<strong>European</strong> CommissionOccasional Paper 60, Volume IThis – admittedly incomplete – evidence suggests that the job-creation effects due to remittancefinancedinvestments tend to be limited, <strong>and</strong> it could be fostered by the adoption of complementarypublic policies aimed at removing the institutional <strong>and</strong> economic disincentives to invest. Such aneffort can hardly be expected to be undertaken by the migrants, as there is limited evidence ofcooperative actions led by migrant associations (Gallina, 2006b). The collective mobilization ofresource for investments in Morocco is scarce, <strong>and</strong> confined to a few cases, like the association ofMoroccan migrants in Catalonia - which invests in agriculture development in Northern Morocco,<strong>and</strong> some social investments from Moroccan migrants to Southern France.Hillal (2007) describes how investments by Palestinian emigrants were extremely important afterthe establishment of the Palestinian Authority. Banks <strong>and</strong> insurance companies opened in WestBank <strong>and</strong> Gaza, <strong>and</strong> a law to encourage foreign investments was passed <strong>and</strong> several activities –which were previously not allowed under the Israeli occupation – were created. In this phase. Therole of expatriate Palestinian businessmen who had made their capital in the Gulf became veryimportant for the country. But, starting with the military occupation of the West Bank in 2002, theuncertainty of investments in Palestine has again become a concern <strong>and</strong> this discourages theinvestments of migrants, providing a telling example of how the job-creation effect due to<strong>migration</strong> is highly dependent on the prevailing economic <strong>and</strong> institutional environment.Zekri (2009) provides data on the number <strong>and</strong> typology of associations of Tunisian emigrants,showing that most of them explicitly pursue some sort of social objectives. The Tunisian governmentacknowledges the importance of these associations abroad to attract the capital of emigrants towardssocial investments in the country. Zekri (2009) also reports data on Tunisian investors residing abroadfrom the Agency of Industry Promotion: from 1988 to 2007, 43,912 jobs have been created thanks toinvestors from abroad, <strong>and</strong> around $385 million have been invested in more than 10,000 projects, inparticular in the service sectors: data comes from the Agency of Industry Promotion. The Tunisiangovernment is aware of the potential benefits for the country from the investments of its emigrants.This is why it offers several advantages (also fiscal advantages) to the migrants who want to invest inTunisia.9.2 Return migrants <strong>and</strong> investmentsAs we observed in the introduction, when <strong>migration</strong> occurs predominantly on a temporary basis, thenwe need to focus on returnees in order to fully underst<strong>and</strong> its impact on the labour <strong>market</strong>; one of themain regularities that is observed for return migrants – <strong>and</strong> AMCs make no exception in this respect, isthat they tend to opt out of salaried jobs. A disproportionate share of return migrants opt for a selfemployedoccupations <strong>and</strong> the MIREM project shows that 27.7 percent of the sampled returnees toAlgeria, Tunisia <strong>and</strong> Morocco became employers or independent workers, while 33.2 percent optedfor a salaried occupation. McCormick <strong>and</strong> Wahba (2001) provide evidence that the duration of the<strong>migration</strong> experience <strong>and</strong> foreign savings increase the probability of becoming an entrepreneur uponreturn to Egypt, though a recent contribution by Wahba <strong>and</strong> Zenou (2008) has cast some doubts on thisconclusion, as the loss of social capital that <strong>migration</strong> entails makes it harder for Egyptian migrants toset up a successful enterprise. Preliminary analysis of the data from the ELMPS 2006 reveals that asignificantly larger share of returnees is engaged in an entrepreneurial activity, <strong>and</strong> – moreinterestingly – that the survival rate of the MSEs run by return migrants between 1998 <strong>and</strong> 2006exceeded by 14 percentage points the corresponding figure for stayers.144

