- Page 1 and 2:

A REPORT ONAboriginalCo-operativesi

- Page 3 and 4:

Copyright © 2001 Centre for the St

- Page 5 and 6:

A B O R I G I N A L C O - O P E R A

- Page 7 and 8:

A B O R I G I N A L C O - O P E R A

- Page 10 and 11:

Table of ContentsExecutive Summary

- Page 12 and 13:

F O R E W O R DThe Nature of This S

- Page 14 and 15:

~ F O R E W O R DCo-operatives are

- Page 16 and 17:

C H A P T E RO N EThe Current State

- Page 18 and 19:

~ T H E C U R R E N T S T A T EGove

- Page 20 and 21:

~ T H E C U R R E N T S T A T EFirs

- Page 22 and 23:

~ T H E C U R R E N T S T A T ESelf

- Page 24 and 25:

~ T H E C U R R E N T S T A T EUnde

- Page 26 and 27:

~ T H E C U R R E N T S T A T EThir

- Page 28 and 29:

~ T H E C U R R E N T S T A T Eretu

- Page 30 and 31:

~ T H E C U R R E N T S T A T Ehave

- Page 32 and 33:

~ T H E C U R R E N T S T A T Epatt

- Page 34 and 35:

~ T H E C U R R E N T S T A T EOngo

- Page 36 and 37:

~ T H E C U R R E N T S T A T Epote

- Page 38 and 39:

~ E M E R G I N G T H E M E SThe ne

- Page 40 and 41:

~ E M E R G I N G T H E M E SEmergi

- Page 42 and 43:

~ E M E R G I N G T H E M E Sl’Ou

- Page 44 and 45:

