to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

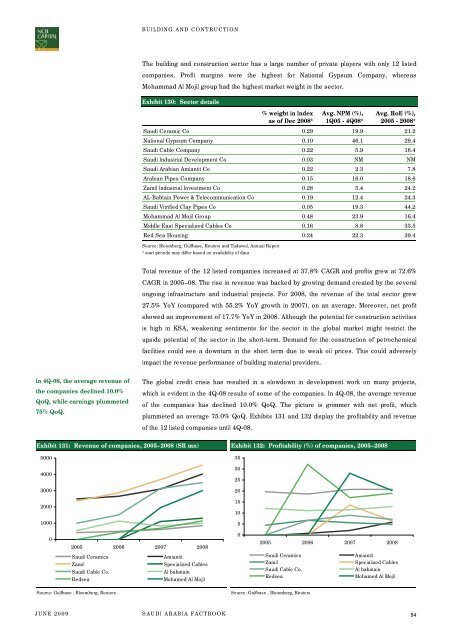

BUILDING AND CONTRUCTIONThe building and construction sec<strong>to</strong>r has a large number of private players with only 12 listed<strong>com</strong>panies. Profit margins were <strong>the</strong> highest for National Gypsum Company, whereasMohammad Al Mojil group had <strong>the</strong> highest market weight in <strong>the</strong> sec<strong>to</strong>r.Exhibit 130: Sec<strong>to</strong>r details% weight in Indexas of Dec 2008*Avg. NPM (%),1Q05 - 4Q08*Avg. RoE (%),2005 - 2008*Saudi Ceramic Co 0.29 19.9 21.2National Gypsum Company 0.10 46.1 29.4Saudi Cable Company 0.22 5.9 18.4Saudi Industrial Development Co 0.03 NM NMSaudi Arabian Amiantit Co 0.22 2.3 7.8Arabian Pipes Company 0.15 16.0 18.6Zamil Industrial Investment Co 0.28 5.4 24.2AL-Babtain Power & Tele<strong>com</strong>munication Co 0.19 12.4 24.3Saudi Vitrified Clay Pipes Co 0.05 19.3 44.2Mohammad Al Mojil Group 0.48 23.9 16.4Middle East Specialized Cables Co 0.16 8.8 33.5Red Sea Housing 0.24 22.3 39.4Source: Bloomberg, Gulfbase, Reuters and Tadawul, Annual Report* start periods may differ based on availability of dataTotal revenue of <strong>the</strong> 12 listed <strong>com</strong>panies increased at 37.8% CAGR and profits grew at 72.6%CAGR in 2005–08. The rise in revenue was backed by growing demand created by <strong>the</strong> severalongoing infrastructure and industrial projects. For 2008, <strong>the</strong> revenue of <strong>the</strong> <strong>to</strong>tal sec<strong>to</strong>r grew27.5% YoY (<strong>com</strong>pared with 55.2% YoY growth in 2007), on an average. Moreover, net profitshowed an improvement of 17.7% YoY in 2008. Although <strong>the</strong> potential for construction activitiesis high in KSA, weakening sentiments for <strong>the</strong> sec<strong>to</strong>r in <strong>the</strong> global market might restrict <strong>the</strong>upside potential of <strong>the</strong> sec<strong>to</strong>r in <strong>the</strong> short-term. Demand for <strong>the</strong> construction of petrochemicalfacilities could see a downturn in <strong>the</strong> short term due <strong>to</strong> weak oil prices. This could adverselyimpact <strong>the</strong> revenue performance of building material providers.In 4Q-08, <strong>the</strong> average revenue of<strong>the</strong> <strong>com</strong>panies declined 10.0%QoQ, while earnings plummeted75% QoQ.The global credit crisis has resulted in a slowdown in development work on many projects,which is evident in <strong>the</strong> 4Q-08 results of some of <strong>the</strong> <strong>com</strong>panies. In 4Q-08, <strong>the</strong> average revenueof <strong>the</strong> <strong>com</strong>panies has declined 10.0% QoQ. The picture is grimmer with net profit, whichplummeted an average 75.0% QoQ. Exhibits 131 and 132 display <strong>the</strong> profitability and revenueof <strong>the</strong> 12 listed <strong>com</strong>panies until 4Q-08.Exhibit 131: Revenue of <strong>com</strong>panies, 2005–2008 (SR mn) Exhibit 132: Profitability (%) of <strong>com</strong>panies, 2005–200850003540003025300020200015101000502005 2006 2007 2008Saudi CeramicsAmiantitZamilSpecialized CablesSaudi Cable Co.Al babatainRedseaMohamed Al Mojil02005 2006 2007 2008Saudi CeramicsAmiantitZamilSpecialized CablesSaudi Cable Co.Al babatainRedseaMohamed Al MojilSource: Gulfbase , Bloomberg, ReutersSource: Gulfbase , Bloomberg, ReutersJUNE 2009SAUDI ARABIA FACTBOOK84