to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

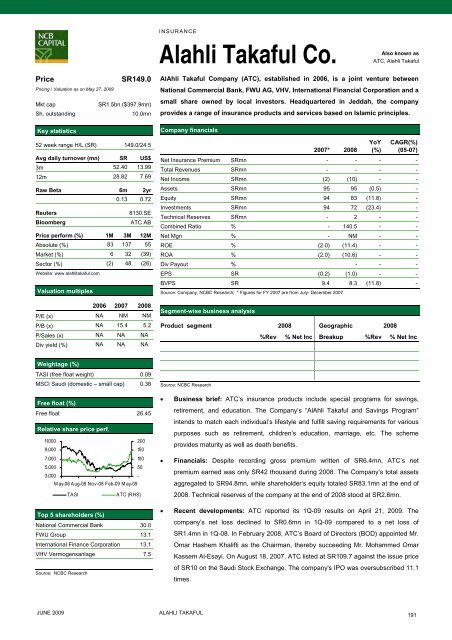

INSURANCEAlahli Takaful Co.Also known asATC, Alahli TakafulPriceSR149.0Pricing / Valuation as on May 27, 2009Mkt capSR1.5bn ($397.9mn)Sh. outstanding10.0mnKey statistics52 week range H/L (SR) 149.0/24.5Avg daily turnover (mn) SR US$3m 52.40 13.9912m 28.82 7.69Raw Beta 6m 2yr0.13 0.72Reuters8130.SEBloombergATC ABPrice perform (%) 1M 3M 12MAbsolute (%) 83 137 55Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (2) 48 (26)Website: www alahlitakaful.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) NA NM NMP/B (x) NA 15.4 5.2P/Sales (x) NA NA NADiv yield (%) NA NA NAAlAhli Takaful Company (ATC), established in 2006, is a joint venture betweenNational Commercial Bank, FWU AG, VHV, International Financial Corporation and asmall share owned by local inves<strong>to</strong>rs. Headquartered in Jeddah, <strong>the</strong> <strong>com</strong>panyprovides a range of insurance products and services based on Islamic principles.Company financials2007* 2008YoY(%)CAGR(%)(05-07)Net Insurance Premium SRmn - - - -Total Revenues SRmn - - - -Net In<strong>com</strong>e SRmn (2) (10) - -Assets SRmn 95 95 (0.5) -Equity SRmn 94 83 (11.8) -Investments SRmn 94 72 (23.4) -Technical Reserves SRmn - 2 - -Combined Ratio % - 140.5 - -Net Mgn % - NM - -ROE % (2.0) (11.4) - -ROA % (2.0) (10.6) - -Div Payout % - - -EPS SR (0.2) (1.0) - -BVPS SR 9.4 8.3 (11.8) -Source: Company, NCBC Research; * Figures for FY 2007 are from July- December 2007Segment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncWeightage (%)TASI (free float weight) 0.09MSCI Saudi (domestic – small cap) 0.38Free float (%)Free float 26.45Relative share price perf.11,0002009,0001507,0001005,000503,000-M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASIATC (RHS)Top 5 shareholders (%)National Commercial Bank 30.0FWU Group 13.1International Finance Corporation 13.1VHV Vermogensanlage 7.5Source: NCBC ResearchSource: NCBC Research• Business brief: ATC’s insurance products include special programs for savings,retirement, and education. The Company’s “AlAhli Takaful and Savings Program”intends <strong>to</strong> match each individual’s lifestyle and fulfill saving requirements for variouspurposes such as retirement, children’s education, marriage, etc. The schemeprovides maturity as well as death benefits.• Financials: Despite recording gross premium written of SR6.4mn, ATC’s netpremium earned was only SR42 thousand during 2008. The Company’s <strong>to</strong>tal assetsaggregated <strong>to</strong> SR94.8mn, while shareholder’s equity <strong>to</strong>taled SR83.1mn at <strong>the</strong> end of2008. Technical reserves of <strong>the</strong> <strong>com</strong>pany at <strong>the</strong> end of 2008 s<strong>to</strong>od at SR2.6mn.• Recent developments: ATC <strong>report</strong>ed its 1Q-09 results on April 21, 2009. The<strong>com</strong>pany’s net loss declined <strong>to</strong> SR0.6mn in 1Q-09 <strong>com</strong>pared <strong>to</strong> a net loss ofSR1.4mn in 1Q-08. In February 2008, ATC’s Board of Direc<strong>to</strong>rs (BOD) appointed Mr.Omar Hashem Khalifti as <strong>the</strong> Chairman, <strong>the</strong>reby succeeding Mr. Mohammed OmarKassem Al-Esayi. On August 18, 2007, ATC listed at SR109.7 against <strong>the</strong> issue priceof SR10 on <strong>the</strong> Saudi S<strong>to</strong>ck Exchange. The <strong>com</strong>pany's IPO was oversubscribed 11.1times.JUNE 2009ALAHLI TAKAFUL191