EPA Review Annex Documents - DFID

EPA Review Annex Documents - DFID

EPA Review Annex Documents - DFID

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

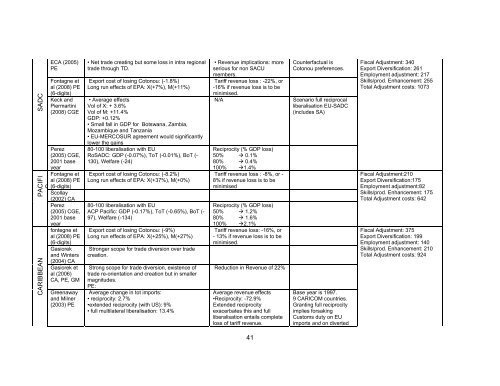

SADC<br />

Fontagne et<br />

PACIFI<br />

C<br />

CARIBBEAN<br />

ECA (2005)<br />

PE<br />

Fontagne et<br />

al (2008) PE<br />

(6-digits)<br />

Keck and<br />

Piermartini<br />

(2008) CGE<br />

Perez<br />

(2005) CGE,<br />

2001 base<br />

year<br />

al (2008) PE<br />

(6-digits)<br />

Scollay<br />

(2002) CA<br />

Perez<br />

(2005) CGE,<br />

2001 base<br />

year<br />

fontegne et<br />

al (2008) PE<br />

(6-digits)<br />

Gasiorek<br />

and Winters<br />

(2004) CA<br />

Gasiorek et<br />

al (2006)<br />

CA, PE, GM<br />

Greenaway<br />

and Milner<br />

(2003) PE<br />

• Net trade creating but some loss in intra regional<br />

trade through TD.<br />

Export cost of losing Cotonou: (-1.8%)<br />

Long run effects of <strong>EPA</strong>: X(+7%), M(+11%)<br />

• Average effects<br />

Vol of X: + 3.6%<br />

Vol of M: +11.4%<br />

GDP: +0.12%<br />

• Small fall in GDP for Botswana, Zambia,<br />

Mozambique and Tanzania<br />

• EU-MERCOSUR agreement would significantly<br />

lower the gains<br />

80-100 liberalisation with EU<br />

RoSADC: GDP (-0.07%), ToT (-0.01%), BoT (-<br />

130), Welfare (-24)<br />

Export cost of losing Cotonou: (-8.2%)<br />

Long run effects of <strong>EPA</strong>: X(+37%), M(+0%)<br />

80-100 liberalisation with EU<br />

ACP Pacific: GDP (-0.17%), ToT (-0.65%), BoT (-<br />

97), Welfare (-134)<br />

Export cost of losing Cotonou: (-9%)<br />

Long run effects of <strong>EPA</strong>: X(+25%), M(+27%)<br />

Stronger scope for trade diversion over trade<br />

creation.<br />

Strong scope for trade diversion, existence of<br />

trade re-orientation and creation but in smaller<br />

magnitudes.<br />

PE:<br />

Average change in tot imports:<br />

• reciprocity: 2.7%<br />

•extended reciprocity (with US): 9%<br />

• full multilateral liberalisation: 13.4%<br />

• Revenue implications: more<br />

serious for non SACU<br />

members.<br />

Tariff revenue loss : -22%, or<br />

-16% if revenue loss is to be<br />

minimised.<br />

41<br />

Counterfactual is<br />

Cotonou preferences.<br />

N/A Scenario full reciprocal<br />

liberalisation EU-SADC<br />

(includes SA)<br />

Reciprocity (% GDP loss)<br />

50% � 0.1%<br />

80% � 0.4%<br />

100% �1.4%<br />

Tariff revenue loss : -8%, or -<br />

8% if revenue loss is to be<br />

minimised<br />

Reciprocity (% GDP loss)<br />

50% � 1.2%<br />

80% � 1.6%<br />

100% �2.1%<br />

Tariff revenue loss: -16%, or<br />

- 13% if revenue loss is to be<br />

minimised.<br />

Reduction in Revenue of 22%<br />

Average revenue effects<br />

•Reciprocity: -72.9%<br />

Extended reciprocity<br />

exacerbates this and full<br />

liberalisation entails complete<br />

loss of tariff revenue.<br />

Base year is 1997.<br />

9 CARICOM countries.<br />

Granting full reciprocity<br />

implies forsaking<br />

Customs duty on EU<br />

imports and on diverted<br />

Fiscal Adjustment: 340<br />

Export Diversification: 261<br />

Employment adjustment: 217<br />

Skills/prod. Enhancement: 255<br />

Total Adjustment costs: 1073<br />

Fiscal Adjustment:210<br />

Export Diversification:175<br />

Employment adjustment:82<br />

Skills/prod. Enhancement: 175<br />

Total Adjustment costs: 642<br />

Fiscal Adjustment: 375<br />

Export Diversification: 199<br />

Employment adjustment: 140<br />

Skills/prod. Enhancement: 210<br />

Total Adjustment costs: 924