PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

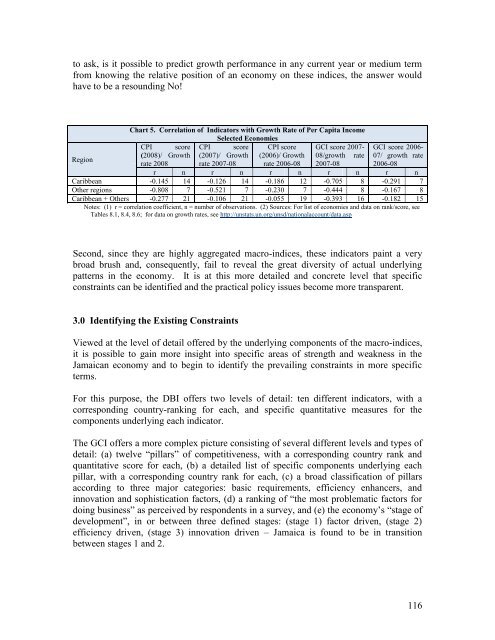

to ask, is it possible to predict growth performance in any current year or medium term<br />

from knowing the relative position <strong>of</strong> an economy on these indices, the answer would<br />

have to be a resounding No!<br />

Chart 5. Correlation <strong>of</strong> Indicators with <strong>Growth</strong> Rate <strong>of</strong> Per Capita Income<br />

Selected Economies<br />

CPI score CPI score CPI score GCI score 2007- GCI score 2006-<br />

Region<br />

(2008)/ <strong>Growth</strong> (2007)/ <strong>Growth</strong> (2006)/ <strong>Growth</strong> 08/growth rate 07/ growth rate<br />

rate 2008 rate 2007-08 rate 2006-08 2007-08 2006-08<br />

r n r n r n r n r n<br />

Caribbean -0.145 14 -0.126 14 -0.186 12 -0.705 8 -0.291 7<br />

Other regions -0.808 7 -0.521 7 -0.230 7 -0.444 8 -0.167 8<br />

Caribbean + Others -0.277 21 -0.106 21 -0.055 19 -0.393 16 -0.182 15<br />

Notes: (1) r = correlation coefficient, n = number <strong>of</strong> observations. (2) Sources: For list <strong>of</strong> economies and data on rank/score, see<br />

Tables 8.1, 8.4, 8.6; for data on growth rates, see http://unstats.un.org/unsd/nationalaccount/data.asp<br />

Second, since they are highly aggregated macro-indices, these indicators paint a very<br />

broad brush and, consequently, fail to reveal the great diversity <strong>of</strong> actual underlying<br />

patterns in the economy. It is at this more detailed and concrete level that specific<br />

constraints can be identified and the practical policy issues become more transparent.<br />

3.0 Identifying the Existing Constraints<br />

Viewed at the level <strong>of</strong> detail <strong>of</strong>fered by the underlying components <strong>of</strong> the macro-indices,<br />

it is possible to gain more insight into specific areas <strong>of</strong> strength and weakness in the<br />

<strong>Jamaica</strong>n economy and to begin to identify the prevailing constraints in more specific<br />

terms.<br />

For this purpose, the DBI <strong>of</strong>fers two levels <strong>of</strong> detail: ten different indicators, with a<br />

corresponding country-ranking for each, and specific quantitative measures for the<br />

components underlying each indicator.<br />

The GCI <strong>of</strong>fers a more complex picture consisting <strong>of</strong> several different levels and types <strong>of</strong><br />

detail: (a) twelve “pillars” <strong>of</strong> competitiveness, with a corresponding country rank and<br />

quantitative score for each, (b) a detailed list <strong>of</strong> specific components underlying each<br />

pillar, with a corresponding country rank for each, (c) a broad classification <strong>of</strong> pillars<br />

according to three major categories: basic requirements, efficiency enhancers, and<br />

innovation and sophistication factors, (d) a ranking <strong>of</strong> “the most problematic factors for<br />

doing business” as perceived by respondents in a survey, and (e) the economy’s “stage <strong>of</strong><br />

development”, in or between three defined stages: (stage 1) factor driven, (stage 2)<br />

efficiency driven, (stage 3) innovation driven – <strong>Jamaica</strong> is found to be in transition<br />

between stages 1 and 2.<br />

116