Download printable catalog - CSU Channel Islands

Download printable catalog - CSU Channel Islands

Download printable catalog - CSU Channel Islands

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

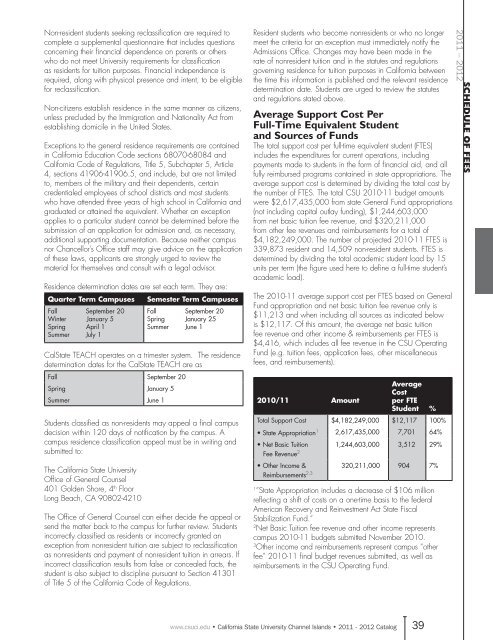

Non-resident students seeking reclassification are required tocomplete a supplemental questionnaire that includes questionsconcerning their financial dependence on parents or otherswho do not meet University requirements for classificationas residents for tuition purposes. Financial independence isrequired, along with physical presence and intent, to be eligiblefor reclassification.Non-citizens establish residence in the same manner as citizens,unless precluded by the Immigration and Nationality Act fromestablishing domicile in the United States.Exceptions to the general residence requirements are containedin California Education Code sections 68070-68084 andCalifornia Code of Regulations, Title 5, Subchapter 5, Article4, sections 41906-41906.5, and include, but are not limitedto, members of the military and their dependents, certaincredentialed employees of school districts and most studentswho have attended three years of high school in California andgraduated or attained the equivalent. Whether an exceptionapplies to a particular student cannot be determined before thesubmission of an application for admission and, as necessary,additional supporting documentation. Because neither campusnor Chancellor’s Office staff may give advice on the applicationof these laws, applicants are strongly urged to review thematerial for themselves and consult with a legal advisor.Residence determination dates are set each term. They are:Quarter Term CampusesFall September 20Winter January 5Spring April 1Summer July 1Semester Term CampusesFall September 20Spring January 25Summer June 1CalState TEACH operates on a trimester system. The residencedetermination dates for the CalState TEACH are asFall September 20Spring January 5Summer June 1Students classified as non-residents may appeal a final campusdecision within 120 days of notification by the campus. Acampus residence classification appeal must be in writing andsubmitted to:The California State UniversityOffice of General Counsel401 Golden Shore, 4 th FloorLong Beach, CA 90802-4210The Office of General Counsel can either decide the appeal orsend the matter back to the campus for further review. Studentsincorrectly classified as residents or incorrectly granted anexception from nonresident tuition are subject to reclassificationas nonresidents and payment of nonresident tuition in arrears. Ifincorrect classification results from false or concealed facts, thestudent is also subject to discipline pursuant to Section 41301of Title 5 of the California Code of Regulations.Resident students who become nonresidents or who no longermeet the criteria for an exception must immediately notify theAdmissions Office. Changes may have been made in therate of nonresident tuition and in the statutes and regulationsgoverning residence for tuition purposes in California betweenthe time this information is published and the relevant residencedetermination date. Students are urged to review the statutesand regulations stated above.Average Support Cost PerFull-Time Equivalent Studentand Sources of FundsThe total support cost per full-time equivalent student (FTES)includes the expenditures for current operations, includingpayments made to students in the form of financial aid, and allfully reimbursed programs contained in state appropriations. Theaverage support cost is determined by dividing the total cost bythe number of FTES. The total <strong>CSU</strong> 2010-11 budget amountswere $2,617,435,000 from state General Fund appropriations(not including capital outlay funding), $1,244,603,000from net basic tuition fee revenue, and $320,211,000from other fee revenues and reimbursements for a total of$4,182,249,000. The number of projected 2010-11 FTES is339,873 resident and 14,509 non-resident students. FTES isdetermined by dividing the total academic student load by 15units per term (the figure used here to define a full-time student’sacademic load).The 2010-11 average support cost per FTES based on GeneralFund appropriation and net basic tuition fee revenue only is$11,213 and when including all sources as indicated belowis $12,117. Of this amount, the average net basic tuitionfee revenue and other income & reimbursements per FTES is$4,416, which includes all fee revenue in the <strong>CSU</strong> OperatingFund (e.g. tuition fees, application fees, other miscellaneousfees, and reimbursements).2010/11 AmountAverageCostper FTEStudent %Total Support Cost $4,182,249,000 $12,117 100%• State Appropriation 1 2,617,435,000 7,701 64%• Net Basic Tuition 1,244,603,000 3,512 29%Fee Revenue 2• Other Income &320,211,000 904 7%Reimbursements 2,31”State Appropriation includes a decrease of $106 millionreflecting a shift of costs on a one-time basis to the federalAmerican Recovery and Reinvestment Act State FiscalStabilization Fund.”2Net Basic Tuition fee revenue and other income representscampus 2010-11 budgets submitted November 2010.3Other income and reimbursements represent campus “otherfee” 2010-11 final budget revenues submitted, as well asreimbursements in the <strong>CSU</strong> Operating Fund.Schedule of fees2011 – 2012www.csuci.edu • California State University <strong>Channel</strong> <strong>Islands</strong> • 2011 - 2012 Catalog 39