~ E M E R G I N G T H E M E SConclu

- Page 46 and 47: ~ E M E R G I N G T H E M E SAkochi

- Page 48 and 49: ~ E M E R G I N G T H E M E SManage

- Page 50 and 51: ~ E M E R G I N G T H E M E SConclu

- Page 52 and 53: ~ T H E P O T E N T I A L F O R G R

- Page 54 and 55: ~ T H E P O T E N T I A L F O R G R

- Page 56 and 57: ~ T H E P O T E N T I A L F O R G R

- Page 58 and 59: ~ T H E P O T E N T I A L F O R G R

- Page 60 and 61: ~ T H E P O T E N T I A L F O R G R

- Page 62 and 63: APPENDIX APART 1Socio-Economic Prof

- Page 64 and 65: 5. Relative performance of consumer

- Page 66 and 67: Every year, the Co-operatives Secre

- Page 68 and 69: 1. Formation of Aboriginal Co-ops a

- Page 70 and 71: is even more striking when we look

- Page 72 and 73: The dichotomous structure ofactivit

- Page 74 and 75: 2.2 Sectoraldistribution ofAborigin

- Page 76 and 77: in sectors that are more labor inte

- Page 78 and 79: 77Table 2.3 ACTIVITIES OF A SAMPLE

- Page 80 and 81: 3. Organization of Aboriginal co-op

- Page 82 and 83: The selling of Inuit art by individ

- Page 84 and 85: caisses populaires Desjardins. The

- Page 86 and 87: Both the Federal and Provincial Gov

- Page 88 and 89: 4.2 Sales GrowthIn this section, we

- Page 90 and 91: products (basically food and hardwa

- Page 92 and 93: in employment between 1993 and 1997

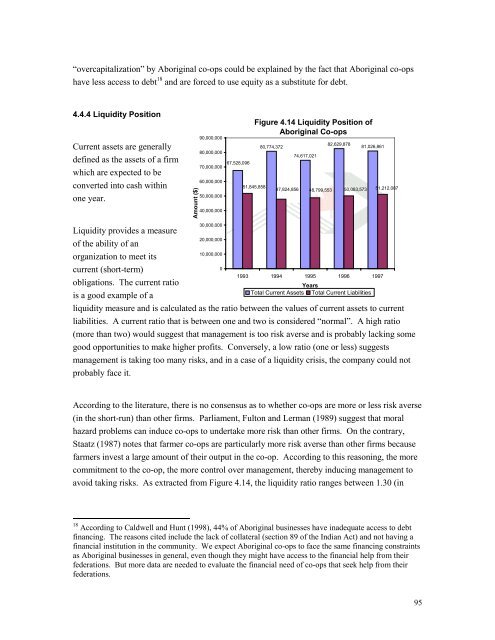

- Page 94 and 95: health of co-ops in general. Unlike

- Page 98 and 99: 5. Relative Performance of Consumer

- Page 100 and 101: 5.3 Consumer Products and Food Sale

- Page 102 and 103: The “Aboriginal” member spends

- Page 104 and 105: to other consumer co-ops.It was als

- Page 106 and 107: Aboriginal) are more liquid than th

- Page 108 and 109: 6.2 EmploymentFigure 6.2 shows the

- Page 110 and 111: Aboriginal workers could receive el

- Page 112 and 113: of two major components: property (

- Page 114 and 115: In short, Inuit co-ops are an impor

- Page 116 and 117: 115Table 6.3 Selected Statistics of

- Page 118 and 119: some analysis that we felt was impo

- Page 120 and 121: Aboriginal co-ops remain active in

- Page 122 and 123: Indian Affairs and Northern Develop

- Page 124 and 125: HIGHLIGHTS• Population, including

- Page 126 and 127: PopulationFigure A.1 Population in

- Page 128 and 129: Table A.1 Public School Enrollments

- Page 130 and 131: Table A.4 Aboriginal Employment Rat

- Page 132 and 133: were 13.7% and 20.7% respectively,

- Page 134 and 135: Consumer Price Index (CPI)Figure A.

- Page 136 and 137: D. Finance and InvestmentThis secti

- Page 138 and 139: BibliographyCensus Dictionary, Fina

- Page 140 and 141: FIGURE B1 A MAP OF CANADIAN ABORIGI

- Page 142 and 143: ~ P E R S P E C T I V E S O F R E G

- Page 144 and 145: ~ P E R S P E C T I V E S O F R E G

- Page 146 and 147:

~ P E R S P E C T I V E S O F R E G

- Page 148 and 149:

~ P E R S P E C T I V E S O F R E G

- Page 150 and 151:

~ P E R S P E C T I V E S O F R E G

- Page 152 and 153:

~ P E R S P E C T I V E S O F R E G

- Page 154 and 155:

~ P E R S P E C T I V E S O F R E G

- Page 156 and 157:

~ P E R S P E C T I V E S O F R E G

- Page 158 and 159:

2.0 INCREASING SELF-RELIANCE2.1 LAN

- Page 160 and 161:

CANADA MORTGAGE AND HOUSING CORPORA

- Page 162 and 163:

3.0 SUPPORTIVE BUSINESS ENVIRONMENT

- Page 164 and 165:

2.0 INCREASING SELF-RELIANCE2.1 LAN

- Page 166 and 167:

INDIAN AND NORTHERN AFFAIRS CANADA1

- Page 168 and 169:

1.4 INNOVATION (FINANCIAL AND NON-F

- Page 170 and 171:

2.2 WORKFORCE TRAINING AND EXPERIEN

- Page 172 and 173:

3.2 CONNECTEDNESS INITIATIVESProgra

- Page 174 and 175:

2.0 INCREASING SELF-RELIANCE2.1 LAN

- Page 176 and 177:

2.3 SOCIAL ASSISTANCE REFORMProgram

- Page 178 and 179:

Part 3: Provincial/Territorial Init

- Page 180 and 181:

~ P R O V I N C I A L / T E R R I T

- Page 182 and 183:

~ P R O V I N C I A L / T E R R I T

- Page 184 and 185:

~ P R O V I N C I A L / T E R R I T

- Page 186 and 187:

~ P R O V I N C I A L / T E R R I T

- Page 188 and 189:

~ P R O V I N C I A L / T E R R I T

- Page 190 and 191:

