to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

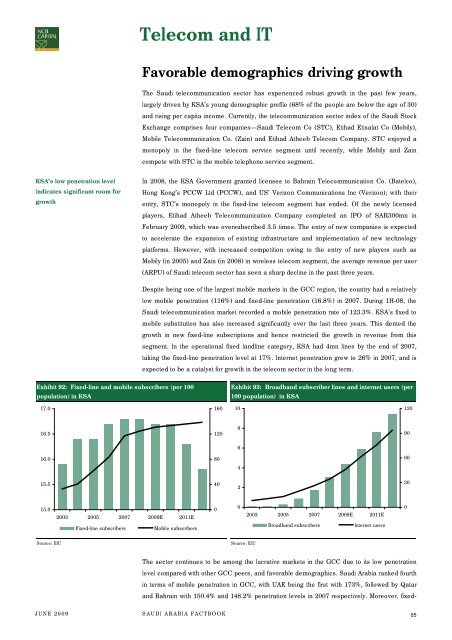

Tele<strong>com</strong> and ITFavorable demographics driving growthThe Saudi tele<strong>com</strong>munication sec<strong>to</strong>r has experienced robust growth in <strong>the</strong> past few years,largely driven by KSA’s young demographic profile (68% of <strong>the</strong> people are below <strong>the</strong> age of 30)and rising per capita in<strong>com</strong>e. Currently, <strong>the</strong> tele<strong>com</strong>munication sec<strong>to</strong>r index of <strong>the</strong> Saudi S<strong>to</strong>ckExchange <strong>com</strong>prises four <strong>com</strong>panies—Saudi Tele<strong>com</strong> Co (STC), Etihad Etisalat Co (Mobily),Mobile Tele<strong>com</strong>munication Co. (Zain) and Etihad A<strong>the</strong>eb Tele<strong>com</strong> Company. STC enjoyed amonopoly in <strong>the</strong> fixed-line tele<strong>com</strong> service segment until recently, while Mobily and Zain<strong>com</strong>pete with STC in <strong>the</strong> mobile telephone service segment.KSA’s low penetration levelindicates significant room forgrowthIn 2008, <strong>the</strong> KSA Government granted licenses <strong>to</strong> Bahrain Tele<strong>com</strong>munication Co. (Batelco),Hong Kong’s PCCW Ltd (PCCW), and US’ Verizon Communications Inc (Verizon); with <strong>the</strong>irentry, STC’s monopoly in <strong>the</strong> fixed-line tele<strong>com</strong> segment has ended. Of <strong>the</strong> newly licensedplayers, Etihad A<strong>the</strong>eb Tele<strong>com</strong>munication Company <strong><strong>com</strong>plete</strong>d an IPO of SAR300mn inFebruary 2009, which was oversubscribed 3.5 times. The entry of new <strong>com</strong>panies is expected<strong>to</strong> accelerate <strong>the</strong> expansion of existing infrastructure and implementation of new technologyplatforms. However, with increased <strong>com</strong>petition owing <strong>to</strong> <strong>the</strong> entry of new players such asMobily (in 2005) and Zain (in 2008) in wireless tele<strong>com</strong> segment, <strong>the</strong> average revenue per user(ARPU) of Saudi tele<strong>com</strong> sec<strong>to</strong>r has seen a sharp decline in <strong>the</strong> past three years.Despite being one of <strong>the</strong> largest mobile markets in <strong>the</strong> GCC region, <strong>the</strong> country had a relativelylow mobile penetration (116%) and fixed-line penetration (16.8%) in 2007. During 1H-08, <strong>the</strong>Saudi tele<strong>com</strong>munication market recorded a mobile penetration rate of 123.3%. KSA’s fixed <strong>to</strong>mobile substitution has also increased significantly over <strong>the</strong> last three years. This dented <strong>the</strong>growth in new fixed-line subscriptions and hence restricted <strong>the</strong> growth in revenue from thissegment. In <strong>the</strong> operational fixed landline category, KSA had 4mn lines by <strong>the</strong> end of 2007,taking <strong>the</strong> fixed-line penetration level at 17%. Internet penetration grew <strong>to</strong> 26% in 2007, and isexpected <strong>to</strong> be a catalyst for growth in <strong>the</strong> tele<strong>com</strong> sec<strong>to</strong>r in <strong>the</strong> long term.Exhibit 92: Fixed-line and mobile subscribers (per 100population) in KSAExhibit 93: Broadband subscriber lines and internet users (per100 population) in KSA17.01601012016.5120890616.08060415.54023015.02003 2005 2007 2009E 2011EFixed-line subscribersMobile subscribers002003 2005 2007 2009E 2011EBroadband subscribersInternet users0Source: EIUSource: EIUThe sec<strong>to</strong>r continues <strong>to</strong> be among <strong>the</strong> lucrative markets in <strong>the</strong> GCC due <strong>to</strong> its low penetrationlevel <strong>com</strong>pared with o<strong>the</strong>r GCC peers, and favorable demographics. Saudi Arabia ranked fourthin terms of mobile penetration in GCC, with UAE being <strong>the</strong> first with 173%, followed by Qatarand Bahrain with 150.4% and 148.2% penetration levels in 2007 respectively. Moreover, fixed-JUNE 2009SAUDI ARABIA FACTBOOK65