to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

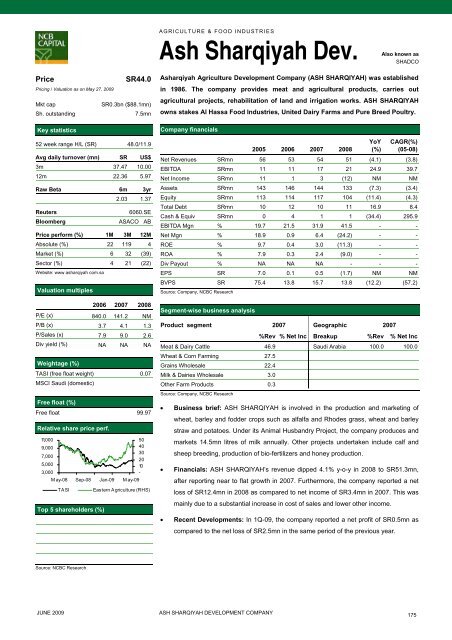

AGRICULTURE & FOOD INDUSTRIESAsh Sharqiyah Dev.Also known asSHADCOPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR44.0SR0.3bn ($88.1mn)7.5mn52 week range H/L (SR) 48.0/11.9Avg daily turnover (mn) SR US$3m 37.47 10.0012m 22.36 5.97Raw Beta 6m 3yr2.03 1.37ReutersBloomberg6060.SEASACO ABPrice perform (%) 1M 3M 12MAbsolute (%) 22 119 4Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 4 21 (22)Website: www asharqiyah <strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 840.0 141.2 NMP/B (x) 3.7 4.1 1.3P/Sales (x) 7.9 9.0 2.6Div yield (%) NA NA NAWeightage (%)TASI (free float weight) 0.07MSCI Saudi (domestic)Free float (%)Free float 99.97Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Sep-08 Jan-09 M ay-09TASITop 5 shareholders (%)5040302010-Eastern Agriculture (RHS)Asharqiyah Agriculture Development Company (ASH SHARQIYAH) was establishedin 1986. The <strong>com</strong>pany provides meat and agricultural products, carries outagricultural projects, rehabilitation of land and irrigation works. ASH SHARQIYAHowns stakes Al Hassa Food Industries, United Dairy Farms and Pure Breed Poultry.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 56 53 54 51 (4.1) (3.8)EBITDA SRmn 11 11 17 21 24.9 39.7Net In<strong>com</strong>e SRmn 11 1 3 (12) NM NMAssets SRmn 143 146 144 133 (7.3) (3.4)Equity SRmn 113 114 117 104 (11.4) (4.3)Total Debt SRmn 10 12 10 11 16.9 8.4Cash & Equiv SRmn 0 4 1 1 (34.4) 295.9EBITDA Mgn % 19.7 21.5 31.9 41.5 - -Net Mgn % 18.9 0.9 6.4 (24.2) - -ROE % 9.7 0.4 3.0 (11.3) - -ROA % 7.9 0.3 2.4 (9.0) - -Div Payout % NA NA NA - - -EPS SR 7.0 0.1 0.5 (1.7) NM NMBVPS SR 75.4 13.8 15.7 13.8 (12.2) (57.2)Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2007 Geographic 2007%Rev % Net Inc Breakup %Rev % Net IncMeat & Dairy Cattle 46.9 Saudi Arabia 100.0 100.0Wheat & Corn Farming 27.5Grains Wholesale 22.4Milk & Dairies Wholesale 3.0O<strong>the</strong>r Farm Products 0.3Source: Company, NCBC Research• Business brief: ASH SHARQIYAH is involved in <strong>the</strong> production and marketing ofwheat, barley and fodder crops such as alfalfa and Rhodes grass, wheat and barleystraw and pota<strong>to</strong>es. Under its Animal Husbandry Project, <strong>the</strong> <strong>com</strong>pany produces andmarkets 14.5mn litres of milk annually. O<strong>the</strong>r projects undertaken include calf andsheep breeding, production of bio-fertilizers and honey production.• Financials: ASH SHARQIYAH’s revenue dipped 4.1% y-o-y in 2008 <strong>to</strong> SR51.3mn,after <strong>report</strong>ing near <strong>to</strong> flat growth in 2007. Fur<strong>the</strong>rmore, <strong>the</strong> <strong>com</strong>pany <strong>report</strong>ed a netloss of SR12.4mn in 2008 as <strong>com</strong>pared <strong>to</strong> net in<strong>com</strong>e of SR3.4mn in 2007. This wasmainly due <strong>to</strong> a substantial increase in cost of sales and lower o<strong>the</strong>r in<strong>com</strong>e.• Recent Developments: In 1Q-09, <strong>the</strong> <strong>com</strong>pany <strong>report</strong>ed a net profit of SR0.5mn as<strong>com</strong>pared <strong>to</strong> <strong>the</strong> net loss of SR2.5mn in <strong>the</strong> same period of <strong>the</strong> previous year.Source: NCBC ResearchJUNE 2009ASH SHARQIYAH DEVELOPMENT COMPANY175