~ P R O V I N C I A L / T E R R I T

- Page 192 and 193:

~ P R O V I N C I A L / T E R R I T

- Page 194 and 195:

~ P R O V I N C I A L / T E R R I T

- Page 196 and 197:

~ P R O V I N C I A L / T E R R I T

- Page 198 and 199:

~ P R O V I N C I A L / T E R R I T

- Page 200 and 201:

~ P R O V I N C I A L / T E R R I T

- Page 202 and 203:

~ P R O V I N C I A L / T E R R I T

- Page 204 and 205:

~ P R O V I N C I A L / T E R R I T

- Page 206 and 207:

~ P R O V I N C I A L / T E R R I T

- Page 208 and 209:

~ P R O V I N C I A L / T E R R I T

- Page 210 and 211:

~ P R O V I N C I A L / T E R R I T

- Page 212 and 213:

~ P R O V I N C I A L / T E R R I T

- Page 214 and 215:

~ P R O V I N C I A L / T E R R I T

- Page 216 and 217:

~ P R O V I N C I A L / T E R R I T

- Page 218 and 219:

A P P E N D I XCCo-operatives in Qu

- Page 220 and 221:

~ C O - O P S I N Q U É B E C A B

- Page 222 and 223:

~ C O - O P S I N Q U É B E C A B

- Page 224 and 225:

~ C O - O P S I N Q U É B E C A B

- Page 226 and 227:

~ C O - O P S I N Q U É B E C A B

- Page 228 and 229:

~ C O - O P S I N Q U É B E C A B

- Page 230 and 231:

~ C O - O P S I N Q U É B E C A B

- Page 232 and 233:

Bibliography[Quotes in the body of

- Page 234 and 235:

~ C O - O P S I N Q U É B E C A B

- Page 236 and 237:

~ C O - O P E R A T I V E S A N D C

- Page 238 and 239:

~ C O - O P E R A T I V E S A N D C

- Page 240 and 241:

~ C O - O P E R A T I V E S A N D C

- Page 242 and 243:

~ C O - O P E R A T I V E S A N D C

- Page 244 and 245:

~ C O - O P E R A T I V E S A N D C

- Page 246 and 247:

~ C O - O P E R A T I V E S A N D C

- Page 248 and 249:

~ C O - O P E R A T I V E S A N D C

- Page 250 and 251:

~ C O - O P E R A T I V E S A N D C

- Page 252 and 253:

~ C O - O P E R A T I V E S A N D C

- Page 254 and 255:

~ C O - O P E R A T I V E S A N D C

- Page 256 and 257:

~ C O - O P E R A T I V E S A N D C

- Page 258 and 259:

~ C O - O P E R A T I V E S A N D C

- Page 260 and 261:

~ C O - O P E R A T I V E S A N D C

- Page 262 and 263:

~ C O - O P E R A T I V E S A N D C

- Page 264 and 265:

~ S T A T E M E N T O N T H E C O -

- Page 266 and 267:

~ M E T H O D O L O G Y2. In-Person

- Page 268 and 269:

~ M E T H O D O L O G Yissues; area

- Page 270 and 271:

A P P E N D I XHCase Study Guidelin

- Page 272 and 273:

~ C A S E S T U D I E SA P P E N D

- Page 274 and 275:

~ C A S E S T U D I E Sthe main foc

- Page 276 and 277:

~ C A S E S T U D I E Sthey sold, t

- Page 278 and 279:

~ C A S E S T U D I E Sboth in Sask

- Page 280 and 281:

~ C A S E S T U D I E Sestimate the

- Page 282 and 283:

~ C A S E S T U D I E SThey are les

- Page 284 and 285:

A P P E N D I X I ~have been diffic

- Page 286 and 287:

A P P E N D I X I ~arts and crafts.

