to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

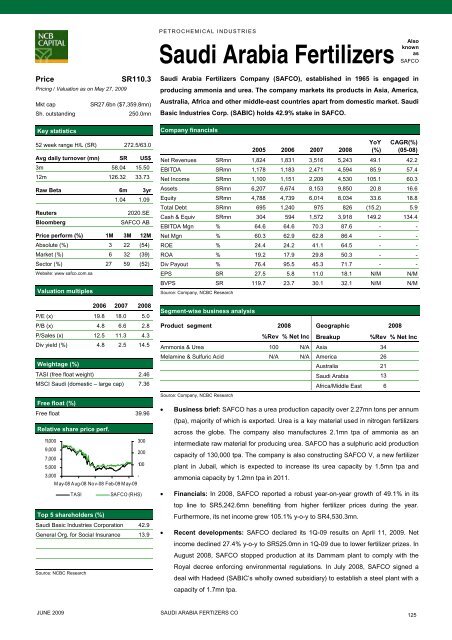

PETROCHEMICAL INDUSTRIESSaudi Arabia FertilizersAlsoknownasSAFCOPriceSR110.3Pricing / Valuation as on May 27, 2009Mkt capSR27.6bn ($7,359.8mn)Sh. outstanding250.0mnKey statistics52 week range H/L (SR) 272.5/63.0Avg daily turnover (mn) SR US$3m 58.04 15.5012m 126.32 33.73Raw Beta 6m 3yr1.04 1.09Reuters2020.SEBloombergSAFCO ABPrice perform (%) 1M 3M 12MAbsolute (%) 3 22 (54)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 27 59 (52)Website: www safco.<strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 19.8 18.0 5.0P/B (x) 4.8 6.6 2.8P/Sales (x) 12.5 11.3 4.3Div yield (%) 4.8 2.5 14.5Weightage (%)TASI (free float weight) 2.46MSCI Saudi (domestic – large cap) 7.36Free float (%)Free float 39.96Relative share price perf.11,0003009,0002007,0005,0001003,000-M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASISAFCO (RHS)Top 5 shareholders (%)Saudi Basic Industries Corporation 42.9General Org. for Social Insurance 13.9Source: NCBC ResearchSaudi Arabia Fertilizers Company (SAFCO), established in 1965 is engaged inproducing ammonia and urea. The <strong>com</strong>pany markets its products in Asia, America,Australia, Africa and o<strong>the</strong>r middle-east countries apart from domestic market. SaudiBasic Industries Corp. (SABIC) holds 42.9% stake in SAFCO.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 1,824 1,831 3,516 5,243 49.1 42.2EBITDA SRmn 1,178 1,183 2,471 4,594 85.9 57.4Net In<strong>com</strong>e SRmn 1,100 1,151 2,209 4,530 105.1 60.3Assets SRmn 6,207 6,674 8,153 9,850 20.8 16.6Equity SRmn 4,788 4,739 6,014 8,034 33.6 18.8Total Debt SRmn 695 1,240 975 826 (15.2) 5.9Cash & Equiv SRmn 304 594 1,572 3,918 149.2 134.4EBITDA Mgn % 64.6 64.6 70.3 87.6 - -Net Mgn % 60.3 62.9 62.8 86.4 - -ROE % 24.4 24.2 41.1 64.5 - -ROA % 19.2 17.9 29.8 50.3 - -Div Payout % 76.4 95.5 45.3 71.7 - -EPS SR 27.5 5.8 11.0 18.1 N/M N/MBVPS SR 119.7 23.7 30.1 32.1 N/M N/MSource: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncAmmonia & Urea 100 N/A Asia 34Melamine & Sulfuric Acid N/A N/A America 26Australia 21Saudi Arabia 13Africa/Middle East 6Source: Company, NCBC Research• Business brief: SAFCO has a urea production capacity over 2.27mn <strong>to</strong>ns per annum(tpa), majority of which is exported. Urea is a key material used in nitrogen fertilizersacross <strong>the</strong> globe. The <strong>com</strong>pany also manufactures 2.1mn tpa of ammonia as anintermediate raw material for producing urea. SAFCO has a sulphuric acid productioncapacity of 130,000 tpa. The <strong>com</strong>pany is also constructing SAFCO V, a new fertilizerplant in Jubail, which is expected <strong>to</strong> increase its urea capacity by 1.5mn tpa andammonia capacity by 1.2mn tpa in 2011.• Financials: In 2008, SAFCO <strong>report</strong>ed a robust year-on-year growth of 49.1% in its<strong>to</strong>p line <strong>to</strong> SR5,242.6mn benefiting from higher fertilizer prices during <strong>the</strong> year.Fur<strong>the</strong>rmore, its net in<strong>com</strong>e grew 105.1% y-o-y <strong>to</strong> SR4,530.3mn.• Recent developments: SAFCO declared its 1Q-09 results on April 11, 2009. Netin<strong>com</strong>e declined 27.4% y-o-y <strong>to</strong> SR525.0mn in 1Q-09 due <strong>to</strong> lower fertilizer prizes. InAugust 2008, SAFCO s<strong>to</strong>pped production at its Dammam plant <strong>to</strong> <strong>com</strong>ply with <strong>the</strong>Royal decree enforcing environmental regulations. In July 2008, SAFCO signed adeal with Hadeed (SABIC’s wholly owned subsidiary) <strong>to</strong> establish a steel plant with acapacity of 1.7mn tpa.JUNE 2009SAUDI ARABIA FERTIZERS CO125