- Page 1 and 2: R E S E A R C H R E P O R T M A R C

- Page 3 and 4: Table of Contents Executive Summary

- Page 5 and 6: Introduction and Review of the Lite

- Page 7 and 8: Market Changes ....................

- Page 9 and 10: Appendix G ........................

- Page 11 and 12: Main Findings We highlight 17 main

- Page 13 and 14: 6. For offenders, the prevalence of

- Page 15 and 16: Chapter 1 Introduction Purpose of t

- Page 17 and 18: information about populations that

- Page 19 and 20: In chapters three through eight, we

- Page 21 and 22: seven sites were finalized in June

- Page 23 and 24: individuals we wanted to interview.

- Page 25 and 26: a total of 142 sex traffickers/pimp

- Page 27 and 28: using interview data for the relati

- Page 29 and 30: Table 2.2 Proxy Variables Dataset V

- Page 31 and 32: Chapter 3 Methodology and Derivatio

- Page 33 and 34: We also looked to estimates of the

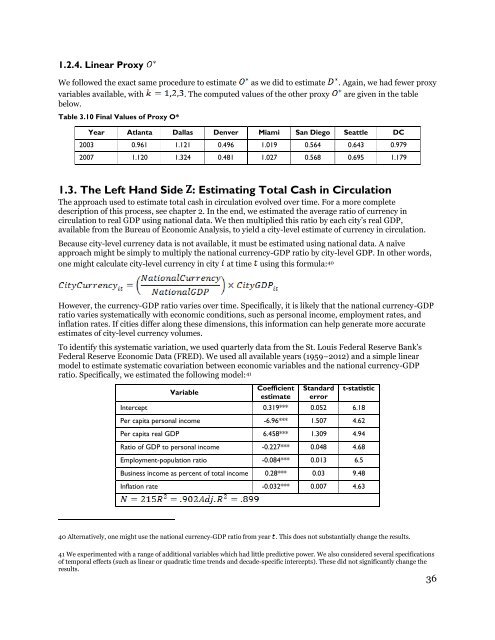

- Page 35 and 36: In this work, the LoCC will be invo

- Page 37 and 38: 1.2.1. Linear Proxy We say that a v

- Page 39 and 40: Table 3.2 Number of Sex Proxy ( ) R

- Page 41 and 42: direct estimation method applied to

- Page 43: in column 3 of the table below. The

- Page 47 and 48: 1.4. The Linear Program 1.4.1. Sex

- Page 49 and 50: Table 3.12 Cross-City Sex Proxy Rat

- Page 51 and 52: Note that the entries in the tables

- Page 53 and 54: Note that the entries in the tables

- Page 55 and 56: Note that the entries in the tables

- Page 57 and 58: 1.4.7. Techniques for Solving the L

- Page 59 and 60: Where the above table shows actual

- Page 61 and 62: 1.6.3. Guns Economy Rankings Here w

- Page 63 and 64: The table suggests that three citie

- Page 65 and 66: Chapter 4 Stakeholder Perspectives

- Page 67 and 68: Main Findings from this Chapter Inc

- Page 69 and 70: Brothels Law enforcement reported t

- Page 71 and 72: The other thing we do have is in th

- Page 73 and 74: Dallas, Texas Fifteen individuals w

- Page 75 and 76: Table 4.2. Continued Erotic massage

- Page 77 and 78: that we’ve done because when we

- Page 79 and 80: Although African American men compr

- Page 81 and 82: I think what we are really talking

- Page 83 and 84: actually go to them to find you wha

- Page 85 and 86: Truckers The underground commercial

- Page 87 and 88: Street and Internet Similar to othe

- Page 89 and 90: Street/Internet-based pimps are net

- Page 91 and 92: Figure 4.4 Erotic Massage Parlors i

- Page 93 and 94: promising sign that law enforcement

- Page 95 and 96:

On the Latino brothel front we foun

- Page 97 and 98:

Street Street-based commercial sex

- Page 99 and 100:

majority of prostitutes. That does

- Page 101 and 102:

potential paper trail. Money was re

- Page 103 and 104:

Kansas City, Missouri Sixteen indiv

- Page 105 and 106:

Internet and Street Similar to what

- Page 107 and 108:

Pimps have always been mobile, movi

- Page 109 and 110:

San Diego, California Eighteen indi

- Page 111 and 112:

Street and Internet Similar to the

- Page 113 and 114:

are not documented by the police as

- Page 115 and 116:

always look for the most vulnerable

- Page 117 and 118:

hotels in their name … they have

- Page 119 and 120:

eliminated from having to follow a

- Page 121 and 122:

the room is, so it a three bedroom

- Page 123 and 124:

Street and Internet Seattle, like m

- Page 125 and 126:

Most of the gang members involved i

- Page 127 and 128:

Erotic Massage Parlors and Spas The

- Page 129 and 130:

getting a ticket in Lynnwood for no

- Page 131 and 132:

Table 4.8 Stakeholder Perceptions o

- Page 133 and 134:

need to be followed and pimps opera

- Page 135 and 136:

Erotic Massage Parlors Another prim

- Page 137 and 138:

typically between the ages of 16 an

- Page 139 and 140:

Chapter 5 Identity, Entry, and Risk

- Page 141 and 142:

Respondent Demographics Respondents

- Page 143 and 144:

presence of pimping in music and it

- Page 145 and 146:

Respondents distinguished between d

- Page 147 and 148:

Figure 5.5 Family Member Involvemen

- Page 149 and 150:

Multiple factors related to neighbo

- Page 151 and 152:

wanted me to know. She fed me the g

- Page 153 and 154:

mom. I wanted to go about it a diff

- Page 155 and 156:

Hiding Behind Legal Businesses Lega

- Page 157 and 158:

