2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

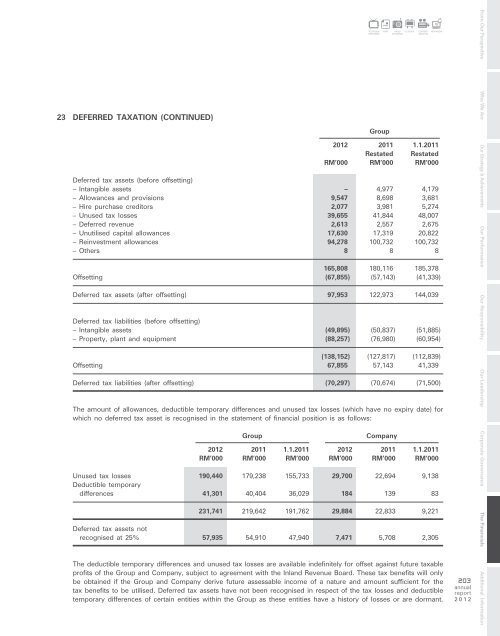

23 DEFERRED TAXATION (CONTINUED)<br />

Group<br />

<strong>2012</strong> 2011 1.1.2011<br />

Restated Restated<br />

RM’000 RM’000 RM’000<br />

Deferred tax assets (before offsetting)<br />

– Intangible assets – 4,977 4,179<br />

– Allowances and provisions 9,547 8,698 3,681<br />

– Hire purchase creditors 2,077 3,981 5,274<br />

– Unused tax losses 39,655 41,844 48,007<br />

– Deferred revenue 2,613 2,557 2,675<br />

– Unutilised capital allowances 17,630 17,319 20,822<br />

– Reinvestment allowances 94,278 100,732 100,732<br />

– Others 8 8 8<br />

165,808 180,116 185,378<br />

Offsetting (67,855) (57,143) (41,339)<br />

Deferred tax assets (after offsetting) 97,953 122,973 144,039<br />

Deferred tax liabilities (before offsetting)<br />

– Intangible assets (49,895) (50,837) (51,885)<br />

– Property, plant and equipment (88,257) (76,980) (60,954)<br />

(138,152) (127,817) (112,839)<br />

Offsetting 67,855 57,143 41,339<br />

Deferred tax liabilities (after offsetting) (70,297) (70,674) (71,500)<br />

The amount of allowances, deductible temporary differences and unused tax losses (which have no expiry date) for<br />

which no deferred tax asset is recognised in the statement of financial position is as follows:<br />

Group<br />

Company<br />

RADIO OUTDOOR<br />

NETWORKS<br />

<strong>2012</strong> 2011 1.1.2011 <strong>2012</strong> 2011 1.1.2011<br />

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000<br />

Unused tax losses 190,440 179,238 155,733 29,700 22,694 9,138<br />

Deductible temporary<br />

differences 41,301 40,404 36,029 184 139 83<br />

231,741 219,642 191,762 29,884 22,833 9,221<br />

Deferred tax assets not<br />

recognised at 25% 57,935 54,910 47,940 7,471 5,708 2,305<br />

The deductible temporary differences and unused tax losses are available indefinitely for offset against future taxable<br />

profits of the Group and Company, subject to agreement with the Inland Revenue Board. These tax benefits will only<br />

be obtained if the Group and Company derive future assessable income of a nature and amount sufficient for the<br />

tax benefits to be utilised. Deferred tax assets have not been recognised in respect of the tax losses and deductible<br />

temporary differences of certain entities within the Group as these entities have a history of losses or are dormant.<br />

TELEVISION<br />

NETWORKS<br />

PRINT<br />

CONTENT<br />

CREATION<br />

NEW MEDIA<br />

203<br />

annual<br />

report<br />

<strong>2012</strong><br />

From Our Perspective Who We Are Our Strategy & Achievements Our Performance Our Responsibility Our Leadership Corporate Governance The Financials Additional Information