to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

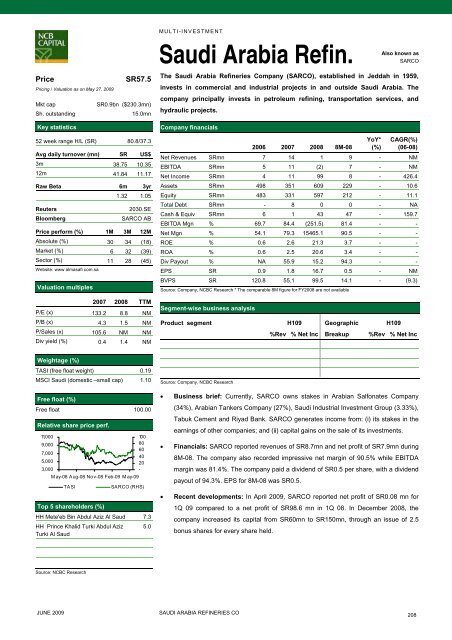

PriceSR57.5Pricing / Valuation as on May 27, 2009Mkt capSR0.9bn ($230.3mn)Sh. outstanding15.0mnKey statistics52 week range H/L (SR) 80.8/37.3Avg daily turnover (mn) SR US$3m 38.75 10.3512m 41.84 11.17Raw Beta 6m 3yr1.32 1.05Reuters2030.SEBloombergSARCO ABPrice perform (%) 1M 3M 12MAbsolute (%) 30 34 (18)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 28 (45)Website: www almasafi <strong>com</strong>.saValuation multiples2007 2008 TTMP/E (x) 133.2 8.8 NMP/B (x) 4.3 1.5 NMP/Sales (x) 105.6 NM NMDiv yield (%) 0.4 1.4 NMMULTI-INVESTMENTSaudi Arabia Refin.Also known asSARCOThe Saudi Arabia Refineries Company (SARCO), established in Jeddah in 1959,invests in <strong>com</strong>mercial and industrial projects in and outside Saudi Arabia. The<strong>com</strong>pany principally invests in petroleum refining, transportation services, andhydraulic projects.Company financials2006 2007 2008 8M-08YoY*(%)CAGR(%)(06-08)Net Revenues SRmn 7 14 1 9 - NMEBITDA SRmn 5 11 (2) 7 - NMNet In<strong>com</strong>e SRmn 4 11 99 8 - 426.4Assets SRmn 498 351 609 229 - 10.6Equity SRmn 483 331 597 212 - 11.1Total Debt SRmn - 8 0 0 - NACash & Equiv SRmn 6 1 43 47 - 159.7EBITDA Mgn % 69.7 84.4 (251.5) 81.4 - -Net Mgn % 54.1 79.3 15465.1 90.5 - -ROE % 0.6 2.6 21.3 3.7 - -ROA % 0.6 2.5 20.6 3.4 - -Div Payout % NA 55.9 15.2 94.3 - -EPS SR 0.9 1.8 16.7 0.5 - NMBVPS SR 120.8 55.1 99.5 14.1 - (9.3)Source: Company, NCBC Research * The <strong>com</strong>parable 8M figure for FY2008 are not availableSegment-wise business analysisProduct segment H109 Geographic H109%Rev % Net Inc Breakup %Rev % Net IncWeightage (%)TASI (free float weight) 0.19MSCI Saudi (domestic –small cap) 1.10Free float (%)Free float 100.00Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)10080604020-SARCO (RHS)HH Mete'eb Bin Abdul Aziz Al Saud 7.3HH Prince Khalid Turki Abdul Aziz 5.0Turki Al SaudSource: Company, NCBC Research• Business brief: Currently, SARCO owns stakes in Arabian Salfonates Company(34%), Arabian Tankers Company (27%), Saudi Industrial Investment Group (3.33%),Tabuk Cement and Riyad Bank. SARCO generates in<strong>com</strong>e from: (i) its stakes in <strong>the</strong>earnings of o<strong>the</strong>r <strong>com</strong>panies; and (ii) capital gains on <strong>the</strong> sale of its investments.• Financials: SARCO <strong>report</strong>ed revenues of SR8.7mn and net profit of SR7.9mn during8M-08. The <strong>com</strong>pany also recorded impressive net margin of 90.5% while EBITDAmargin was 81.4%. The <strong>com</strong>pany paid a dividend of SR0.5 per share, with a dividendpayout of 94.3%. EPS for 8M-08 was SR0.5.• Recent developments: In April 2009, SARCO <strong>report</strong>ed net profit of SR0.08 mn for1Q 09 <strong>com</strong>pared <strong>to</strong> a net profit of SR98.6 mn in 1Q 08. In December 2008, <strong>the</strong><strong>com</strong>pany increased its capital from SR60mn <strong>to</strong> SR150mn, through an issue of 2.5bonus shares for every share held.Source: NCBC ResearchJUNE 2009SAUDI ARABIA REFINERIES CO208