALLIANZ RE (Germany), CONVERIUM(Germany), ODYSSEY RE (France), TAKAFUL RE (UAE), and B.E.S.T. RE (Tunis).• Financials: Sagr Insurance <strong>report</strong>ed net in<strong>com</strong>e of SR2.5mn in 2008. The <strong>com</strong>pany’s<strong>to</strong>tal assets s<strong>to</strong>od at SR208.0mn in 2008, while <strong>the</strong> <strong>to</strong>tal equity was SR202.5mn.• Recent developments: Sagr Insurance <strong>report</strong>ed its 1Q-09 results on April 20, 2009.The <strong>com</strong>pany recorded a net profit of SR0.7mn in 1Q-09. Corresponding figures for<strong>the</strong> year-ago period are not available. In February 2009, <strong>the</strong> <strong>com</strong>pany received finalapproval from <strong>the</strong> General Secretariat of <strong>the</strong> Council of Health Insurance <strong>to</strong> operate in<strong>the</strong> field of medical insurance. The purchase of SR29.5mn insurance portfolio (as ofDecember 31, 2006) of Al Sagr (Bahrain) Saudi Insurance Company was approved in<strong>the</strong> annual general meeting held in February 2009. In addition <strong>to</strong> this, <strong>the</strong> <strong>com</strong>panywill also purchase 15% of <strong>the</strong> 2007 and 2008 portfolio.JUNE 2009AL SAGR COMPANY188