- Page 1 and 2:

Pesticide Managemen and Integrated

- Page 3 and 4:

Correct citation: P. S.Teng and K.,

- Page 5 and 6:

IPM DEVELOPMENT Crop protection and

- Page 7 and 8:

A comparative study on the occupati

- Page 9 and 10:

PREFACE The Southeast Asi-n region

- Page 11 and 12:

FUTURE NEEDS FOR PESTICIDE MANAGEME

- Page 13 and 14:

FUIURE NEEDS FOR PESTICIDE MANAGEME

- Page 15 and 16:

FUTURE NEEDS FOR P'STICIDE ,MANAGEM

- Page 17 and 18:

FUTURE NEEDS FOR PESTICIDE MANAGEME

- Page 19 and 20:

1UI'RE NEEDS FOR PIESTICIDF MA NAGI

- Page 21 and 22:

1:1-FURT: NEED'I)S FOR PF.SII1)" MA

- Page 23 and 24:

14 PI-S'IlCIDE MANAGIEMENT AND 1PM

- Page 25 and 26:

16 Il-'IICIDE MANA(C;I-N'I AND IPM

- Page 27 and 28:

18 PF1STnCIDF MANAGEMENT AND IPM 1:

- Page 29 and 30:

OVERVIEW OF IPM INFRASTRUCTURE AND

- Page 31 and 32:

Table 2. List of some of the major

- Page 33 and 34:

IPM ON ESTATE CROPS ININDONTSIA 25

- Page 35 and 36:

OVERVIEW OF IPM INFRASTRUCTURE AND

- Page 37 and 38:

2. IMPLEMENTATION PHASE IPM ON FOOD

- Page 39 and 40:

OVERVIEW OF IPM INFRASTRUCTURE AND

- Page 41 and 42:

[IM ON ESTATE CROPS IN MALAYSIA 33

- Page 43 and 44:

IMPLEI MENTATION Cost Objectives IP

- Page 45 and 46:

HPM ON ESTATE CROPS IN MALAYSIA 37

- Page 47 and 48:

IPM ON ESTATE CROPS IN MALAYSIA 39

- Page 49 and 50:

HPM ON ESTATE CROPS IN MALAYSIA 4 1

- Page 51 and 52:

4.4 PESTICIDE MANAGEMENT AND IPM IN

- Page 53 and 54:

46 PESTCIDE MANAGEMENT AND IPM INSO

- Page 55 and 56:

Table 1continued Variety Maturity N

- Page 57 and 58:

50 PESTICIDE MANAGEMENT AND IPM IN

- Page 59 and 60:

52 PESCIDE MANAGEMENT AND 1PM IN SO

- Page 61 and 62:

54 PESTICIDE MANAGEMENTI AND IPM IN

- Page 63 and 64:

56 PES'IiCIDE MANAGIEMI/N'I AND 1PM

- Page 65 and 66:

5X iILPI1CiDI: NANA;I-\II AND 1PM I

- Page 67 and 68:

6G PESI1CIDE MANAGEMENT AND 1PM INS

- Page 69 and 70:

02 PI:SICIDIANAGIME-T AND I, INSOUI

- Page 71 and 72:

64 PESTiCIDE MANAGEMENT AND IPM INS

- Page 73 and 74:

THE ROLE OF INSECTICIDES IN RICE IP

- Page 75 and 76:

ROLE OF INSE-TICIDES INRICE IPM SYS

- Page 77 and 78:

ROLE OF INSETICIDES INRICE I1'M SYS

- Page 79 and 80:

FEASIBILITY OF USING LOCALLY PRODUC

- Page 81 and 82:

USE OFB 1"J CONTROL IROPICAL INSECr

- Page 83 and 84:

USE OF BI TO CONTROL'TROPICAL INSEC

- Page 85 and 86:

USE OF Bt TO CONrOIROLTOPICAL INS E

- Page 87 and 88:

USE OF B TO CONTROL'IROPICAL INSECT

- Page 89 and 90:

84 PFS'I1CID MANAGEMFN'I AND IPM IN

- Page 91 and 92:

86 PESTICIDE MANAGEMENT AND IPM IN

- Page 93 and 94:

88 PESTICIDE MANAGEMENT AND IPM IN

- Page 95 and 96:

90 PI:S'ICIDE MANAGI'ENTIIN AND HPM

- Page 97 and 98:

