- Page 1 and 2:

Domestic technical textiles Industr

- Page 3 and 4:

Domestic consumotion of Oekotech is

- Page 5 and 6:

Overall, the domestic consumption o

- Page 7 and 8:

1. Low awareness about the benefits

- Page 9 and 10:

The key application areas of shade

- Page 11 and 12:

Shade-nets usage in India Existing

- Page 13 and 14:

Imports and Exports of Shade-nets T

- Page 15 and 16:

At present, mulch mats are being us

- Page 17 and 18:

during the Xth plan. The mulching t

- Page 19 and 20:

The machinery required is available

- Page 21 and 22:

a low level of shade (13% to 30%).

- Page 23 and 24:

The quantum of imports for Anti-hai

- Page 25 and 26:

In addition, woven crop-covers are

- Page 27 and 28:

Fishing nets Fishnets are key techn

- Page 29 and 30:

There are as many as 250-300 player

- Page 32 and 33:

MEDITECH Meditech products include

- Page 34 and 35:

Surgical Dressings Contact Lenses A

- Page 36 and 37:

Company Name Capital Employed (Rs c

- Page 38 and 39:

The baby diaper market in India is

- Page 40 and 41:

Incontinence Diapers Incontinence d

- Page 42 and 43:

The import figures for adult incont

- Page 44 and 45:

cover close to 85-90% of sanitary n

- Page 46 and 47:

In India, the majority of hospitals

- Page 48 and 49:

Average price per drape Rs 300 Aver

- Page 50 and 51:

In addition to the imports listed a

- Page 52 and 53:

administrators to promote the usage

- Page 54 and 55:

Exports of surgical sutures are exp

- Page 56 and 57:

Non-adherent hypoallergenic, gamma

- Page 58 and 59:

Rolled bandage Crepe bandage POP ba

- Page 60 and 61:

Contact Lenses The contact lenses a

- Page 62 and 63:

Eyewear market (per annum) Around 3

- Page 64 and 65:

There are two types of artificial h

- Page 66 and 67:

The imports of heart valves arrive

- Page 68 and 69:

Key manufacturers TTK Healthcare in

- Page 70 and 71:

TTK Healthcare in collaboration wit

- Page 72 and 73:

Artificial kidneys Domestic usage A

- Page 74 and 75:

HS Code Description 90189099, 90211

- Page 76 and 77:

Artificial Cornea The cornea is the

- Page 78 and 79:

Artificial Heart In India, about 20

- Page 80 and 81:

MOBILTECH Mobiltech segment of tech

- Page 82 and 83:

Nylon tyre cord Seat belt webbing*

- Page 84 and 85:

Market size (ECTT report) Airbags (

- Page 86 and 87:

(Vehicles in '000 numbers) Producti

- Page 88 and 89:

Seat belts webbings Effective domes

- Page 90 and 91:

The exports of seat belt webbing fr

- Page 92 and 93:

Car upholstery: Seat cover fabrics

- Page 94 and 95:

HS Code Description Imports Imports

- Page 96 and 97:

Quantity 1.04 lakh nos. 2.1 lakh no

- Page 98 and 99:

Quantity 13.6 million sq. m. 29 mil

- Page 100 and 101:

Headliner fabrics domestic usage Qu

- Page 102 and 103:

Insulation Felts Insulation felts,

- Page 104 and 105:

The manufacturing process for NVH p

- Page 106 and 107:

The potential market for sunvisors

- Page 108 and 109:

Autoliv is global leader in airbag

- Page 110 and 111:

Helmets Helmets are used as protect

- Page 112 and 113:

Helmets market - Domestic usage Qua

- Page 114 and 115:

Nylon tyre cord fabric Nylon tyre c

- Page 116 and 117:

The production of nylon tyre fabric

- Page 118 and 119:

Usage of technical textiles in airl

- Page 120 and 121:

The current and future forecast of

- Page 122 and 123:

UK accounts for over 50% of the imp

- Page 124 and 125:

The typical usage 9 of the material

- Page 126 and 127:

PACKTECH Packtech includes several

- Page 128 and 129:

Market size (ECTT report) Polyolefi

- Page 130 and 131:

• Tarpaulins • Leno bags • La

- Page 132 and 133:

Neo Corp Intern 2006-07 2007-08 7,6

- Page 134 and 135:

Polyolefin Woven Sacks (excluding F

- Page 136 and 137:

Value Rs 6,725 crore Rs 12,950 cror

- Page 138 and 139:

Flexible Intermediate Bulk Containe

- Page 140 and 141:

prices in the last few years have s

- Page 142 and 143:

Leno Bags Leno bags are excellent f

- Page 144 and 145:

The main machine required for leno

- Page 146 and 147:

Soft Luggage The luggage industry i

- Page 148 and 149:

HS Code* Description 42021110/20/30

- Page 150 and 151:

Jute Hessian and Sacks (including F

- Page 152 and 153:

Manufacturer Year Quantity (MT) Val

- Page 154 and 155:

Source: IBIS, IMaCS Analysis * This

- Page 156 and 157:

