to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

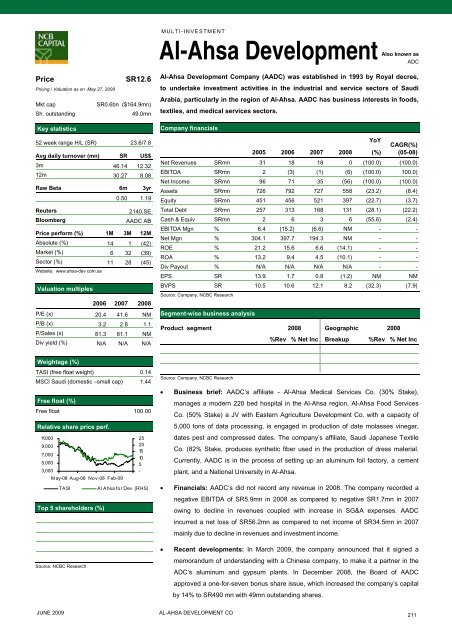

MULTI-INVESTMENTAl-Ahsa DevelopmentAlsoknown asADCPriceSR12.6Pricing / Valuation as on May 27, 2009Mkt capSR0.6bn ($164.9mn)Sh. outstanding49.0mnKey statistics52 week range H/L (SR) 23.6/7.8Avg daily turnover (mn) SR US$3m 46.14 12.3212m 30.27 8.08Raw Beta 6m 3yr0.50 1.19Reuters2140.SEBloombergAADC ABPrice perform (%) 1M 3M 12MAbsolute (%) 14 1 (42)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 28 (45)Website: www.ahsa-dev <strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 20.4 41.6 NMP/B (x) 3.2 2.8 1.1P/Sales (x) 81.3 81.1 NMDiv yield (%) N/A N/A N/AAl-Ahsa Development Company (AADC) was established in 1993 by Royal decree,<strong>to</strong> undertake investment activities in <strong>the</strong> industrial and service sec<strong>to</strong>rs of SaudiArabia, particularly in <strong>the</strong> region of Al-Ahsa. AADC has business interests in foods,textiles, and medical services sec<strong>to</strong>rs.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 31 18 18 0 (100.0) (100.0)EBITDA SRmn 2 (3) (1) (6) (100.0) 100.0)Net In<strong>com</strong>e SRmn 96 71 35 (56) (100.0) (100.0)Assets SRmn 726 792 727 558 (23.2) (8.4)Equity SRmn 451 456 521 397 (22.7) (3.7)Total Debt SRmn 257 313 168 131 (28.1) (22.2)Cash & Equiv SRmn 2 6 3 6 (55.6) (2.4)EBITDA Mgn % 6.4 (15.2) (6.6) NM - -Net Mgn % 304.1 397.7 194.3 NM - -ROE % 21.2 15.6 6.6 (14.1) - -ROA % 13.2 9.4 4.5 (10.1) - -Div Payout % N/A N/A N/A N/A - -EPS SR 13.9 1.7 0.8 (1.2) NM NMBVPS SR 10.5 10.6 12.1 8.2 (32.3) (7.9)Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncWeightage (%)TASI (free float weight) 0.14MSCI Saudi (domestic –small cap) 1.44Free float (%)Free float 100.00Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09TASITop 5 shareholders (%)252015105-Al Ahsa for Dev. (RHS)Source: Company, NCBC Research• Business brief: AADC’s affiliate - Al-Ahsa Medical Services Co. (30% Stake),manages a modern 220 bed hospital in <strong>the</strong> Al-Ahsa region, Al-Ahsa Food ServicesCo. (50% Stake) a JV with Eastern Agriculture Development Co. with a capacity of5,000 <strong>to</strong>ns of data processing, is engaged in production of date molasses vinegar,dates pest and <strong>com</strong>pressed dates. The <strong>com</strong>pany’s affiliate, Saudi Japanese TextileCo. (82% Stake, produces syn<strong>the</strong>tic fiber used in <strong>the</strong> production of dress material.Currently, AADC is in <strong>the</strong> process of setting up an aluminum foil fac<strong>to</strong>ry, a cementplant, and a National University in Al-Ahsa.• Financials: AADC’s did not record any revenue in 2008. The <strong>com</strong>pany recorded anegative EBITDA of SR5.9mn in 2008 as <strong>com</strong>pared <strong>to</strong> negative SR1.7mn in 2007owing <strong>to</strong> decline in revenues coupled with increase in SG&A expenses. AADCincurred a net loss of SR56.2mn as <strong>com</strong>pared <strong>to</strong> net in<strong>com</strong>e of SR34.5mn in 2007mainly due <strong>to</strong> decline in revenues and investment in<strong>com</strong>e.• Recent developments: In March 2009, <strong>the</strong> <strong>com</strong>pany announced that it signed aSource: NCBC Researchmemorandum of understanding with a Chinese <strong>com</strong>pany, <strong>to</strong> make it a partner in <strong>the</strong>ADC’s aluminum and gypsum plants. In December 2008, <strong>the</strong> Board of AADCapproved a one-for-seven bonus share issue, which increased <strong>the</strong> <strong>com</strong>pany’s capitalby 14% <strong>to</strong> SR490 mn with 49mn outstanding shares.JUNE 2009AL-AHSA DEVELOPMENT CO211