PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

PIOJ Growth-Inducement Strategy - Planning Institute of Jamaica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

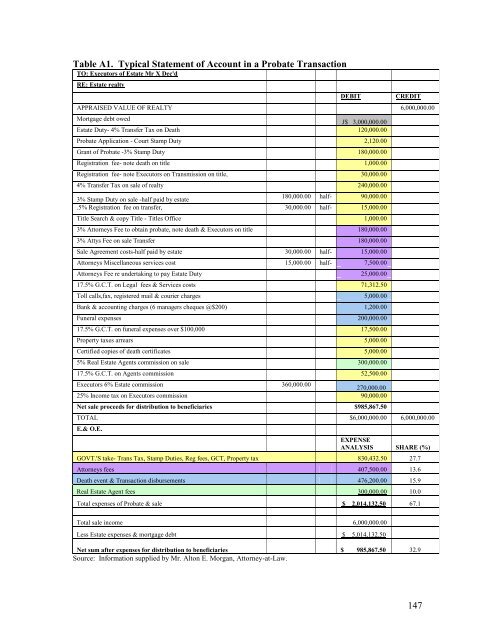

Table A1. Typical Statement <strong>of</strong> Account in a Probate Transaction<br />

TO: Executors <strong>of</strong> Estate Mr X Dec'd<br />

RE: Estate realty<br />

DEBIT<br />

CREDIT<br />

APPRAISED VALUE OF REALTY 6,000,000.00<br />

Mortgage debt owed<br />

J$ 3,000,000.00<br />

Estate Duty- 4% Transfer Tax on Death 120,000.00<br />

Probate Application - Court Stamp Duty 2,120.00<br />

Grant <strong>of</strong> Probate -3% Stamp Duty 180,000.00<br />

Registration fee- note death on title 1,000.00<br />

Registration fee- note Executors on Transmission on title, 30,000.00<br />

4% Transfer Tax on sale <strong>of</strong> realty 240,000.00<br />

3% Stamp Duty on sale -half paid by estate<br />

180,000.00 half- 90,000.00<br />

.5% Registration fee on transfer, 30,000.00 half- 15,000.00<br />

Title Search & copy Title - Titles Office 1,000.00<br />

3% Attorneys Fee to obtain probate, note death & Executors on title 180,000.00<br />

3% Attys Fee on sale Transfer 180,000.00<br />

Sale Agreement costs-half paid by estate 30,000.00 half- 15,000.00<br />

Attorneys Miscellaneous services cost 15,000.00 half- 7,500.00<br />

Attorneys Fee re undertaking to pay Estate Duty 25,000.00<br />

17.5% G.C.T. on Legal fees & Services costs 71,312.50<br />

Toll calls,fax, registered mail & courier charges 5,000.00<br />

Bank & accounting charges (6 managers cheques @$200) 1,200.00<br />

Funeral expenses 200,000.00<br />

17.5% G.C.T. on funeral expenses over $100,000 17,500.00<br />

Property taxes arrears 5,000.00<br />

Certified copies <strong>of</strong> death certificates 5,000.00<br />

5% Real Estate Agents commission on sale 300,000.00<br />

17.5% G.C.T. on Agents commission 52,500.00<br />

Executors 6% Estate commission 360,000.00<br />

270,000.00<br />

25% Income tax on Executors commission 90,000.00<br />

Net sale proceeds for distribution to beneficiaries $985,867.50<br />

TOTAL $6,000,000.00 6,000,000.00<br />

E.& O.E.<br />

EXPENSE<br />

ANALYSIS SHARE (%)<br />

GOVT.'S take- Trans Tax, Stamp Duties, Reg fees, GCT, Property tax 830,432.50 27.7<br />

Attorneys fees 407,500.00 13.6<br />

Death event & Transaction disbursements 476,200.00 15.9<br />

Real Estate Agent fees 300,000.00 10.0<br />

Total expenses <strong>of</strong> Probate & sale $ 2,014,132.50 67.1<br />

Total sale income 6,000,000.00<br />

Less Estate expenses & mortgage debt $ 5,014,132.50<br />

Net sum after expenses for distribution to beneficiaries $ 985,867.50 32.9<br />

Source: Information supplied by Mr. Alton E. Morgan, Attorney-at-Law.<br />

147