to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

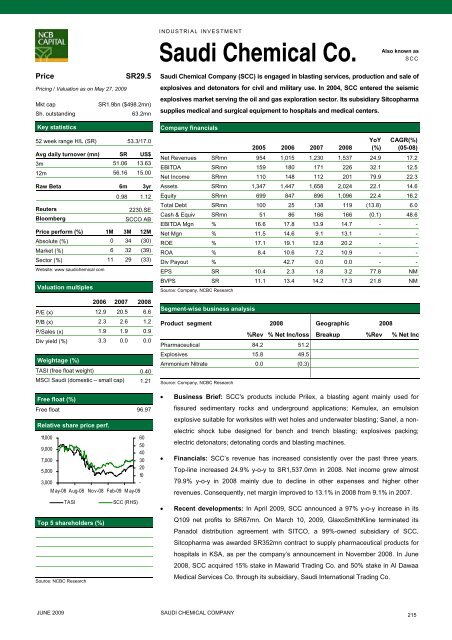

INDUSTRIAL INVESTMENTSaudi Chemical Co.Also known asSCCPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR29.5SR1.9bn ($498.2mn)63.2mn52 week range H/L (SR) 53.3/17.0Avg daily turnover (mn) SR US$3m 51.06 13.6312m 56.16 15.00Raw Beta 6m 3yr0.98 1.12ReutersBloomberg2230.SESCCO ABPrice perform (%) 1M 3M 12MAbsolute (%) 0 34 (30)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 29 (33)Website: www saudichemical <strong>com</strong>Valuation multiples2006 2007 2008P/E (x) 12.9 20.5 6.6P/B (x) 2.3 2.6 1.2P/Sales (x) 1.9 1.9 0.9Div yield (%) 3.3 0.0 0.0Weightage (%)TASI (free float weight) 0.40MSCI Saudi (domestic – small cap) 1.21Free float (%)Free float 96.97Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08TASITop 5 shareholders (%)Source: NCBC ResearchNov-08 Feb-09 M ay-09SCC (RHS)605040302010-Saudi Chemical Company (SCC) is engaged in blasting services, production and sale ofexplosives and de<strong>to</strong>na<strong>to</strong>rs for civil and military use. In 2004, SCC entered <strong>the</strong> seismicexplosives market serving <strong>the</strong> oil and gas exploration sec<strong>to</strong>r. Its subsidiary Sitcopharmasupplies medical and surgical equipment <strong>to</strong> hospitals and medical centers.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 954 1,015 1,230 1,537 24.9 17.2EBITDA SRmn 159 180 171 226 32.1 12.5Net In<strong>com</strong>e SRmn 110 148 112 201 79.9 22.3Assets SRmn 1,347 1,447 1,658 2,024 22.1 14.6Equity SRmn 699 847 896 1,096 22.4 16.2Total Debt SRmn 100 25 138 119 (13.8) 6.0Cash & Equiv SRmn 51 86 166 166 (0.1) 48.6EBITDA Mgn % 16.6 17.8 13.9 14.7 - -Net Mgn % 11.5 14.6 9.1 13.1 - -ROE % 17.1 19.1 12.8 20.2 - -ROA % 8.4 10.6 7.2 10.9 - -Div Payout % 42.7 0.0 0.0 - -EPS SR 10.4 2.3 1.8 3.2 77.8 NMBVPS SR 11.1 13.4 14.2 17.3 21.8 NMSource: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc/loss Breakup %Rev % Net IncPharmaceutical 84.2 51.2Explosives 15.8 49.5Ammonium Nitrate 0.0 (0.3)Source: Company, NCBC Research• Business Brief: SCC's products include Prilex, a blasting agent mainly used forfissured sedimentary rocks and underground applications; Kemulex, an emulsionexplosive suitable for worksites with wet holes and underwater blasting; Sanel, a nonelectricshock tube designed for bench and trench blasting; explosives packing;electric de<strong>to</strong>na<strong>to</strong>rs; de<strong>to</strong>nating cords and blasting machines.• Financials: SCC’s revenue has increased consistently over <strong>the</strong> past three years.Top-line increased 24.9% y-o-y <strong>to</strong> SR1,537.0mn in 2008. Net in<strong>com</strong>e grew almost79.9% y-o-y in 2008 mainly due <strong>to</strong> decline in o<strong>the</strong>r expenses and higher o<strong>the</strong>rrevenues. Consequently, net margin improved <strong>to</strong> 13.1% in 2008 from 9.1% in 2007.• Recent developments: In April 2009, SCC announced a 97% y-o-y increase in itsQ109 net profits <strong>to</strong> SR67mn. On March 10, 2009, GlaxoSmithKline terminated itsPanadol distribution agreement with SITCO, a 99%-owned subsidiary of SCC.Sitcopharma was awarded SR352mn contract <strong>to</strong> supply pharmaceutical products forhospitals in KSA, as per <strong>the</strong> <strong>com</strong>pany’s announcement in November 2008. In June2008, SCC acquired 15% stake in Mawarid Trading Co. and 50% stake in Al DawaaMedical Services Co. through its subsidiary, Saudi International Trading Co.JUNE 2009SAUDI CHEMICAL COMPANY215