92 PI-iCIDE ,MANAGEMENTr AND IPM IN

- Page 99 and 100:

DEVELOPMENT OF ACTION CONTROL THRES

- Page 101 and 102:

DEVELOPMflr r OF ACTION CONTROL TIR

- Page 103 and 104:

DEVEOPMENr OF ACTION CONTROL TIRESI

- Page 105 and 106:

DEVE.OPMENT OF ACTION CONTROLmTIIRE

- Page 107 and 108:

ECONOMICS OF INTEGRATED PEST CONTRO

- Page 109 and 110:

Increase innet return (S/ho) 30 25

- Page 111 and 112:

Table 3. Possible negative impact o

- Page 113 and 114:

ECONOMICS OFIPC IN RICE IN SOUTIIlE

- Page 115 and 116:

ECONOMICS OF IPC IN RICE INSOUTIEAS

- Page 117 and 118:

114 PSTICIDE MANAGENTIr AND IPM IN

- Page 119 and 120:

116 PES11CIDE MANAGEMENT AND IPM IN

- Page 121 and 122: 118 PFSTICIDE MANAGEMENT AND IPM IN

- Page 123 and 124: 120 PESTICIDE MANAGEMENT AND IPM IN

- Page 125 and 126: 122 PESCIDE MANAGEMENT AND IPM INSO

- Page 127 and 128: 124 PESTICIDE MANAGIEN-" AND nPM IN

- Page 129 and 130: 126 PEI1CIDE MANAGIMENT AND IPM IN

- Page 131 and 132: 128 PESTICIDE MANAGEMENT AND IPM IN

- Page 133 and 134: BIOLOGICAL CONTROL OF CORN STALK BO

- Page 135 and 136: BIOLOGICAL CONTROL OFCORN STALK BOR

- Page 137 and 138: CROP PROTECTION AND 1PM IN RAINFED

- Page 139 and 140: IPM IN RAINFED CROPPING SYSTEMS INN

- Page 141 and 142: IPM IN RAINI:ED CROI iNC; SYSTE'IMS

- Page 143 and 144: IPM IN RAINFED CROPPING SYSIEMS IN

- Page 145 and 146: 1PM IN RAINFIED CROPIPING SYS'I.IS

- Page 147 and 148: I 4b IIk%1CII)E - MANAGIIj.NTI ANt)

- Page 149 and 150: 148 PE3SIICtDEMANAGEMENI' AND IPM I

- Page 151 and 152: 150 PFSTICII)E MANAG'MENTI" AND IIM

- Page 153 and 154: 152 PESllCIDE MANAGEMENT AND IPM IN

- Page 155 and 156: 154 PESTICIDE MANAGEMFNT AND IPM IN

- Page 157 and 158: AN APPROACH TO INTEGRATED PEST MANA

- Page 159 and 160: IPM AI'I V'IIlE.S OF TI tE PlIIAI'P

- Page 161 and 162: no.&% 60 50 40 1PM ACTIVrI1S OF "I'