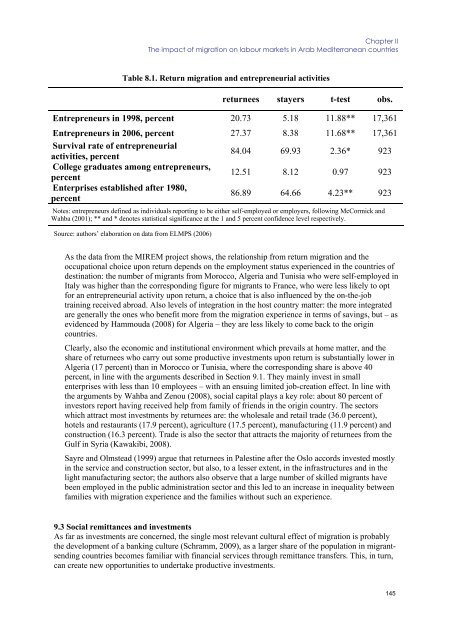

Chapter IIThe impact of <strong>migration</strong> on labour <strong>market</strong>s in Arab Mediterranean countriesTable 8.1. Return <strong>migration</strong> <strong>and</strong> entrepreneurial activitiesreturnees stayers t-test obs.Entrepreneurs in 1998, percent 20.73 5.18 11.88** 17,361Entrepreneurs in 2006, percent 27.37 8.38 11.68** 17,361Survival rate of entrepreneurialactivities, percent84.04 69.93 2.36* 923College graduates among entrepreneurs,percent12.51 8.12 0.97 923Enterprises established after 1980,percent86.89 64.66 4.23** 923Notes: entrepreneurs defined as individuals reporting to be either self-employed or employers, following McCormick <strong>and</strong>Wahba (2001); ** <strong>and</strong> * denotes statistical significance at the 1 <strong>and</strong> 5 percent confidence level respectively.Source: authors’ elaboration on data from ELMPS (2006)As the data from the MIREM project shows, the relationship from return <strong>migration</strong> <strong>and</strong> theoccupational choice upon return depends on the employment status experienced in the countries ofdestination: the number of migrants from Morocco, Algeria <strong>and</strong> Tunisia who were self-employed inItaly was higher than the corresponding figure for migrants to France, who were less likely to optfor an entrepreneurial activity upon return, a choice that is also influenced by the on-the-jobtraining received abroad. Also levels of integration in the host country matter: the more integratedare generally the ones who benefit more from the <strong>migration</strong> experience in terms of savings, but – asevidenced by Hammouda (2008) for Algeria – they are less likely to come back to the origincountries.Clearly, also the economic <strong>and</strong> institutional environment which prevails at home matter, <strong>and</strong> theshare of returnees who carry out some productive investments upon return is substantially lower inAlgeria (17 percent) than in Morocco or Tunisia, where the corresponding share is above 40percent, in line with the arguments described in Section 9.1. They mainly invest in smallenterprises with less than 10 employees – with an ensuing limited job-creation effect. In line withthe arguments by Wahba <strong>and</strong> Zenou (2008), social capital plays a key role: about 80 percent ofinvestors report having received help from family of friends in the origin country. The sectorswhich attract most investments by returnees are: the wholesale <strong>and</strong> retail trade (36.0 percent),hotels <strong>and</strong> restaurants (17.9 percent), agriculture (17.5 percent), manufacturing (11.9 percent) <strong>and</strong>construction (16.3 percent). Trade is also the sector that attracts the majority of returnees from theGulf in Syria (Kawakibi, 2008).Sayre <strong>and</strong> Olmstead (1999) argue that returnees in Palestine after the Oslo accords invested mostlyin the service <strong>and</strong> construction sector, but also, to a lesser extent, in the infrastructures <strong>and</strong> in thelight manufacturing sector; the authors also observe that a large number of skilled migrants havebeen employed in the public administration sector <strong>and</strong> this led to an increase in inequality betweenfamilies with <strong>migration</strong> experience <strong>and</strong> the families without such an experience.9.3 Social remittances <strong>and</strong> investmentsAs far as investments are concerned, the single most relevant cultural effect of <strong>migration</strong> is probablythe development of a banking culture (Schramm, 2009), as a larger share of the population in migrantsendingcountries becomes familiar with financial services through remittance transfers. This, in turn,can create new opportunities to undertake productive investments.145

- Page 5 and 6:

STUDYLABOUR MARKETS PERFORMANCE AND

- Page 7 and 8:

Table of ContentsLABOUR MARKETS PER

- Page 10:

8.1 Actual migration and consumptio

- Page 15 and 16:

Chapter IFinal Report 15 MILLION NE

- Page 17 and 18:

Chapter IFinal Report …so that MI

- Page 19 and 20:

Chapter IFinal Reportroots). The cu

- Page 21 and 22:

Chapter IFinal Report In AMCs, REMI

- Page 23 and 24:

Chapter IFinal Reportpolicies. This

- Page 25 and 26:

Chapter IFinal ReportMediterranean

- Page 27 and 28:

Chapter IFinal ReportMore recently,

- Page 29 and 30:

Chapter IFinal Reportfor EU employm

- Page 31 and 32:

Chapter IFinal Reportchosen, these

- Page 33 and 34:

Chapter IFinal Reportexit of women

- Page 35 and 36:

Chapter IFinal ReportFigure 1.2.1.

- Page 37 and 38:

Chapter IFinal ReportA Declining Em

- Page 39 and 40:

Chapter IFinal ReportThe same year,

- Page 41 and 42:

Chapter IFinal ReportTable 2.2.1. I

- Page 43 and 44:

Chapter IFinal Reportminimum wages

- Page 45 and 46:

Chapter IFinal Report2.4 Unemployme

- Page 47 and 48:

Chapter IFinal ReportYouth Unemploy

- Page 49 and 50:

Chapter IFinal ReportBut one should

- Page 51 and 52:

Chapter IFinal Reportmillion) 10 .