• IS 11193:1984 Jute canvas posta

- Page 158 and 159:

The market size of tea-bag filter h

- Page 160 and 161:

SPORTECH Sportech segment comprises

- Page 162 and 163:

Swimwear Tents TOTAL Value Quantity

- Page 165 and 166:

Sports Composites Market Sports com

- Page 167 and 168:

and Germany. The Boxing equipments

- Page 169 and 170: Artificial turf Artificial turf, or

- Page 171 and 172: Hence, on an average, 6-8 astro-tur

- Page 173 and 174: • Harness - The pack is fastened

- Page 175 and 176: Equivalent parachute fabric Around

- Page 177 and 178: The market for hot air balloons is

- Page 179 and 180: 88010020 Hot air balloon envelope Q

- Page 181 and 182: Sail cloth Sail is a large piece of

- Page 183 and 184: equally over the years which equals

- Page 185 and 186: Sleeping bags Value Rs 12 crore app

- Page 187 and 188: • Bundesman water Repellency Equi

- Page 189 and 190: The specifications for various nets

- Page 191 and 192: Sport shoes components Product char

- Page 193 and 194: The Indian shoe manufacturing indus

- Page 196 and 197: Tents Tents are portable shelter ma

- Page 198 and 199: The domestic market for camping ten

- Page 200 and 201: Cotton and Polyester cotton blended

- Page 202 and 203: Besides the outer part of tent, fab

- Page 204 and 205: Swimwear A swimsuit, bathing suit o

- Page 206 and 207: esistance. While this chlorine resi

- Page 208 and 209: 61123100, 61123990, 61124100, 61124

- Page 210 and 211: Summary of the market-sizing for Bu

- Page 212 and 213: The key impediments to growth of Bu

- Page 214 and 215: • PVC coated polyester PVC coated

- Page 216 and 217: Market size of tensile membrane fab

- Page 218 and 219: Quality Control and Standards The p

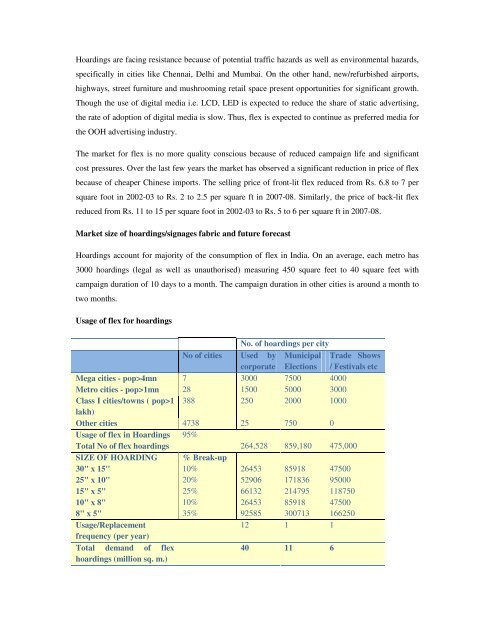

- Page 222 and 223: fabric Quantity 95 million sq m or

- Page 224 and 225: Tarpaulins - HDPE, Cotton canvas an

- Page 226 and 227: enjoys over the HDPE tarpaulin is t

- Page 228 and 229: HS Code Description 63061990 630619

- Page 230 and 231: The average domestic market price o

- Page 232 and 233: • Kabra Extrusiontechnik Ltd. (KE

- Page 234 and 235: size of awnings & canopies has been

- Page 236 and 237: • Woven or Warp knitted fabrics -

- Page 238 and 239: Floor and wall coverings Floor & Wa

- Page 240 and 241: The estimated import figures for Fl

- Page 242 and 243: Scaffolding Nets Scaffolding nettin

- Page 244 and 245: CLOTHTECH The Clothtech segment of

- Page 246 and 247: Umbrella Cloth Sewing Threads TOTAL

- Page 248 and 249: Impediments to growth The cheaper i

- Page 250 and 251: countries next only to China. The I

- Page 252 and 253: of 300 denier. Reliance Industries

- Page 254 and 255: The current domestic men’s readym

- Page 256 and 257: Imports and Exports of Interlining

- Page 258 and 259: Zip Fasteners A zipper (zip fastene

- Page 260 and 261: segment is expected to grow at 4% y

- Page 262 and 263: Source: IBIS, IMaCS Analysis Over 5

- Page 264 and 265: Current Market size and future pote

- Page 266 and 267: The key machinery suppliers in Indi

- Page 268 and 269: segment consumes H&L fasteners in c

- Page 270 and 271:

HS Code* Description 58061000, 5806

- Page 272 and 273:

Labels Label is a piece of material

- Page 274 and 275:

Average price of a label Rs 0.55 Av

- Page 276 and 277:

Printed labels are often printed on

- Page 278 and 279:

Umbrella Fabric Umbrella fabric is

- Page 280 and 281:

Sewing threads Sewing thread is a p

- Page 282 and 283:

Madura Coats Ltd (MCL), a subsidiar

- Page 284 and 285:

HS Code Description Imports (in Rs

- Page 286 and 287:

