PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

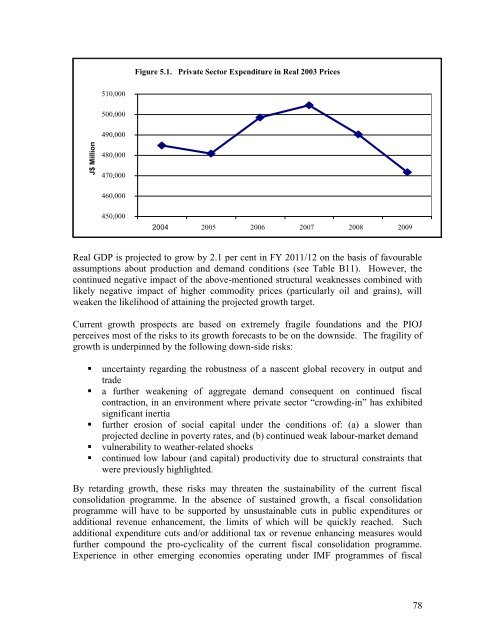

J$ Million<br />

Figure 5.1. Private Sector Expenditure in Real 2003 Prices<br />

510,000<br />

500,000<br />

490,000<br />

480,000<br />

470,000<br />

460,000<br />

450,000<br />

2004 2005 2006 2007 2008 2009<br />

Real GDP is projected to grow by 2.1 per cent in FY 2011/12 on the basis <strong>of</strong> favourable<br />

assumptions about production and demand conditions (see Table B11). However, the<br />

continued negative impact <strong>of</strong> the above-mentioned structural weaknesses combined with<br />

likely negative impact <strong>of</strong> higher commodity prices (particularly oil and grains), will<br />

weaken the likelihood <strong>of</strong> attaining the projected growth target.<br />

Current growth prospects are based on extremely fragile foundations and the <strong>PIOJ</strong><br />

perceives most <strong>of</strong> the risks to its growth forecasts to be on the downside. The fragility <strong>of</strong><br />

growth is underpinned by the following down-side risks:<br />

• uncertainty regarding the robustness <strong>of</strong> a nascent global recovery in output and<br />

trade<br />

• a further weakening <strong>of</strong> aggregate demand consequent on continued fiscal<br />

contraction, in an environment where private sector “crowding-in” has exhibited<br />

significant inertia<br />

• further erosion <strong>of</strong> social capital under the conditions <strong>of</strong>: (a) a slower than<br />

projected decline in poverty rates, and (b) continued weak labour-market demand<br />

• vulnerability to weather-related shocks<br />

• continued low labour (and capital) productivity due to structural constraints that<br />

were previously highlighted.<br />

By retarding growth, these risks may threaten the sustainability <strong>of</strong> the current fiscal<br />

consolidation programme. In the absence <strong>of</strong> sustained growth, a fiscal consolidation<br />

programme will have to be supported by unsustainable cuts in public expenditures or<br />

additional revenue enhancement, the limits <strong>of</strong> which will be quickly reached. Such<br />

additional expenditure cuts and/or additional tax or revenue enhancing measures would<br />

further compound the pro-cyclicality <strong>of</strong> the current fiscal consolidation programme.<br />

Experience in other emerging economies operating under IMF programmes <strong>of</strong> fiscal<br />

78