to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

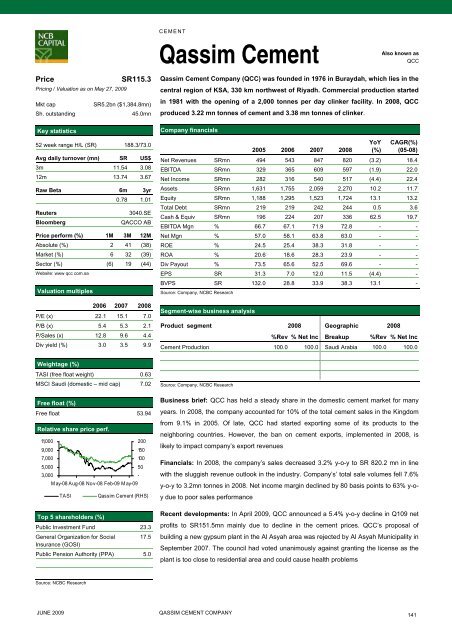

CEMENTQassim CementAlso known asQCCPriceSR115.3Pricing / Valuation as on May 27, 2009Mkt capSR5.2bn ($1,384.8mn)Sh. outstanding45.0mnKey statistics52 week range H/L (SR) 188.3/73.0Avg daily turnover (mn) SR US$3m 11.54 3.0812m 13.74 3.67Raw Beta 6m 3yr0.78 1.01Reuters3040.SEBloombergQACCO ABPrice perform (%) 1M 3M 12MAbsolute (%) 2 41 (38)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (6) 19 (44)Website: www qcc <strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 22.1 15.1 7.0P/B (x) 5.4 5.3 2.1P/Sales (x) 12.8 9.6 4.4Div yield (%) 3.0 3.5 9.9Qassim Cement Company (QCC) was founded in 1976 in Buraydah, which lies in <strong>the</strong>central region of KSA, 330 km northwest of Riyadh. Commercial production startedin 1981 with <strong>the</strong> opening of a 2,000 <strong>to</strong>nnes per day clinker facility. In 2008, QCCproduced 3.22 mn <strong>to</strong>nnes of cement and 3.38 mn <strong>to</strong>nnes of clinker.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 494 543 847 820 (3.2) 18.4EBITDA SRmn 329 365 609 597 (1.9) 22.0Net In<strong>com</strong>e SRmn 282 316 540 517 (4.4) 22.4Assets SRmn 1,631 1,755 2,059 2,270 10.2 11.7Equity SRmn 1,188 1,295 1,523 1,724 13.1 13.2Total Debt SRmn 219 219 242 244 0.5 3.6Cash & Equiv SRmn 196 224 207 336 62.5 19.7EBITDA Mgn % 66.7 67.1 71.9 72.8 - -Net Mgn % 57.0 58.1 63.8 63.0 - -ROE % 24.5 25.4 38.3 31.8 - -ROA % 20.6 18.6 28.3 23.9 - -Div Payout % 73.5 65.6 52.5 69.6 - -EPS SR 31.3 7.0 12.0 11.5 (4.4) -BVPS SR 132.0 28.8 33.9 38.3 13.1 -Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncCement Production 100.0 100.0 Saudi Arabia 100.0 100.0Weightage (%)TASI (free float weight) 0.63MSCI Saudi (domestic – mid cap) 7.02Free float (%)Free float 53.94Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)20015010050Qassim Cement (RHS)Public Investment Fund 23.3General Organization for Social 17.5Insurance (GOSI)Public Pension Authority (PPA) 5.0-Source: Company, NCBC ResearchBusiness brief: QCC has held a steady share in <strong>the</strong> domestic cement market for manyyears. In 2008, <strong>the</strong> <strong>com</strong>pany accounted for 10% of <strong>the</strong> <strong>to</strong>tal cement sales in <strong>the</strong> Kingdomfrom 9.1% in 2005. Of late, QCC had started exporting some of its products <strong>to</strong> <strong>the</strong>neighboring countries. However, <strong>the</strong> ban on cement exports, implemented in 2008, islikely <strong>to</strong> impact <strong>com</strong>pany’s export revenuesFinancials: In 2008, <strong>the</strong> <strong>com</strong>pany’s sales decreased 3.2% y-o-y <strong>to</strong> SR 820.2 mn in linewith <strong>the</strong> sluggish revenue outlook in <strong>the</strong> industry. Company’s’ <strong>to</strong>tal sale volumes fell 7.6%y-o-y <strong>to</strong> 3.2mn <strong>to</strong>nnes in 2008. Net in<strong>com</strong>e margin declined by 80 basis points <strong>to</strong> 63% y-oydue <strong>to</strong> poor sales performanceRecent developments: In April 2009, QCC announced a 5.4% y-o-y decline in Q109 netprofits <strong>to</strong> SR151.5mn mainly due <strong>to</strong> decline in <strong>the</strong> cement prices. QCC’s proposal ofbuilding a new gypsum plant in <strong>the</strong> Al Asyah area was rejected by Al Asyah Municipality inSeptember 2007. The council had voted unanimously against granting <strong>the</strong> license as <strong>the</strong>plant is <strong>to</strong>o close <strong>to</strong> residential area and could cause health problemsSource: NCBC ResearchJUNE 2009QASSIM CEMENT COMPANY141