The stuffed toys segment is expecte

- Page 288 and 289:

Market size (ECTT report) Jute carp

- Page 290 and 291:

Fiberfil Fiberfil refers to Polyest

- Page 292 and 293:

Value Chain of Virgin PSF Petrochem

- Page 295 and 296:

Carpet Backing Cloth A carpet is an

- Page 297 and 298:

Jute CBC Synthetic CBC Total Key ma

- Page 299 and 300:

Stuffed toys Stuffed toys, also ref

- Page 301 and 302:

HS Code Description Quantity 950300

- Page 303 and 304:

Slat blinds, which consist of many

- Page 305 and 306:

63039910/90, 63049990, 63061930 391

- Page 307 and 308:

Filtration efficiency: Filtration e

- Page 309 and 310:

sizes and use different filtration

- Page 311 and 312:

Type of Raw materials The major fil

- Page 313 and 314:

The import of filter fabric used in

- Page 315 and 316:

Pillows can be made of variety of f

- Page 317 and 318:

Imports and Exports The import figu

- Page 319 and 320:

of 15%). The market potential for w

- Page 321 and 322:

Nylon net consumption norm (Mosquit

- Page 323 and 324:

PROTECH Protech is an ensemble of t

- Page 325 and 326:

apparels and high visibility clothi

- Page 327:

Market size (ECTT report) (C) F. R.

- Page 330 and 331:

With the rising trend of crime, vio

- Page 332 and 333:

fire. The there are typically two m

- Page 334 and 335:

In addition, Delkon Textile Pvt. Lt

- Page 336 and 337:

Fire /Flame retardant apparel The f

- Page 338 and 339:

manufactured using inherently fire

- Page 340 and 341:

Nuclear Biological and Chemical (NB

- Page 342 and 343:

High-Visibility clothing High visib

- Page 344 and 345:

Quantity (Lakh pieces) 60.0 120.7 V

- Page 346 and 347:

chemical and chemical product indus

- Page 348 and 349:

High altitude clothing High altitud

- Page 350 and 351:

Domestic use of high altitude cloth

- Page 352 and 353:

The market of work gloves or indust

- Page 354 and 355:

40159030 Industrial gloves 4.95 6.3

- Page 356 and 357:

GEOTECH Geotech segment comprises o

- Page 358 and 359:

The principal functions performed b

- Page 360 and 361:

one or two directions for improved

- Page 362 and 363:

Roads (excluding PMGSY) 245,000 54,

- Page 364 and 365:

Kusumgar Corporates 2007-08 250 225

- Page 366 and 367:

Sectors Investment Needs during 200

- Page 368 and 369:

above factors in mind, we have assu

- Page 370 and 371:

At present, majority of manufacture

- Page 372 and 373:

OEKOTECH Oekotech segment refers to

- Page 374 and 375:

Both woven and non-woven geosynthet

- Page 376 and 377:

Total 72.40 6827.25 Source: Industr

- Page 378 and 379:

• AGM glass battery separators

- Page 380 and 381:

Paper making fabrics TOTAL Value Qu

- Page 382 and 383:

Indutech segment of technical texti

- Page 384 and 385:

Bombay Dyeing is the largest manufa

- Page 386 and 387:

Bolting Cloth Bolting cloth is a me

- Page 388 and 389:

Absorbent Glass mat Battery separat

- Page 390 and 391:

End-user Year Quantity Value (Rs Un

- Page 392 and 393:

70193900, 70199010, GLASS FIBRE SHE

- Page 394 and 395:

(Million) rods) (Crore) ITC 2007-08

- Page 396 and 397:

Coated abrasives An abrasive materi

- Page 398 and 399:

Cloth backing consumption norms (co

- Page 400 and 401:

Conveyor Belts Belt Conveyor system

- Page 402 and 403:

Market size 2007-2008 2012-2013 Uni

- Page 404 and 405:

The transmission belts can be class

- Page 406 and 407:

HS Code Description Imports (in Rs

- Page 408 and 409:

Quality Control and Standards Raw M

- Page 410 and 411:

5. Inkwayz - Super Tech Ribbon Pvt.

- Page 412 and 413:

Printed Circuit Board The Printed C

- Page 414 and 415:

The potential market for glass fibr

- Page 416 and 417:

Source: DGCIS, IMaCS Analysis The c

- Page 418 and 419:

The demand for these fabrics is pri

- Page 420 and 421:

Paper Making Fabric industry 2007-0

- Page 422 and 423:

Composites The burgeoning manufactu

- Page 424 and 425:

Building and Construction Construct

- Page 426 and 427:

The current and future forecast of

- Page 428 and 429:

The import of Glass fibre products

- Page 430 and 431:

Market dynamics and key growth driv

- Page 432 and 433:

56074900 56079090 56081900 56089090

- Page 434 and 435:

Filtration products Key application

- Page 436 and 437:

Polymer Paper Limited is another fi

- Page 438 and 439:

59119090, 59111000, 59112000, 59113

- Page 440:

BIS Standard Description IS 11574 :