EPA Review Annex Documents - DFID

EPA Review Annex Documents - DFID

EPA Review Annex Documents - DFID

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

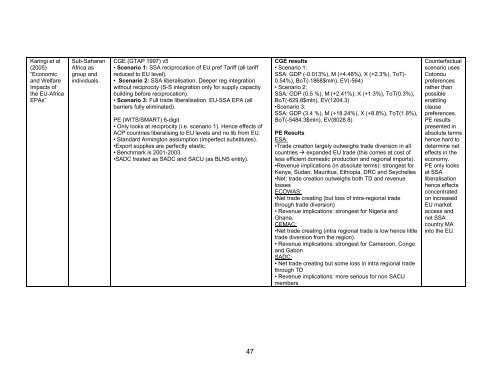

Karingi et al<br />

(2005)<br />

“Economic<br />

and Welfare<br />

Impacts of<br />

the EU-Africa<br />

<strong>EPA</strong>s”<br />

Sub-Saharan<br />

Africa as<br />

group and<br />

individuals.<br />

CGE (GTAP 1997) v5<br />

• Scenario 1: SSA reciprocation of EU pref Tariff (all tariff<br />

reduced to EU level).<br />

• Scenario 2: SSA liberalisation. Deeper reg integration<br />

without reciprocity (S-S integration only for supply capacity<br />

building before reciprocation).<br />

• Scenario 3: Full trade liberalisation. EU-SSA <strong>EPA</strong> (all<br />

barriers fully eliminated).<br />

PE (WITS/SMART) 6-digit<br />

• Only looks at reciprocity (i.e. scenario 1). Hence effects of<br />

ACP countries liberalising to EU levels and no lib from EU.<br />

• Standard Armington assumption (imperfect substitutes).<br />

•Export supplies are perfectly elastic.<br />

• Benchmark is 2001-2003.<br />

•SADC treated as SADC and SACU (as BLNS entity).<br />

47<br />

CGE results<br />

• Scenario 1:<br />

SSA: GDP (-0.013%), M (+4.48%), X (+2.3%), ToT(-<br />

0.54%), BoT(-1868$mln), EV(-564)<br />

• Scenario 2:<br />

SSA: GDP (0.5 %), M (+2.41%), X (+1.3%), ToT(0.3%),<br />

BoT(-629.8$mln), EV(1204.3)<br />

•Scenario 3:<br />

SSA: GDP (3.4 %), M (+18.24%), X (+8.8%), ToT(1.8%),<br />

BoT(-5484.3$mln), EV(8028.8)<br />

PE Results<br />

ESA:<br />

•Trade creation largely outweighs trade diversion in all<br />

countries � expanded EU trade (this comes at cost of<br />

less efficient domestic production and regional imports).<br />

•Revenue implications (in absolute terms): strongest for<br />

Kenya, Sudan, Mauritius, Ethiopia, DRC and Seychelles<br />

•Net: trade creation outweighs both TD and revenue<br />

losses<br />

ECOWAS:<br />

•Net trade creating (but loss of intra-regional trade<br />

through trade diversion)<br />

• Revenue implications: strongest for Nigeria and<br />

Ghana.<br />

CEMAC:<br />

•Net trade creating (intra regional trade is low hence little<br />

trade diversion from the region).<br />

• Revenue implications: strongest for Cameroon, Congo<br />

and Gabon<br />

SADC:<br />

• Net trade creating but some loss in intra regional trade<br />

through TD<br />

• Revenue implications: more serious for non SACU<br />

members<br />

Counterfactual<br />

scenario uses<br />

Cotonou<br />

preferences<br />

rather than<br />

possible<br />

enabling<br />

clause<br />

preferences.<br />

PE results<br />

presented in<br />

absolute terms<br />

hence hard to<br />

determine net<br />

effects in the<br />

economy.<br />

PE only looks<br />

at SSA<br />

liberalisation<br />

hence effects<br />

concentrated<br />

on increased<br />

EU market<br />

access and<br />

not SSA<br />

country MA<br />

into the EU.