Labour market performance and migration flows - European ...

Labour market performance and migration flows - European ...

Labour market performance and migration flows - European ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

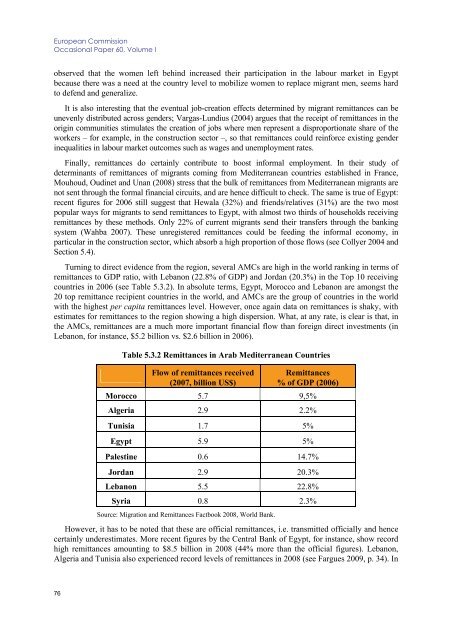

<strong>European</strong> CommissionOccasional Paper 60, Volume Iobserved that the women left behind increased their participation in the labour <strong>market</strong> in Egyptbecause there was a need at the country level to mobilize women to replace migrant men, seems hardto defend <strong>and</strong> generalize.It is also interesting that the eventual job-creation effects determined by migrant remittances can beunevenly distributed across genders; Vargas-Lundius (2004) argues that the receipt of remittances in theorigin communities stimulates the creation of jobs where men represent a disproportionate share of theworkers – for example, in the construction sector –, so that remittances could reinforce existing genderinequalities in labour <strong>market</strong> outcomes such as wages <strong>and</strong> unemployment rates.Finally, remittances do certainly contribute to boost informal employment. In their study ofdeterminants of remittances of migrants coming from Mediterranean countries established in France,Mouhoud, Oudinet <strong>and</strong> Unan (2008) stress that the bulk of remittances from Mediterranean migrants arenot sent through the formal financial circuits, <strong>and</strong> are hence difficult to check. The same is true of Egypt:recent figures for 2006 still suggest that Hewala (32%) <strong>and</strong> friends/relatives (31%) are the two mostpopular ways for migrants to send remittances to Egypt, with almost two thirds of households receivingremittances by these methods. Only 22% of current migrants send their transfers through the bankingsystem (Wahba 2007). These unregistered remittances could be feeding the informal economy, inparticular in the construction sector, which absorb a high proportion of those <strong>flows</strong> (see Collyer 2004 <strong>and</strong>Section 5.4).Turning to direct evidence from the region, several AMCs are high in the world ranking in terms ofremittances to GDP ratio, with Lebanon (22.8% of GDP) <strong>and</strong> Jordan (20.3%) in the Top 10 receivingcountries in 2006 (see Table 5.3.2). In absolute terms, Egypt, Morocco <strong>and</strong> Lebanon are amongst the20 top remittance recipient countries in the world, <strong>and</strong> AMCs are the group of countries in the worldwith the highest per capita remittances level. However, once again data on remittances is shaky, withestimates for remittances to the region showing a high dispersion. What, at any rate, is clear is that, inthe AMCs, remittances are a much more important financial flow than foreign direct investments (inLebanon, for instance, $5.2 billion vs. $2.6 billion in 2006).Table 5.3.2 Remittances in Arab Mediterranean CountriesFlow of remittances received(2007, billion US$)Remittances% of GDP (2006)Morocco 5.7 9,5%Algeria 2.9 2.2%Tunisia 1.7 5%Egypt 5.9 5%Palestine 0.6 14.7%Jordan 2.9 20.3%Lebanon 5.5 22.8%Syria 0.8 2.3%Source: Migration <strong>and</strong> Remittances Factbook 2008, World Bank.However, it has to be noted that these are official remittances, i.e. transmitted officially <strong>and</strong> hencecertainly underestimates. More recent figures by the Central Bank of Egypt, for instance, show recordhigh remittances amounting to $8.5 billion in 2008 (44% more than the official figures). Lebanon,Algeria <strong>and</strong> Tunisia also experienced record levels of remittances in 2008 (see Fargues 2009, p. 34). In76