Another female interviewee, serving

- Page 159 and 160:

Chapter 6 Networks, Relationships,

- Page 161 and 162:

Actors in the Underground Sex Marke

- Page 163 and 164:

everything. I collected the money,

- Page 165 and 166:

they’ve made enough. That’s wha

- Page 167 and 168:

eally nice—not whorish—I’d ha

- Page 169 and 170:

Respondent: Right. I got a friend,

- Page 171 and 172:

affording a fancy lifestyle. Offend

- Page 173 and 174:

Figure 6.1 Recruitment Venues Neigh

- Page 175 and 176:

e escaping one life or seeking anot

- Page 177 and 178:

Mutual Dependency We are going to t

- Page 179 and 180:

money. I took care of who took care

- Page 181 and 182:

Rules One bad girl can knock your w

- Page 183 and 184:

Reasons for restrictions varied, bu

- Page 185 and 186:

encourage his employees to make mon

- Page 187 and 188:

have sex with each other when a con

- Page 189 and 190:

Competition Between Employees We ca

- Page 191 and 192:

little partner pull a gun on me. I

- Page 193 and 194:

Beyond employees, pimps shared othe

- Page 195 and 196:

pimp reported, “Usually you stay

- Page 197 and 198:

(D13). Another respondent reported

- Page 199 and 200:

Chapter 7 Business Practices and Op

- Page 201 and 202:

7.1 presents the percentage of resp

- Page 203 and 204:

eported the costs of maintaining he

- Page 205 and 206:

hour special. In-calls only.” You

- Page 207 and 208:

used because respondents feared tha

- Page 209 and 210:

Rates and Pricing Structures Rates

- Page 211 and 212:

One respondent explained the evolut

- Page 213 and 214:

Finally, respondents also charged d

- Page 215 and 216:

transactions completed were in-call

- Page 217 and 218:

associated with their charges, thou

- Page 219 and 220:

Changes in the Field The field does

- Page 221 and 222:

“Years ago, a john, a certain guy

- Page 223 and 224:

connected through the same gang. Th

- Page 225 and 226:

Main Findings from this Chapter Inc

- Page 227 and 228:

clients, served as a coping mechani

- Page 229 and 230:

Respondents worked in five of the e

- Page 231 and 232:

gays being together, men treating t

- Page 233 and 234:

multitude of environments including

- Page 235 and 236:

Rates, Expenses, and Spending Those

- Page 237 and 238:

individuals in their social network

- Page 239 and 240:

The Makeup and Conditions of the St

- Page 241 and 242:

Interviewer: You mentioned that wha

- Page 243 and 244:

Interviewer: And was that in cash o

- Page 245 and 246:

Demand, Clients, and Establishing D

- Page 247 and 248:

new venue to solicit sex work. A mo

- Page 249 and 250:

Respondent: Yeah, illegal. They mak

- Page 251 and 252:

explained, “A lot of guys would g

- Page 253 and 254:

Substances Participants felt that t

- Page 255 and 256:

A number of sex workers were caught

- Page 257 and 258:

I hear [other sex workers] talking

- Page 259 and 260:

while another respondent described

- Page 261 and 262:

the genital regions of clothed chil

- Page 263 and 264:

Recent studies (Merdian et al. 2013

- Page 265 and 266:

Technology It is widely accepted th

- Page 267 and 268:

Deep Web There is big problem that

- Page 269 and 270:

One offender acknowledged that purc

- Page 271 and 272:

The sample was almost evenly split

- Page 273 and 274:

One offender believed he knew what

- Page 275 and 276:

particular series When did this com

- Page 277 and 278:

One guy hacked into my computer one

- Page 279 and 280:

Production Location When asked wher

- Page 281 and 282:

availability, affordability, and an

- Page 283 and 284:

and eventually, it works its way to

- Page 285 and 286:

Law enforcement said they were able

- Page 287 and 288:

A national or international nexus w

- Page 289 and 290:

Table 10.1 Estimates of Illicit Mar

- Page 291 and 292:

Law enforcement noted that travel c

- Page 293 and 294:

in public venues, utilized their ow

- Page 295 and 296:

Pimps who were aware of the penalti

- Page 297 and 298:

Practice Implications Investigative

- Page 299 and 300:

Policy Implications As the above fi

- Page 301 and 302:

Finding 6: For offenders, the preva

- Page 303 and 304:

child pornography. More research ne

- Page 305 and 306:

Cooper, Bo. 2002. “New Approach t

- Page 307 and 308:

McMillan, John, and Pablo Zoido. 20

- Page 309 and 310:

US Department of Justice. 2010. The

- Page 311 and 312:

Appendix B Screening Interview Ques

- Page 313 and 314:

1. How many UCS cases has your agen

- Page 315 and 316:

8. How has the UCSE changed in rece

- Page 317 and 318:

If you have any additional question

- Page 319 and 320:

18:2421 Transportation generally 18

- Page 321 and 322:

these case reviews as supplementing

- Page 323 and 324:

Point-person designation The person

- Page 325 and 326:

Voluntary Participation: You may re

- Page 327 and 328:

Part I: Background information 1. W

- Page 329 and 330:

Part II: Specific Case Questions (P

- Page 331 and 332:

a. If yes, how did you learn about

- Page 333 and 334:

Part I: Background information 46.

- Page 335 and 336:

70. Are there any differences in th

- Page 337 and 338:

89. Are you aware of the prosecutor

- Page 339 and 340:

19. Who did what How was that decid

- Page 341 and 342:

Technology Questions These question

- Page 343 and 344:

discuss new or unprosecuted crimina

- Page 345 and 346:

Voluntary Participation. You may re

- Page 347 and 348:

Appendix L Terminology Blade: A pub