- Page 1 and 2:

Table of Contents Title Page Copyri

- Page 3 and 4:

Chapter 6 - Planning Capital Expend

- Page 5 and 6:

For Further Reading Part IV - Manag

- Page 7 and 8:

Successful Postmerger Implementatio

- Page 10 and 11:

This book is printed on acid-free p

- Page 12 and 13:

Syllabus How Chapter Topics in This

- Page 14 and 15:

Some of these experts are full-time

- Page 16 and 17:

About the Contributors Richard T. B

- Page 18 and 19:

Advances in Quantitative Analysis o

- Page 20 and 21:

enterprise development. Dr. Zachara

- Page 22 and 23:

The left side shows Nutrimin‟s in

- Page 24 and 25:

Gail, let‟s go over this balance

- Page 26 and 27:

Gail, do you have any questions abo

- Page 28 and 29:

11. Not all expenses are cash outfl

- Page 30 and 31:

Financial Statements: Who Uses Them

- Page 32 and 33:

profitability to keep investing for

- Page 34 and 35:

Financial Accounting Standards It i

- Page 36 and 37: Downloadable Resources for this cha

- Page 38 and 39: Next, we explain each of these thre

- Page 40 and 41: liquidity. Or, more simply, achievi

- Page 42 and 43: If these ratios are seriously defic

- Page 44 and 45: The debt-to-equity ratio is evaluat

- Page 46 and 47: year 1 to year 3. The net effect wa

- Page 48 and 49: to rate of return on the equity. Th

- Page 50 and 51: Other types of comparisons of finan

- Page 52 and 53: income/sales), asset turnover (sale

- Page 54 and 55: successful businesspeople should ha

- Page 58 and 59: More than a decade ago, a special c

- Page 60 and 61: companies is used for illustration.

- Page 62 and 63: The identification of nonrecurring

- Page 64 and 65: The Dow Chemical single-step income

- Page 66 and 67: is a pretax measure, but income fro

- Page 68 and 69: Sources: Companies‟ annual report

- Page 70 and 71: Exhibit 3.11 Examples of discontinu

- Page 72 and 73: amortization purposes, the Company

- Page 74 and 75: Examples of nonrecurring items disc

- Page 76 and 77: During Fiscal 2006, inventory quant

- Page 78 and 79: The nonrecurring items of Boston Sc

- Page 80 and 81: The disclosure presented earlier in

- Page 82 and 83: gains or losses that appear as part

- Page 84 and 85: ecurring as for Kimberly-Clark, the

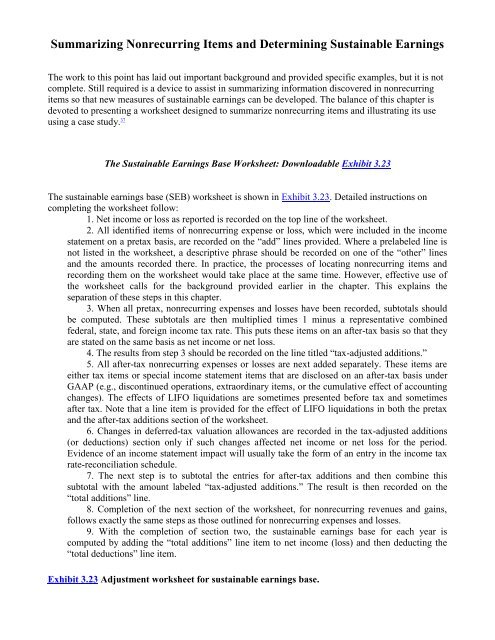

- Page 88 and 89: Role of the Sustainable Earnings Ba

- Page 90: Exhibit 3.26 Income tax note—exce

- Page 93: Exhibit 3.28 Management’s discuss

- Page 98 and 99: Exhibit 3.29 Summary of significant

- Page 100 and 101: Exhibit 3.31 Discontinued operation

- Page 102 and 103: Exhibit 3.32 Asset impairment charg

- Page 104 and 105: Exhibit 3.34 Acquisition-related co

- Page 106 and 107: Source: Pfizer, Inc., annual report

- Page 109 and 110: An efficient search sequence for id

- Page 111 and 112: The construction of an SEB workshee

- Page 113 and 114: Adobe Systems, Inc. (2007) Advanced

- Page 115 and 116: Panera Bread Company (2007) PepsiCo

- Page 117 and 118: 14 Accounting Principles Board Opin

- Page 119 and 120: For Further Reading Comiskey, E., a

- Page 121 and 122: on the original balance plus whatev

- Page 123 and 124: Here is a step-by-step Excel approa

- Page 125 and 126: question; we must, however, know th

- Page 127 and 128: F V = $9,000 F V = $10,000 F V = $1

- Page 129 and 130: The algebraic formula for calculati

- Page 131 and 132: The FV of this ordinary annuity is

- Page 133 and 134: Additional Exercise: FVA N Determin

- Page 135 and 136: Exhibit 4.17 Finding the present va

- Page 137 and 138:

