PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

decline <strong>of</strong> 2.0 - 2.2 percentage points compared with 2010. 3<br />

predicated on the following assumptions:<br />

This baseline projection is<br />

1) Real GDP: Real GDP is projected to grow by 2.1% during FY2011/12, driven<br />

mainly by Mining & Quarrying, Hotels & Restaurants, Electricity & Water<br />

Supply, and Agriculture, Forestry & Fishing.<br />

2) Employment: Total employment level is projected to increase by 1.5 per cent;<br />

this increase is associated with expected growth in the following industries:<br />

Agriculture, Forestry & Fishing, Wholesale & Retail Trade, Repair and<br />

Installation <strong>of</strong> Machinery, all <strong>of</strong> which are labour-intensive industries.<br />

3) Remittance: Remittance is projected to increase as the global economy continues<br />

to record economic growth. Economic activities are also expected to improve in<br />

<strong>Jamaica</strong>’s main source <strong>of</strong> remittance, the USA.<br />

4) Pension: The increase in pension benefits from NIS (initiated in July 2010 and<br />

paid in December 2010), in addition to the announced increase in government<br />

workers’ pension, will positively impact disposable income and, thus, assist in<br />

reducing poverty in an age group (age 60 and over) where it is most prevalent.<br />

6.4 Under the improved growth scenario, the higher growth rates are projected to<br />

further reduce poverty rates to a range <strong>of</strong> 14.8%-16.4% (assuming a 3.7% growth rate)<br />

and 12.4% - 14.6% (assuming a 5.2% growth rate).<br />

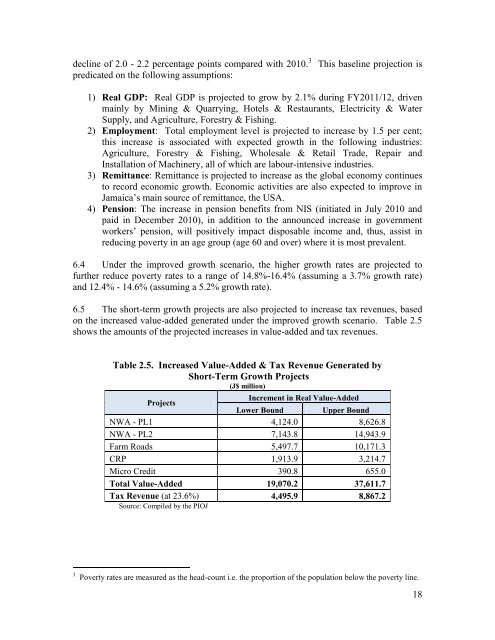

6.5 The short-term growth projects are also projected to increase tax revenues, based<br />

on the increased value-added generated under the improved growth scenario. Table 2.5<br />

shows the amounts <strong>of</strong> the projected increases in value-added and tax revenues.<br />

Table 2.5. Increased Value-Added & Tax Revenue Generated by<br />

Short-Term <strong>Growth</strong> Projects<br />

(J$ million)<br />

Projects<br />

Increment in Real Value-Added<br />

Lower Bound Upper Bound<br />

NWA - PL1 4,124.0 8,626.8<br />

NWA - PL2 7,143.8 14,943.9<br />

Farm Roads 5,497.7 10,171.3<br />

CRP 1,913.9 3,214.7<br />

Micro Credit 390.8 655.0<br />

Total Value-Added 19,070.2 37,611.7<br />

Tax Revenue (at 23.6%) 4,495.9 8,867.2<br />

Source: Compiled by the <strong>PIOJ</strong><br />

3 Poverty rates are measured as the head-count i.e. the proportion <strong>of</strong> the population below the poverty line.<br />

18