2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16 DEBT INSTRUMENTS (CONTINUED)<br />

(i)<br />

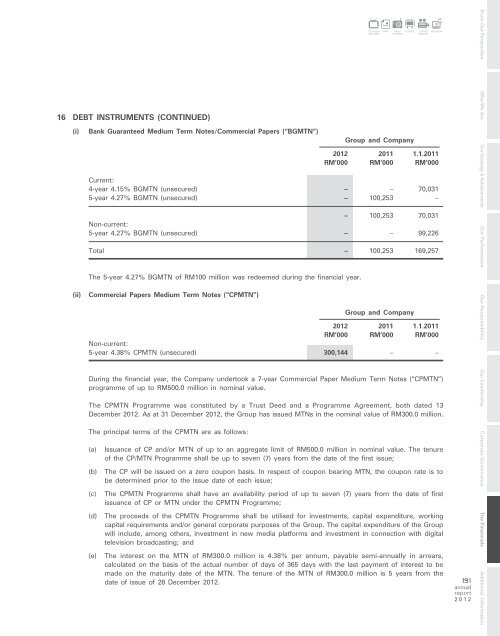

Bank Guaranteed Medium Term Notes/Commercial Papers (“BGMTN”)<br />

Group and Company<br />

<strong>2012</strong> 2011 1.1.2011<br />

RM’000 RM’000 RM’000<br />

Current:<br />

4-year 4.15% BGMTN (unsecured) – – 70,031<br />

5-year 4.27% BGMTN (unsecured) – 100,253 –<br />

– 100,253 70,031<br />

Non-current:<br />

5-year 4.27% BGMTN (unsecured) – – 99,226<br />

Total – 100,253 169,257<br />

The 5-year 4.27% BGMTN of RM100 million was redeemed during the financial year.<br />

(ii) Commercial Papers Medium Term Notes (“CPMTN”)<br />

Group and Company<br />

<strong>2012</strong> 2011 1.1.2011<br />

RM’000 RM’000 RM’000<br />

Non-current:<br />

5-year 4.38% CPMTN (unsecured) 300,144 – –<br />

During the financial year, the Company undertook a 7-year Commercial Paper Medium Term Notes (“CPMTN”)<br />

programme of up to RM500.0 million in nominal value.<br />

The CPMTN Programme was constituted by a Trust Deed and a Programme Agreement, both dated 13<br />

December <strong>2012</strong>. As at 31 December <strong>2012</strong>, the Group has issued MTNs in the nominal value of RM300.0 million.<br />

The principal terms of the CPMTN are as follows:<br />

RADIO OUTDOOR<br />

NETWORKS<br />

(a) Issuance of CP and/or MTN of up to an aggregate limit of RM500.0 million in nominal value. The tenure<br />

of the CP/MTN Programme shall be up to seven (7) years from the date of the first issue;<br />

(b) The CP will be issued on a zero coupon basis. In respect of coupon bearing MTN, the coupon rate is to<br />

be determined prior to the issue date of each issue;<br />

(c) The CPMTN Programme shall have an availability period of up to seven (7) years from the date of first<br />

issuance of CP or MTN under the CPMTN Programme;<br />

(d) The proceeds of the CPMTN Programme shall be utilised for investments, capital expenditure, working<br />

capital requirements and/or general corporate purposes of the Group. The capital expenditure of the Group<br />

will include, among others, investment in new media platforms and investment in connection with digital<br />

television broadcasting; and<br />

(e) The interest on the MTN of RM300.0 million is 4.38% per annum, payable semi-annually in arrears,<br />

calculated on the basis of the actual number of days of 365 days with the last payment of interest to be<br />

made on the maturity date of the MTN. The tenure of the MTN of RM300.0 million is 5 years from the<br />

date of issue of 28 December <strong>2012</strong>. 191<br />

annual<br />

report<br />

<strong>2012</strong><br />

TELEVISION<br />

NETWORKS<br />

PRINT<br />

CONTENT<br />

CREATION<br />

NEW MEDIA<br />

From Our Perspective Who We Are Our Strategy & Achievements Our Performance Our Responsibility Our Leadership Corporate Governance The Financials Additional Information