From the data we solve for “PMT,

- Page 139 and 140:

Exhibit 4.21 Determine the annual p

- Page 141 and 142:

Exhibit 4.23 Regular cash flows wit

- Page 143 and 144:

Summary What is the value of a doll

- Page 147 and 148:

Financial managers perform many tas

- Page 149 and 150:

Research on the common stock of the

- Page 151 and 152:

1. Calculate the arithmetic mean re

- Page 153 and 154:

Correlation measures the joint vari

- Page 155 and 156:

contributes less to the standard de

- Page 157 and 158:

Finally, if the numerator in the be

- Page 159 and 160:

The last bit of information require

- Page 161 and 162:

Cost of Debt and Equity Capital We

- Page 163 and 164:

If the firm has preferred stock in

- Page 165 and 166:

The cost of capital for Disney, bas

- Page 167 and 168:

It is important to understand how c

- Page 169 and 170:

the newly offered shares. Outside i

- Page 171 and 172:

Company A has insufficient cash flo

- Page 173 and 174:

With these inputs the Excel functio

- Page 175 and 176:

Hudson is growing quickly in the ye

- Page 177 and 178:

sufficient information to determine

- Page 179 and 180:

peer to Gracie, then Hudson‟s tot

- Page 181:

Steven P. Feinstein

- Page 185 and 186:

The first step in calculating a pro

- Page 187 and 188:

Treatment of Net Working Capital Ch

- Page 189 and 190:

The reason for omitting interest ex

- Page 191 and 192:

Sunk Costs Sunk costs are expenses

- Page 193 and 194:

Similarly, the year 2 cash flow was

- Page 195 and 196:

It makes sense that project C shoul

- Page 197 and 198:

scope of this chapter, but the text

- Page 199 and 200:

Because leverage increases the risk

- Page 201 and 202:

A project‟s internal rate of retu

- Page 203 and 204:

home buyer finance the same house,

- Page 205:

Brealey, Richard A., and Stewart C.

- Page 209 and 210:

one unit of currency in another cou

- Page 211 and 212:

Exhibit 7.4 Time line in pounds and

- Page 213 and 214:

Exhibit 7.5 Amount of euros (€) p

- Page 215 and 216:

happened to the value of the invest

- Page 217 and 218:

Political risk comes from changes i

- Page 219 and 220:

Useful information from the World B

- Page 221 and 222:

Step 2 Determine the discrete proba

- Page 223 and 224:

There are some at Robinson who reco

- Page 225 and 226:

In his final presentation, he noted

- Page 227 and 228:

As you can imagine, the presentatio

- Page 229 and 230:

It is possible to use contracts to

- Page 231 and 232:

choices intelligently and effective

- Page 233 and 234:

Reflecting its status as the defaul

- Page 235 and 236:

As you might expect, given the limi

- Page 237 and 238:

Recognition of Corporations and Lim

- Page 239 and 240:

Limited Liability Companies Most st

- Page 241 and 242:

This complexity or flexibility does

- Page 243 and 244:

piece of the equity of their operat

- Page 245 and 246:

which normally must consider it and

- Page 247 and 248:

Limited partners will normally have

- Page 249 and 250:

and, in a novel decision, pierced t

- Page 251 and 252:

to page 1, where it is added to (or

- Page 253 and 254:

Corporations Corporations are norma

- Page 255 and 256:

eturns of its stockholders in propo

- Page 257 and 258:

forms. Other forms exist, such as t

- Page 259 and 260:

The hotel venture contemplated by B

- Page 261:

epayment schedule. Lauren and Clair

- Page 265 and 266:

Most entrepreneurs long for the day

- Page 267 and 268:

any strategy he adopts, the gifts o

- Page 269 and 270:

past, Morris has always attempted t

- Page 271 and 272:

will also result in acquisition of

- Page 273 and 274:

the amount of such deductions will

- Page 275 and 276:

the earnings are taxed currently. T

- Page 277 and 278:

eturn of the interest is a gift and

- Page 279 and 280:

Taxability of Stock Options If Morr

- Page 281 and 282:

The taxation of restricted stock is

- Page 283 and 284:

may be used by such taxpayer, free

- Page 285 and 286:

This technique appears so attractiv

- Page 287 and 288:

Thus, Morris‟s plan to turn in hi

- Page 289 and 290:

Redemptions to Pay Death Taxes and

- Page 291 and 292:

eneficiaries of the stockholders‟

- Page 293 and 294:

a subsidiary corporation, wholly ow

- Page 295 and 296:

As for the risk of double taxation,

- Page 297 and 298:

Until the late 1990s, only a few oc

- Page 299 and 300:

• Baptist Foundation of Arizona w

- Page 301 and 302:

ineffective audit committees. SOX e

- Page 303 and 304:

the takeover threat, and gives it t

- Page 305 and 306:

The Integrity of Financial Accounti

- Page 307 and 308:

eaffirm their core operating strate

- Page 309 and 310:

more difficult to quantify the impa

- Page 311 and 312:

individuals need to understand thei

- Page 313 and 314:

When actual prices and quantities a

- Page 315 and 316:

The Structure of Budgets Regardless

- Page 318 and 319:

For C&G‟s Gift Shop, expected sal

- Page 320 and 321:

The Financial Budget The financial

- Page 322 and 323:

Budgeted Accrued Expenses (34) Expe

- Page 324 and 325:

Net cash flows from financing activ

- Page 326 and 327:

Many other statistical techniques c

- Page 328 and 329:

Naturally, the term profit plan is

- Page 330 and 331:

that are not direct measures of ben

- Page 332 and 333:

www.bbrt.org CAM-I Beyond Budgeting

- Page 336 and 337:

In the highly volatile markets of t

- Page 338 and 339:

As stated earlier, analysts focus t

- Page 340 and 341:

It also should be clear why the fix

- Page 342 and 343:

Scenario 2 might be a volume increa

- Page 344 and 345:

(that is, overall sales would remai

- Page 346 and 347:

Exhibit 12.7 illustrates the extrem

- Page 348 and 349:

targeted set of customers with more

- Page 350 and 351:

incremental revenue, and at 77% con

- Page 352 and 353:

Of course, this is only one indicat

- Page 354:

William C. Lawler

- Page 358 and 359:

these competitors to invest in both

- Page 360 and 361:

Company executives were amazed at t

- Page 362 and 363:

Exhibit 13.5 Transaction processing

- Page 364 and 365:

The preceding example provides a nu

- Page 366 and 367:

Having identified the appropriate l

- Page 368 and 369:

1. Divide the indirect channel part

- Page 370 and 371:

If Airborne attains 80% of capacity

- Page 372 and 373:

5 John Shank and Vijay Govindarajan

- Page 374 and 375:

an entrepreneur might spend trying

- Page 376 and 377:

One of the major goals of business

- Page 378 and 379:

Finally, the cover should be eye-ca

- Page 380 and 381:

• Description of Opportunity. •

- Page 382 and 383:

the wave of the emerging technology

- Page 384 and 385:

Finding information about your comp

- Page 386 and 387:

Marketing Plan Up to this point we

- Page 388 and 389:

This section identifies how you wil

- Page 390 and 391:

Those estimates can then be aggrega

- Page 392 and 393:

operational business plan, the leve

- Page 394 and 395:

Team Georges Doriot, the father of

- Page 396 and 397:

Market Interest and Growth Potentia

- Page 398 and 399:

Financial Plan If the proceeding pl

- Page 400 and 401:

Business Plan Preparation Sites www

- Page 402:

Kim, C., and R. Mauborgne, Blue Oce

- Page 406 and 407:

In recent years there has been revo

- Page 408 and 409:

Experts are still divided over what

- Page 410 and 411:

low a price. By the time it found t

- Page 412 and 413:

At this point, in September 1998, a

- Page 414 and 415:

The lesson from these case studies

- Page 416 and 417:

for the machinery you bought. You v

- Page 418 and 419:

Upon expiration, the futures contra

- Page 420 and 421:

holding the underlying spot instrum

- Page 422 and 423:

A call option is an asset that give

- Page 424 and 425:

emain low, below the strike price,

- Page 426 and 427:

executives who became fabulously we

- Page 428 and 429:

A Protective Put Strategy A put opt

- Page 430 and 431:

Interest Rate Swaps The most common

- Page 432 and 433:

debt, but might help a pension fund

- Page 434 and 435:

tolerate a 10% rise in copper price

- Page 438 and 439:

It has been said that estimating th

- Page 440 and 441:

An Overview of the Business Valuati

- Page 442 and 443:

Acme has had research and developme

- Page 444 and 445:

Income Statement Analysis Victoria

- Page 446 and 447:

Acme reported consistent profitabil

- Page 448 and 449:

The purpose of this part of Victori

- Page 450 and 451:

Bob asks Victoria to explain the co

- Page 452 and 453:

As discussed earlier, financial sta

- Page 454 and 455:

An error when using the income appr

- Page 456 and 457:

Cost of Equity As discussed earlier

- Page 458 and 459:

Furthermore, she estimates Acme‟s

- Page 460 and 461:

The residual value is based on the

- Page 462 and 463:

• Market value of invested capita

- Page 464 and 465:

approach. Furthermore, she used pri

- Page 466 and 467:

• Eliminate the owners‟ nonbusi

- Page 468:

Pratt, Shannon P., and Alina V. Nic

- Page 472 and 473:

As we can see, acquisitions may occ

- Page 474 and 475:

Recent Trends and the Performance R

- Page 476 and 477:

2. Returns to bidders have fallen o

- Page 478 and 479:

Exhibit 17.7 Disaster deal #3: AT&T

- Page 480 and 481:

equipment were third-world regions.

- Page 482 and 483:

When Chambers felt comfortable that

- Page 484 and 485:

V AB - (V A + V B ), is the increme

- Page 486 and 487:

Finally, the acquisition of a compe

- Page 488 and 489:

Example 4: Consider two firms, A an

- Page 490 and 491:

The total value created by the acqu

- Page 492 and 493:

investors may anticipate this and v

- Page 494 and 495:

Lean‟s equity has increased by th

- Page 496 and 497:

3. Inability to implement change. 4

- Page 498 and 499:

Summary and Conclusions Mergers and

- Page 500 and 501:

8 “Cisco Changes Tack in Takeover

- Page 502:

Outsourcing Theodore Grossman

- Page 506 and 507:

increase margins. The last thing a

- Page 508 and 509:

Of companies outsourcing, 44% repor

- Page 510 and 511:

work long hours in subhuman conditi

- Page 512 and 513:

Companies and their outsourced part

- Page 514 and 515:

IBM, and Accenture are willing to a

- Page 516 and 517:

Beware of companies that do not wan

- Page 518 and 519:

The specification of the project is

- Page 520 and 521:

contract through poor performance o

- Page 522 and 523:

2 Ibid. 3 Ibid. For Further Reading

- Page 526 and 527:

Of all the chapters in this book, t

- Page 528 and 529:

and smaller devices. Over the past

- Page 530 and 531:

Today‟s PDAs have a touch screen

- Page 532 and 533:

drives. These portable storage devi

- Page 534 and 535:

(LAN) so that they can share printe

- Page 536 and 537:

PowerPoint (presentation graphics),

- Page 538 and 539:

Exhibits 19.3 Pro forma income stat

- Page 540 and 541:

elative addressing (change cell add

- Page 542 and 543:

Most current tools also offer the u

- Page 544 and 545:

Instant messaging (IM) (AIM is one

- Page 546 and 547:

Often, a manager is faced with the

- Page 548 and 549:

within a corporate network are usua

- Page 550 and 551:

Web browsers do have the ability to

- Page 552 and 553:

Multimedia By the latter half of th

- Page 554 and 555:

Note 1 Updated—based on work done

- Page 558 and 559:

The information technology (IT) and

- Page 560 and 561:

These systems are focused on how ef

- Page 562 and 563:

point-of-sale transactions are ente

- Page 564 and 565:

E-commerce (electronic commerce) ha

- Page 566 and 567:

generated queries against a databas

- Page 568 and 569:

Consider a BI model for a chain of

- Page 570 and 571:

Source: Information Builders. An ex

- Page 572 and 573:

have taken this evolution to a new

- Page 574 and 575:

through interconnected networks. Th

- Page 576 and 577:

However, the customer relinquishes

- Page 578 and 579:

The following scenario depicts what

- Page 580 and 581:

Field names are shown with syntax o

- Page 582 and 583:

in the early 1970s. The network was

- Page 584 and 585:

Controls Because the initial softwa

- Page 586 and 587:

of data privacy. Organizations need

- Page 590 and 591:

Note 1 Updated from a previous chap

- Page 594 and 595:

Unless you picked up this book at t

- Page 596 and 597:

The corporate finance role is inten

- Page 598 and 599:

a class invest in a broad range of

- Page 600 and 601:

Within commercial real estate, MBAs

- Page 602 and 603:

the power of the brand. As you thin

- Page 604 and 605:

Shift your resume from “This is w

- Page 606 and 607:

In many ways the cover letter can b

- Page 608 and 609:

considering a career in investment

- Page 610 and 611:

First Stage Key Contacts These are

- Page 612 and 613:

In this case, you will be speaking

- Page 614:

3 http://hedgeweek.com (HedgeMedia

- Page 619 and 620:

financial expertise. The purpose of

- Page 621 and 622:

Cost approach: A general way of est

- Page 623 and 624:

Fair market value: The price, expre

- Page 625 and 626:

Internal control: The policies and

- Page 627 and 628:

Multistep income statement: An inco

- Page 629 and 630:

Psychographic data: Information tha

- Page 631 and 632:

Tax-adjusted nonrecurring items: Pr

- Page 633 and 634:

Accounting systems Accounts payable

- Page 635 and 636:

American Institute of Certified Pub

- Page 637 and 638:

Audit firms‟ conflict of interest

- Page 639 and 640:

udgeted accounts payable budgeted a

- Page 641 and 642:

Buildup method Built-in gain Burn r

- Page 643 and 644:

taxation transferability of interes

- Page 645 and 646:

standards three approaches to value

- Page 647 and 648:

Capital structure bond valuation ca

- Page 649 and 650:

Cash-basis taxpayer, accounts recei

- Page 651 and 652:

Classification Clayton Act of 1914,

- Page 653 and 654:

limited liability companies limited

- Page 655 and 656:

Cost of capital Cost of debt Cost o

- Page 657 and 658:

Cross-border deals Cross-docking Cr

- Page 659 and 660:

Decision rules Decision support sys

- Page 661 and 662:

Discontinued operations note Discou

- Page 663 and 664:

Domain name servers (DNS) Domestic

- Page 665 and 666:

uy-sell agreements family limited p

- Page 667 and 668:

Financial advisor position Financia

- Page 669 and 670:

Forecasting Forecasts Forecasts and

- Page 671 and 672:

Gain vs. loss Gantt chart Gap analy

- Page 673 and 674:

central processing unit (CPU) hard

- Page 675 and 676:

Independent CPA Index of Economic F

- Page 677 and 678:

estatements of previously published

- Page 679 and 680:

Irregular cash flow IRS Form 1040 S

- Page 681 and 682:

control conversion to formation, of

- Page 683 and 684:

hardware software Margin analysis M

- Page 685 and 686:

Microsoft Outlook Microsoft PowerPo

- Page 687 and 688:

associations careers in finance e-c

- Page 689 and 690:

Objectives Object-oriented programm

- Page 691 and 692:

Other income (expense) note Out-of-

- Page 693 and 694:

Payback period Payment card industr

- Page 695 and 696:

Pooling of interest method Porter

- Page 697 and 698:

Private wealth management Privilege

- Page 699 and 700:

Quantify the material Quantity vari

- Page 701 and 702:

Revenue enhancement Revenue growth

- Page 703 and 704:

Security market line (SML) Segment

- Page 705 and 706:

networks and communication open sou

- Page 707 and 708:

Stock transfer Story model Straddle

- Page 709 and 710:

Takeovers Tangible goals Target Tar

- Page 711 and 712:

Tax savings Tax shelters Tax shield

- Page 713 and 714:

centralized resource allocation fin

- Page 715 and 716:

private wealth management. venture

- Page 717:

World Factbook (CIA) World Wide Web

![Genki - An Integrated Course in Elementary Japanese II [Second Edition] (2011), WITH PDF BOOKMARKS!](https://img.yumpu.com/58322134/1/180x260/genki-an-integrated-course-in-elementary-japanese-ii-second-edition-2011-with-pdf-bookmarks.jpg?quality=85)

![Genki - An Integrated Course in Elementary Japanese I [Second Edition] (2011), WITH PDF BOOKMARKS!](https://img.yumpu.com/58322120/1/182x260/genki-an-integrated-course-in-elementary-japanese-i-second-edition-2011-with-pdf-bookmarks.jpg?quality=85)