- Page 53 and 54:

Chapter IFinal Reportmight intensif

- Page 55 and 56:

Chapter IFinal Reporttrue labour ma

- Page 57 and 58:

Chapter IFinal Reportto reform the

- Page 59 and 60:

Chapter IFinal ReportFrom a differe

- Page 61 and 62:

Chapter IFinal ReportTable 4.2.1 Ou

- Page 63 and 64:

Chapter IFinal ReportSource: Adams

- Page 65 and 66:

Chapter IFinal Reportin the destina

- Page 67 and 68:

Chapter IFinal ReportIn conclusion,

- Page 69 and 70:

Chapter IFinal Reportorganised in B

- Page 71 and 72:

Chapter IFinal Reportsecond Intifad

- Page 73 and 74:

Chapter IFinal Reportstands at 29.7

- Page 75 and 76:

Chapter IFinal Reportconstruction w

- Page 77 and 78:

Chapter IFinal ReportAs far as the

- Page 79 and 80:

Chapter IFinal Reportother cases, l

- Page 81 and 82:

Chapter IFinal Reportunemployment a

- Page 83 and 84:

Chapter IFinal Reportof Egypt, so f

- Page 85 and 86:

Chapter IFinal ReportWhile progress

- Page 87 and 88:

Chapter IFinal ReportThese reservat

- Page 89 and 90:

Chapter IFinal ReportAs Figure 6.3.

- Page 91 and 92:

Chapter IFinal Reportin skill devel

- Page 93 and 94:

Chapter IFinal ReportThe Directive

- Page 95 and 96: Chapter IFinal ReportThe need for

- Page 97 and 98: Chapter IFinal Reportobjectives are

- Page 99 and 100: Chapter IFinal Reporttrue Euro-Medi

- Page 101 and 102: Chapter IFinal Report- Putting empl

- Page 103 and 104: Chapter IFinal Report promotion of

- Page 105 and 106: Chapter IFinal ReportOtherADAMS, R.

- Page 107 and 108: Chapter IFinal ReportDE BEL-AIR, F.

- Page 109 and 110: Chapter IFinal ReportGUPTA, S., C.

- Page 111 and 112: Chapter IFinal ReportOECD (2000): M

- Page 113 and 114: Chapter II - Thematic Background Pa

- Page 115 and 116: Chapter IIThe impact of migration o

- Page 117 and 118: Chapter IIThe impact of migration o

- Page 119 and 120: Chapter IIThe impact of migration o

- Page 121 and 122: Chapter IIThe impact of migration o

- Page 123 and 124: Chapter IIThe impact of migration o

- Page 125 and 126: Chapter IIThe impact of migration o

- Page 127 and 128: Chapter IIThe impact of migration o

- Page 129 and 130: Chapter IIThe impact of migration o

- Page 131 and 132: Chapter IIThe impact of migration o

- Page 133 and 134: Chapter IIThe impact of migration o

- Page 135 and 136: Chapter IIThe impact of migration o

- Page 137 and 138: Chapter IIThe impact of migration o

- Page 139 and 140: Chapter IIThe impact of migration o

- Page 141 and 142: Chapter IIThe impact of migration o

- Page 143 and 144: Chapter IIThe impact of migration o

- Page 145: Chapter IIThe impact of migration o

- Page 149 and 150: Chapter IIThe impact of migration o

- Page 151 and 152: Chapter IIThe impact of migration o

- Page 153 and 154: Chapter IIThe impact of migration o

- Page 155 and 156: Chapter IIThe impact of migration o

- Page 157 and 158: Chapter IIThe impact of migration o

- Page 159 and 160: Chapter IIThe impact of migration o

- Page 161 and 162: Chapter III - Thematic Background P

- Page 163 and 164: Chapter IIIEU Migration Policy towa

- Page 165 and 166: Chapter IIIEU Migration Policy towa

- Page 167 and 168: Chapter IIIEU Migration Policy towa

- Page 169 and 170: Chapter IIIEU Migration Policy towa

- Page 171 and 172: Chapter IIIEU Migration Policy towa

- Page 173 and 174: Chapter IIIEU Migration Policy towa

- Page 175 and 176: Chapter IIIEU Migration Policy towa

- Page 177 and 178: Chapter IIIEU Migration Policy towa

- Page 179 and 180: Chapter IIIEU Migration Policy towa

- Page 181 and 182: Chapter IIIEU Migration Policy towa

- Page 183 and 184: Chapter IIIEU Migration Policy towa

- Page 185 and 186: Chapter IIIEU Migration Policy towa

- Page 187 and 188: Chapter IIIEU Migration Policy towa

- Page 189 and 190: Chapter IIIEU Migration Policy towa

- Page 191 and 192: Chapter IIIEU Migration Policy towa

- Page 193 and 194: Chapter IIIEU Migration Policy towa

- Page 195 and 196: Chapter IIIEU Migration Policy towa

- Page 197 and 198:

Chapter IIIEU Migration Policy towa

- Page 199 and 200:

Chapter IIIEU Migration Policy towa

- Page 201 and 202:

Chapter IIIEU Migration Policy towa

- Page 203 and 204:

Chapter IIIEU Migration Policy towa

- Page 205 and 206:

Chapter IIIEU Migration Policy towa

- Page 207:

Chapter IIIEU Migration Policy towa