2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

25 INVESTMENT PROPERTIES (CONTINUED)<br />

The fair value of the properties was estimated at RM66.3 million (2011: RM67.1 million, 1.1.2011: RM66.9 million)<br />

based on valuations by independent professional valuers in 2011. Valuations were based on current prices in an<br />

active market.<br />

Direct operating expenses from investment properties that generated rental income of the Group during the financial<br />

year amounted to RM357,043 (2011: RM444,891).<br />

Direct operating expenses from investment properties that did not generate rental income of the Group during the<br />

financial year amounted to RM562,301 (2011: RM682,441).<br />

The titles to freehold and leasehold properties included in the investment properties for the Group at net book value<br />

of RM20.4 million (2011: RM20.7 million, 1.1.2011: RM21.0 million) are in the process of being transferred to the<br />

Group. Risks, rewards and effective titles to those properties have been passed to the Group upon unconditional<br />

completion of the acquisition of the properties. The Group has submitted the relevant documents to the authorities<br />

for transfer of legal titles to the Group and is awaiting the process and formalities of this transfer to be completed.<br />

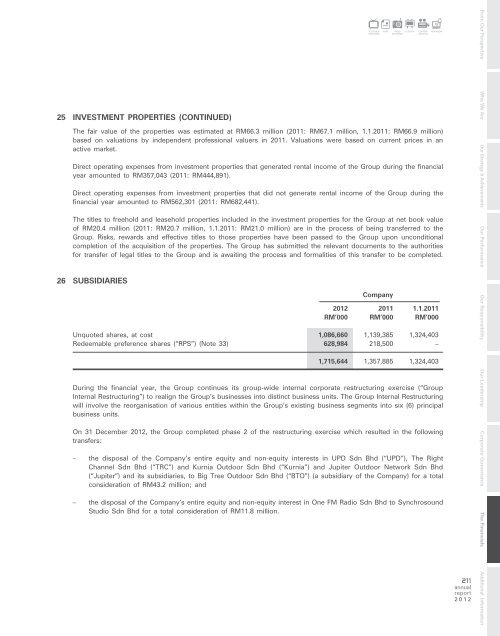

26 SUBSIDIARIES<br />

Company<br />

RADIO OUTDOOR<br />

NETWORKS<br />

<strong>2012</strong> 2011 1.1.2011<br />

RM’000 RM’000 RM’000<br />

Unquoted shares, at cost 1,086,660 1,139,385 1,324,403<br />

Redeemable preference shares (“RPS”) (Note 33) 628,984 218,500 –<br />

1,715,644 1,357,885 1,324,403<br />

During the financial year, the Group continues its group-wide internal corporate restructuring exercise (“Group<br />

Internal Restructuring”) to realign the Group’s businesses into distinct business units. The Group Internal Restructuring<br />

will involve the reorganisation of various entities within the Group’s existing business segments into six (6) principal<br />

business units.<br />

On 31 December <strong>2012</strong>, the Group completed phase 2 of the restructuring exercise which resulted in the following<br />

transfers:<br />

– the disposal of the Company’s entire equity and non-equity interests in UPD Sdn Bhd (“UPD”), The Right<br />

Channel Sdn Bhd (“TRC”) and Kurnia Outdoor Sdn Bhd (“Kurnia”) and Jupiter Outdoor Network Sdn Bhd<br />

(“Jupiter”) and its subsidiaries, to Big Tree Outdoor Sdn Bhd (“BTO”) (a subsidiary of the Company) for a total<br />

consideration of RM43.2 million; and<br />

– the disposal of the Company’s entire equity and non-equity interest in One FM Radio Sdn Bhd to Synchrosound<br />

Studio Sdn Bhd for a total consideration of RM11.8 million.<br />

TELEVISION<br />

NETWORKS<br />

PRINT<br />

CONTENT<br />

CREATION<br />

NEW MEDIA<br />

211<br />

annual<br />

report<br />

<strong>2012</strong><br />

From Our Perspective Who We Are Our Strategy & Achievements Our Performance Our Responsibility Our Leadership Corporate Governance The Financials Additional Information