- Page 288 and 289:

A P P E N D I X I ~286 ~

- Page 290 and 291:

A P P E N D I X I ~288 ~

- Page 292 and 293:

~ C A S E S T U D I E SIkaluktutiak

- Page 294 and 295:

A P P E N D I X I ~In order to meet

- Page 296 and 297:

A P P E N D I X I ~and recently dra

- Page 298 and 299:

A P P E N D I X I ~The bakery was s

- Page 300 and 301:

A P P E N D I X I ~Bill describes h

- Page 302 and 303:

A P P E N D I X I ~Reasons for Succ

- Page 304 and 305:

A P P E N D I X I ~Bill states, “

- Page 306 and 307:

A P P E N D I X I ~The future looks

- Page 308 and 309:

A P P E N D I X I ~communities in C

- Page 310 and 311:

A P P E N D I X I ~third parties wh

- Page 312 and 313:

A P P E N D I X I ~measure of confi

- Page 314 and 315:

A P P E N D I X I ~BibliographyPape

- Page 316 and 317:

A P P E N D I X I ~number of areas,

- Page 318 and 319:

A P P E N D I X I ~although the org

- Page 320 and 321:

A P P E N D I X I ~BibliographyPape

- Page 322 and 323:

A P P E N D I X I ~Apaqtukewaq Fish

- Page 324 and 325:

A P P E N D I X I ~ManagementIn the

- Page 326 and 327:

A P P E N D I X I ~Anishinabek Nati

- Page 328 and 329:

A P P E N D I X I ~termed Aborigina

- Page 330 and 331:

A P P E N D I X I ~Profitable Proje

- Page 332 and 333:

A P P E N D I X I ~ANCU will only b

- Page 334 and 335:

A P P E N D I X I ~3. Funding is se

- Page 336 and 337:

A P P E N D I X I ~knowledgeable ab

- Page 338 and 339:

A P P E N D I X I ~Native Inter-Tri

- Page 340 and 341:

A P P E N D I X I ~are both working

- Page 342 and 343:

A P P E N D I X I ~local school and

- Page 344 and 345:

A P P E N D I X I ~We found that th

- Page 346 and 347:

A P P E N D I X I ~In return for th

- Page 348 and 349:

A P P E N D I X I ~When they do hav

- Page 350 and 351:

A P P E N D I X I ~The two NITH int

- Page 352 and 353:

A P P E N D I X I ~for anyone to us

- Page 354 and 355:

A P P E N D I X I ~youth of the com

- Page 356 and 357:

A P P E N D I X I ~Community Involv

- Page 358 and 359:

A P P E N D I X I ~Advice to Others

- Page 360 and 361:

A P P E N D I X I ~Neechi Foods Co-

- Page 362 and 363:

A P P E N D I X I ~Community Impact

- Page 364 and 365:

A P P E N D I X I ~few years as a r

- Page 366 and 367:

A P P E N D I X I ~The worker co-op

- Page 368 and 369:

A P P E N D I X I ~Since the start

- Page 370 and 371:

A P P E N D I X I ~to urban Native

- Page 372 and 373:

A P P E N D I X I ~December because

- Page 374 and 375:

A P P E N D I X I ~Social Attitudes

- Page 376 and 377:

A P P E N D I X I ~years ago. The o

- Page 378 and 379:

A P P E N D I X I ~sources can be m

- Page 380 and 381:

A P P E N D I X I ~Wilp Sa Maa’y

- Page 382 and 383:

A P P E N D I X I ~opened an accoun

- Page 384 and 385:

A P P E N D I X I ~grow on the coas

- Page 386 and 387:

A P P E N D I X I ~We also need to

- Page 388 and 389:

A P P E N D I X I ~• We gave pres

- Page 390 and 391:

A P P E N D I X I ~its direction. (

- Page 392 and 393:

A P P E N D I XJAdditional Case Stu

- Page 394 and 395:

A P P E N D I X J : A D D I T I O N

- Page 396 and 397:

A P P E N D I X J : A D D I T I O N

- Page 398 and 399:

A P P E N D I X J : A D D I T I O N

- Page 400 and 401:

A P P E N D I X J : A D D I T I O N

- Page 402:

A P P E N D I X K : T H E C O N S U