2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Media</strong> <strong>Prima</strong> <strong>Berhad</strong><br />

Summary of Significant<br />

Accounting Policies<br />

for the financial year ended 31 December <strong>2012</strong><br />

D<br />

RESEARCH AND DEVELOPMENT<br />

Research and development costs are charged to the profit or loss in the financial year in which they are incurred.<br />

Development costs previously recognised as an expense are not recognised as an asset in the subsequent financial<br />

year. Capitalised development costs are recorded as an intangible asset and amortised from the point at which the<br />

asset is ready for use on a straight-line basis over its useful life not exceeding five years.<br />

E<br />

INVESTMENTS IN SUBSIDIARIES AND ASSOCIATES<br />

In the Company’s separate financial statements, investments in subsidiaries and associates are stated at cost less<br />

accumulated impairment losses. Where an indication of impairment exists, the carrying amount of the investment is<br />

assessed and written down immediately to its recoverable amount. See accounting policy Note I on impairment of<br />

non-financial assets.<br />

On disposal of an investment, the difference between the net disposal proceeds and its carrying amount is charged/<br />

credited to the profit or loss.<br />

F<br />

PROPERTY, PLANT AND EQUIPMENT<br />

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses.<br />

The cost of an item of property, plant and equipment initially recognised includes its purchase price and any cost<br />

that is directly attributable to bringing the asset to the location and condition necessary for it to be capable of<br />

operating in the manner intended by management. Cost also includes borrowing costs that are directly attributable<br />

to the acquisition, construction or production of a qualifying asset.<br />

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as appropriate, only<br />

when it is probable that future economic benefits associated with the item will flow to the Group and the cost of<br />

the item can be measured reliably. The carrying amount of the replaced part is derecognised. All other repairs and<br />

maintenance costs are charged to the profit or loss during the financial year in which they are incurred.<br />

Freehold land is not depreciated as it has an infinite life. Depreciation on assets under construction commences when<br />

the assets are ready for their intended use.<br />

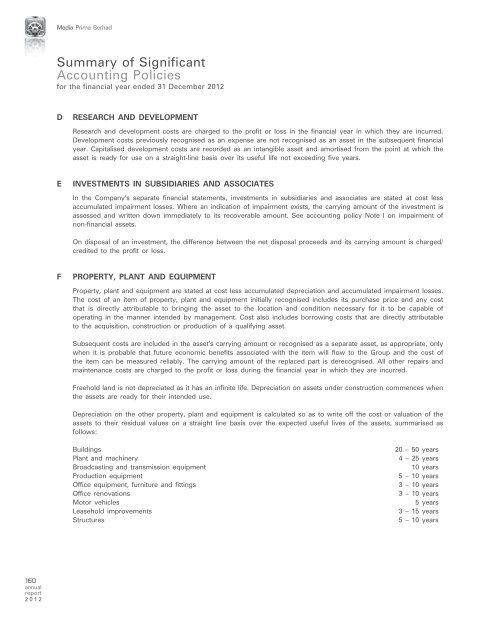

Depreciation on the other property, plant and equipment is calculated so as to write off the cost or valuation of the<br />

assets to their residual values on a straight line basis over the expected useful lives of the assets, summarised as<br />

follows:<br />

Buildings<br />

Plant and machinery<br />

Broadcasting and transmission equipment<br />

Production equipment<br />

Office equipment, furniture and fittings<br />

Office renovations<br />

Motor vehicles<br />

Leasehold improvements<br />

Structures<br />

20 – 50 years<br />

4 – 25 years<br />

10 years<br />

5 – 10 years<br />

3 – 10 years<br />

3 – 10 years<br />

5 years<br />

3 – 15 years<br />

5 – 10 years<br />

160<br />

annual<br />

report<br />

<strong>2012</strong>