2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

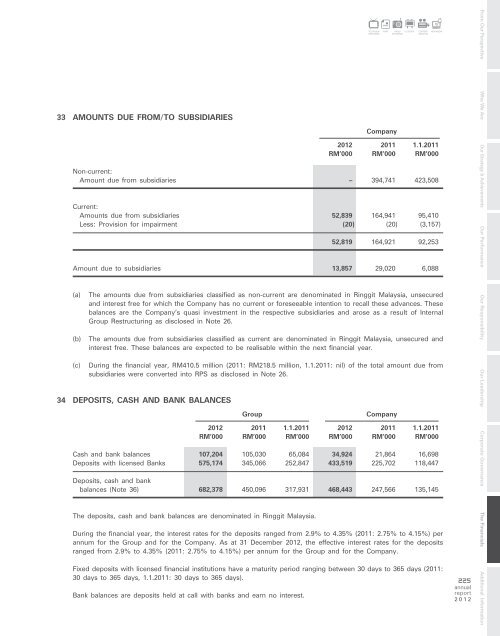

33 AMOUNTS DUE FROM/TO SUBSIDIARIES<br />

Company<br />

<strong>2012</strong> 2011 1.1.2011<br />

RM’000 RM’000 RM’000<br />

Non-current:<br />

Amount due from subsidiaries – 394,741 423,508<br />

Current:<br />

Amounts due from subsidiaries 52,839 164,941 95,410<br />

Less: Provision for impairment (20) (20) (3,157)<br />

52,819 164,921 92,253<br />

Amount due to subsidiaries 13,857 29,020 6,088<br />

(a) The amounts due from subsidiaries classified as non-current are denominated in Ringgit Malaysia, unsecured<br />

and interest free for which the Company has no current or foreseeable intention to recall these advances. These<br />

balances are the Company’s quasi investment in the respective subsidiaries and arose as a result of Internal<br />

Group Restructuring as disclosed in Note 26.<br />

(b) The amounts due from subsidiaries classified as current are denominated in Ringgit Malaysia, unsecured and<br />

interest free. These balances are expected to be realisable within the next financial year.<br />

(c) During the financial year, RM410.5 million (2011: RM218.5 million, 1.1.2011: nil) of the total amount due from<br />

subsidiaries were converted into RPS as disclosed in Note 26.<br />

34 DEPOSITS, CASH AND BANK BALANCES<br />

Group<br />

Company<br />

<strong>2012</strong> 2011 1.1.2011 <strong>2012</strong> 2011 1.1.2011<br />

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000<br />

Cash and bank balances 107,204 105,030 65,084 34,924 21,864 16,698<br />

Deposits with licensed Banks 575,174 345,066 252,847 433,519 225,702 118,447<br />

Deposits, cash and bank<br />

balances (Note 36) 682,378 450,096 317,931 468,443 247,566 135,145<br />

The deposits, cash and bank balances are denominated in Ringgit Malaysia.<br />

During the financial year, the interest rates for the deposits ranged from 2.9% to 4.35% (2011: 2.75% to 4.15%) per<br />

annum for the Group and for the Company. As at 31 December <strong>2012</strong>, the effective interest rates for the deposits<br />

ranged from 2.9% to 4.35% (2011: 2.75% to 4.15%) per annum for the Group and for the Company.<br />

Fixed deposits with licensed financial institutions have a maturity period ranging between 30 days to 365 days (2011:<br />

30 days to 365 days, 1.1.2011: 30 days to 365 days).<br />

Bank balances are deposits held at call with banks and earn no interest.<br />

TELEVISION<br />

NETWORKS<br />

PRINT<br />

RADIO OUTDOOR<br />

NETWORKS<br />

CONTENT<br />

CREATION<br />

NEW MEDIA<br />

225<br />

annual<br />

report<br />

<strong>2012</strong><br />

From Our Perspective Who We Are Our Strategy & Achievements Our Performance Our Responsibility Our Leadership Corporate Governance The Financials Additional Information