to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

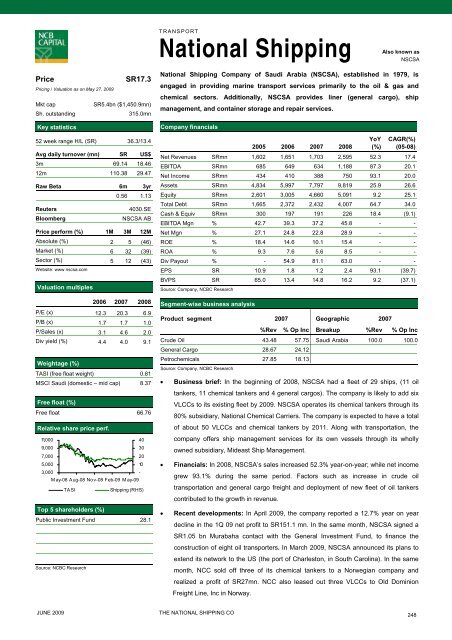

TRANSPORTNational ShippingAlso known asNSCSAPriceSR17.3Pricing / Valuation as on May 27, 2009Mkt capSR5.4bn ($1,450.9mn)Sh. outstanding315.0mnKey statistics52 week range H/L (SR) 36.3/13.4Avg daily turnover (mn) SR US$3m 69.14 18.4612m 110.38 29.47Raw Beta 6m 3yr0.56 1.13Reuters4030.SEBloombergNSCSA ABPrice perform (%) 1M 3M 12MAbsolute (%) 2 5 (46)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 5 12 (43)Website: www nscsa.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) 12.3 20.3 6.9P/B (x) 1.7 1.7 1.0P/Sales (x) 3.1 4.6 2.0Div yield (%) 4.4 4.0 9.1Weightage (%)TASI (free float weight) 0.81MSCI Saudi (domestic – mid cap) 8.37Free float (%)Free float 66.76Relative share price perf.11,000409,000307,000205,000103,000-M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASIShipping (RHS)Top 5 shareholders (%)Public Investment Fund 28.1Source: NCBC ResearchNational Shipping Company of Saudi Arabia (NSCSA), established in 1979, isengaged in providing marine transport services primarily <strong>to</strong> <strong>the</strong> oil & gas andchemical sec<strong>to</strong>rs. Additionally, NSCSA provides liner (general cargo), shipmanagement, and container s<strong>to</strong>rage and repair services.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 1,602 1,651 1,703 2,595 52.3 17.4EBITDA SRmn 685 649 634 1,188 87.3 20.1Net In<strong>com</strong>e SRmn 434 410 388 750 93.1 20.0Assets SRmn 4,834 5,997 7,797 9,819 25.9 26.6Equity SRmn 2,601 3,005 4,660 5,091 9.2 25.1Total Debt SRmn 1,665 2,372 2,432 4,007 64.7 34.0Cash & Equiv SRmn 300 197 191 226 18.4 (9.1)EBITDA Mgn % 42.7 39.3 37.2 45.8 - -Net Mgn % 27.1 24.8 22.8 28.9 - -ROE % 18.4 14.6 10.1 15.4 - -ROA % 9.3 7.6 5.6 8.5 - -Div Payout % - 54.9 81.1 63.0 - -EPS SR 10.9 1.8 1.2 2.4 93.1 (39.7)BVPS SR 65.0 13.4 14.8 16.2 9.2 (37.1)Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2007 Geographic 2007%Rev % Op Inc Breakup %Rev % Op IncCrude Oil 43.48 57.75 Saudi Arabia 100.0 100.0General Cargo 28.67 24.12Petrochemicals 27.85 18.13Source: Company, NCBC Research• Business brief: In <strong>the</strong> beginning of 2008, NSCSA had a fleet of 29 ships, (11 oiltankers, 11 chemical tankers and 4 general cargos). The <strong>com</strong>pany is likely <strong>to</strong> add sixVLCCs <strong>to</strong> its existing fleet by 2009. NSCSA operates its chemical tankers through its80% subsidiary, National Chemical Carriers. The <strong>com</strong>pany is expected <strong>to</strong> have a <strong>to</strong>talof about 50 VLCCs and chemical tankers by 2011. Along with transportation, <strong>the</strong><strong>com</strong>pany offers ship management services for its own vessels through its whollyowned subsidiary, Mideast Ship Management.• Financials: In 2008, NSCSA’s sales increased 52.3% year-on-year; while net in<strong>com</strong>egrew 93.1% during <strong>the</strong> same period. Fac<strong>to</strong>rs such as increase in crude oiltransportation and general cargo freight and deployment of new fleet of oil tankerscontributed <strong>to</strong> <strong>the</strong> growth in revenue.• Recent developments: In April 2009, <strong>the</strong> <strong>com</strong>pany <strong>report</strong>ed a 12.7% year on yeardecline in <strong>the</strong> 1Q 09 net profit <strong>to</strong> SR151.1 mn. In <strong>the</strong> same month, NSCSA signed aSR1.05 bn Murabaha contact with <strong>the</strong> General Investment Fund, <strong>to</strong> finance <strong>the</strong>construction of eight oil transporters. In March 2009, NSCSA announced its plans <strong>to</strong>extend its network <strong>to</strong> <strong>the</strong> US (<strong>the</strong> port of Charles<strong>to</strong>n, in South Carolina). In <strong>the</strong> samemonth, NCC sold off three of its chemical tankers <strong>to</strong> a Norwegian <strong>com</strong>pany andrealized a profit of SR27mn. NCC also leased out three VLCCs <strong>to</strong> Old DominionFreight Line, Inc in Norway.JUNE 2009THE NATIONAL SHIPPING CO248