- Page 163 and 164: IM ACI'IV1IS OF1TI III 111.1 11NI t

- Page 165 and 166: 1PM ACT'IVrIIES O: TIlE II/P1 IILII

- Page 167 and 168: IPM ACI'IVrll-S OF TI I 11 II.PlNE-

- Page 169 and 170: ECONOMIC JUSTIFICATION OF IPM: THE

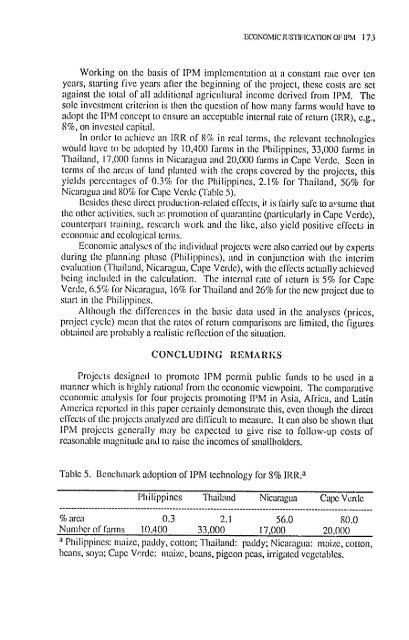

- Page 171: ECONOMIC JUSTIFICATION OF 1PM 171 W

- Page 175 and 176: IPM ACTIVITIES IN SUGARCANE IN THAI

- Page 177 and 178: HPM ACHIVITIES INSUGARCANI INTIIAIL

- Page 179 and 180: Table 2. Comparison of investment c

- Page 181 and 182: IPM ACTIVITIES IN COCONUT IN SOUTHE

- Page 183 and 184: )M A(:I'IV'IIB.S INC(X:()N1S 183 co

- Page 185 and 186: IPM ACI'VITIES IN COCONUTS 185 year

- Page 187 and 188: PEST MANAGEMENT ON OIL PALM IN MALA

- Page 189 and 190: IPEST MANAGEF.N'rON OI IPALM IhNMAL

- Page 191 and 192: PI TFMANAGIEMI-\I'ON O11. IAIM INMA

- Page 193 and 194: PEST MANAGEMENT ON COCOA IN MALAYSI

- Page 195 and 196: PI'ST MANAGLMI .N'I' ON C(XXOA INMA

- Page 197 and 198: IIST M,',ANAGEMpI'r ON COCO,', INMA

- Page 199 and 200: P.ST MANAG!,MlNI" ON CCXTO)A IN MAA

- Page 201 and 202: PEST MANAGEMENT ON COCOA IN MALAYSI

- Page 203 and 204: PES' MANAGEMIN ON COCOA INMALAYSIA

- Page 205 and 206: 206 I'ES'ICIDI MANA(IMFIT AND IPMIN

- Page 207 and 208: 208 PESTICIDE MANAGI-2.MENT AND HPM

- Page 209 and 210: 210 PFS'I1CIDE MANAG[12EN' AND IPM

- Page 211 and 212: 212 PESTICIDE MANAGEMENT AND IPM IN

- Page 213 and 214: 21 - 1CIDI- MANAGI.MI-NT AND IPM IN

- Page 215 and 216: Table 2. Effect of different insect

- Page 217 and 218: Table 3. Comparative economics of d

- Page 219 and 220: 220 IP'FCID:IMANAGMENT AND HPM IN S

- Page 221 and 222: 222 PFuS'IICIDE MANAGFMI'NT' AND IP

- Page 223 and 224:

224 PESTICIDE MANAGIEMEN'I' AND 1PM

- Page 225 and 226:

2 26 I'S'lCII)EIIMANAGFMI'NT"AND IP

- Page 227 and 228:

228 PESTICIDE MANAGENENT AND IPM IN

- Page 229 and 230:

230 P.STICIDE MANAGEMIN I'AND IM IN

- Page 231 and 232:

232 IESTICIDE MANAGEMENT AND fPM IN

- Page 233 and 234:

234 PESTICIDIF MIANAGI:.EN' AND 1PM

- Page 235 and 236:

236 I. S'EI1CI1)- MANAGtMI/NT' AND

- Page 237 and 238:

I 0 af VV4' ~ . f). IC AI ~ 1U 8 '8

- Page 239 and 240:

240 PES'I1CIDE MANAGFMEN'"I' AND IP

- Page 241 and 242:

242 tl-S'(ll.E MANAGIMI-NI AND IPM

- Page 243 and 244:

244 PESTICIDE MANAGEMI-Nt' AND IPM

- Page 245 and 246:

APPENDIX I continued__ Pest 1.6 Zig

- Page 247 and 248:

APPENDIX I continued Pest 3. Rats (

- Page 249 and 250:

APPENDIX I continued Pest Sampling

- Page 251 and 252:

252 PE."ST'IICIDI- MANAGEMI-ENT AND

- Page 253 and 254:

254 PESICIDE MANAGFMAENT AND [PM IN

- Page 255 and 256:

OVERVIEW OF PESTICIDE RESISTANCE PR

- Page 257 and 258:

PISICIDE R3SISTANCE PROILEMS INSOU1

- Page 259 and 260:

PII'S'IICIDI" RESISTAN(J- IROBI.I[M

- Page 261 and 262:

lI.S'I1CIDEi RFSISIANCI- IIROIII.I'

- Page 263 and 264:

Insect Rice insect pcst Nilaparvata

- Page 265 and 266:

APPENDIX I continued Insect Insect

- Page 267 and 268:

271 Pt-5ICIDI- MANA(;I\I-' AN) 1PM

- Page 269 and 270:

272 7 cb2ol:\1ANA { \I:\ AND PM IN

- Page 271 and 272:

274 PESICDE MANAG-MENT AND 11M IN S

- Page 273 and 274:

276 Pt:S'ICIDF MANAGI-I' AND IIM IN

- Page 275 and 276:

PESTICIDE RESISTANCE PROBLEMS N. Si

- Page 277 and 278:

Percent Control Figure 1. Trend of

- Page 279 and 280:

1'ESTICIDE RISISTANCE PROBLEMS IN T

- Page 281 and 282:

PESTICIDE RESISTANCE IN THE PHILIPP

- Page 283 and 284:

PSTICIDE RESISTANCE IN TIME PHILIPP

- Page 285 and 286:

PESTICIDE RESISTANCE INTIlE PHILIPP

- Page 287 and 288:

292 PE'STICIDE MANAGMitwr AND IPM I

- Page 289 and 290:

294 PESTICIDE MANAGEmr[ ENT AND IM

- Page 291 and 292:

PESTICIDE RESISTANCE: THE REALITIES

- Page 293 and 294:

PFESlICIDE RIEISTANCE: TILE REALIES

- Page 295 and 296:

HEALTH HAZARDS DUE TO THE USE OF PE

- Page 297 and 298:

IEALTH LAZARDS OF PESIfCIDE USE INI

- Page 299 and 300:

IEALTII IhAZARDS OF PESTICIDE USE I

- Page 301 and 302:

IIEALIII HAZARDS OFPESrICIDE USE IN

- Page 303 and 304:

HEALTH HIAZARDS OF PESICIDE USE IN

- Page 305 and 306:

312 PESTICIDE MANAGEMENT AND IPM IN

- Page 307 and 308:

314 PFSTICIDE MANAGEMENr AND IPM IN

- Page 309 and 310:

316 PESTICIDE MANAGEMENT AND IPM IN

- Page 311 and 312:

318 PESTICIDJE MANAGIB-ENT AND IPM

- Page 313 and 314:

PESTICIDE POISONING STUDIES AND DAT

- Page 315 and 316:

IEST1CIDE POISONING INTI1AILAND 323

- Page 317 and 318:

PESTICIDE POISONING: IMPROVING AND

- Page 319 and 320:

PESTICIDE POISONING IN SOUTiIEASTAS

- Page 321 and 322:

PE.STICIDE POISONING IN SOUhIIIEAST

- Page 323 and 324:

332 PfS'I1CID. MANAG6EMI'NTF AND I1

- Page 325 and 326:

334 PESICIDF .MANAGFR\WF.NT AND IPM

- Page 327 and 328:

336 P'ST:I1DIE MANAGF.MI N'IAND IPM

- Page 329 and 330:

338 PrsI1CID MANAGEI\WEN-r AND IPM

- Page 331 and 332:

340 III MANAGIPMNM' ANI 1PM IN SOUI

- Page 333 and 334:

PESTICIDE RESIDUES IN THAILAND N. T

- Page 335 and 336:

PF;TICl)I:B RI'NIID I S iN I'IIJAIL

- Page 337 and 338:

PI-STICIDF RESIDUES IN TIIAILAND 3-

- Page 339 and 340:

35(0 PIS'ICIIE MANA(;IINI AND IPM I

- Page 341 and 342:

352 PESTICIDE MANAGEIEN'Ir AND HPM

- Page 343 and 344:

354 PESTICIDE MANAGEMEN' AND IPM IN

- Page 345 and 346:

356( I'FUsTICII).. MANAGt~I-MENT AN

- Page 347 and 348:

358 PIESTICIDF MANAG:M'NT AND IM IN

- Page 349 and 350:

360 PFTP0CIDE MANAGMMENF AND HPM IN

- Page 351 and 352:

362 PFS'l1CJDF MANAGEMINT AND 1PM I

- Page 353 and 354:

364 PFS11CIDIMANAGI.MI:N'F AND IPM

- Page 355 and 356:

366 PFPSTICtDF IANAGLME1.N-r AND IP

- Page 357 and 358:

PESTICIDE RESIDUE TRIALS IN RICE IN

- Page 359 and 360:

t'ESI('IDiE RIsIRtIIS IN INt)NI SIA

- Page 361 and 362:

PESTICIDE RESIDUE CONTROL AND MONIT

- Page 363 and 364:

PMtI1CIDE RESIDUE CONTROL AND MoNrr

- Page 365 and 366:

Table 2 continued Crop and pesticid

- Page 367 and 368:

PESTICIDE RESIDUES IN FOOD AND THE

- Page 369 and 370:

PES'I1CIDE RFSIDUES INfI-OD AND TIE

- Page 371 and 372:

PESTICIDF RESIDUES INFOOD ANDTIIE E

- Page 373 and 374:

PIS'IICIDI:RI-SIDLt.S INIOODANDTIIE

- Page 375 and 376:

PES1ICIDF RESIDUES INFOOD AND1IILEE

- Page 377 and 378:

PESICIDE RFSIDUFS INFOOD AND TIIEEN

- Page 379 and 380:

WHAT DO PESTICIDE RESIDUE LEVELS IN

- Page 381 and 382:

PESTICIDE RESIDUES IN 11EIENVIRONME

- Page 383 and 384:

PESTICIDE RESIDUES INTIIlE EN VIRON

- Page 385 and 386:

I S11CID[E RSI I)UES INTIl E NVIRON

- Page 387 and 388:

MANUAL ON THE USE OF PESTICIDES UND

- Page 389 and 390:

USE OF PESTICIDES UNDEI.HI)ANK-FINA

- Page 391 and 392:

USE OF PESTICIDES UNDER BANK-FINANC

- Page 393 and 394:

APPENDIX I continued USE OF PES'ICI

- Page 395 and 396:

A COMPARATIVE STUDY ON THE OCCUPATI

- Page 397 and 398:

Table 1. Operator exposure (ml spra

- Page 399 and 400:

OCCUPATIONAL FIDPOSURE OF SPRAY WOR

- Page 401 and 402:

OCCUPATIONAT. TEIPOSI IRE OF SIRAY

- Page 403 and 404:

Dl-t-r 4 26t filtercaftirdme cast O

- Page 405 and 406:

418 PESI1CIDE MANAGIEMENr AND IPM I

- Page 407 and 408:

420 PESTCIDE MANAGFMENI"r AND IPM I

- Page 409 and 410:

DESTRUCTION OF PESTICIDES AND CHEMI

- Page 411 and 412:

DE9IRUCtION OF PESTICIDE AND CIIEMI

- Page 413 and 414:

DISI'RtCI'ION 01 I[.SIICII)I" AND C

- Page 415 and 416:

DIgi'RLCI'ION O II'I1fCIDI)I ANI) C

- Page 417 and 418:

DESIRUCTION O1 PESTICIDE AND C1 IEM

- Page 419 and 420:

LOOKING FOR THAILAND'S "LOVE CANAL"

- Page 421 and 422:

LOOKING FOR'I11AILAND'S LOVE CANAL"

- Page 423 and 424:

PESTICIDE PROBLEMS AND INDONESIAN N

- Page 425 and 426:

PFSTICIDE PROBLEMS AND NGO ACI'IVIT

- Page 427 and 428:

4412 I)I'I(CII)F MANA( I-I' AN) 1PM

- Page 429 and 430:

444 Pt':S-c'iI[E M\IANAGMI'.11 .V A

- Page 431 and 432:

446 IPESTICIDtE MANAGEIENT AND I'M

- Page 433 and 434:

Table 1. Training program on the sa

- Page 435 and 436:

PESTICIDE SAFE USE TRAINING PROGRAM

- Page 437 and 438:

PESTICII)E SAFE USE TRAINING PROGRA

- Page 439 and 440:

I-STICIDt SA-E USTRAIN1NG PROGRAMS

- Page 441 and 442:

TRAINING THE TRAINER BY INDUSTRY E.

- Page 443 and 444:

TRAIN-THE-TRAINER PROGRAMS IN THAIL

- Page 445 and 446:

TRAIN-TIlE-TRAINER PROGRAMS IN TIIA

- Page 447 and 448:

PESTICIDE SAFETY TRAINING PROGRAMS

- Page 449 and 450:

DURATION 45-60 min. 60-90 min. 120

- Page 451 and 452:

PIESTICIDIE SAI.IY '[RAINING PROGRA

- Page 453 and 454:

470 IPESTICIDL: MANAGFMI:NI' AND HP

- Page 455 and 456:

472 PFIS1CIDF NANA(;ILMI.N'F AND HP