2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

2012 Annual Report - Media Prima Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Media</strong> <strong>Prima</strong> <strong>Berhad</strong><br />

Notes to<br />

the Financial Statements<br />

for the financial year ended 31 December <strong>2012</strong><br />

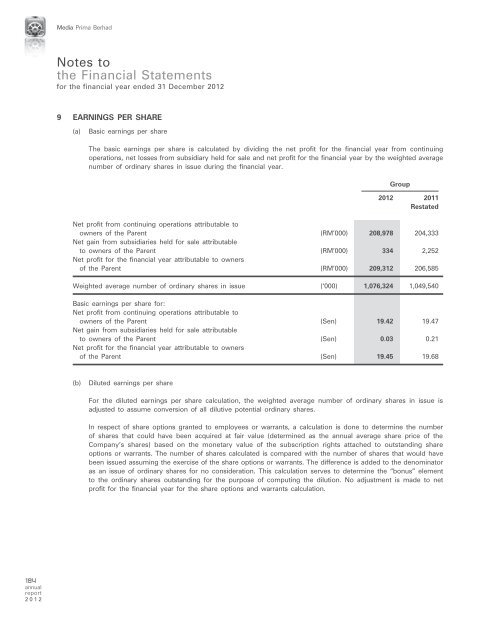

9 EARNINGS PER SHARE<br />

(a)<br />

Basic earnings per share<br />

The basic earnings per share is calculated by dividing the net profit for the financial year from continuing<br />

operations, net losses from subsidiary held for sale and net profit for the financial year by the weighted average<br />

number of ordinary shares in issue during the financial year.<br />

Group<br />

<strong>2012</strong> 2011<br />

Restated<br />

Net profit from continuing operations attributable to<br />

owners of the Parent (RM’000) 208,978 204,333<br />

Net gain from subsidiaries held for sale attributable<br />

to owners of the Parent (RM’000) 334 2,252<br />

Net profit for the financial year attributable to owners<br />

of the Parent (RM’000) 209,312 206,585<br />

Weighted average number of ordinary shares in issue (‘000) 1,076,324 1,049,540<br />

Basic earnings per share for:<br />

Net profit from continuing operations attributable to<br />

owners of the Parent (Sen) 19.42 19.47<br />

Net gain from subsidiaries held for sale attributable<br />

to owners of the Parent (Sen) 0.03 0.21<br />

Net profit for the financial year attributable to owners<br />

of the Parent (Sen) 19.45 19.68<br />

(b) Diluted earnings per share<br />

For the diluted earnings per share calculation, the weighted average number of ordinary shares in issue is<br />

adjusted to assume conversion of all dilutive potential ordinary shares.<br />

In respect of share options granted to employees or warrants, a calculation is done to determine the number<br />

of shares that could have been acquired at fair value (determined as the annual average share price of the<br />

Company’s shares) based on the monetary value of the subscription rights attached to outstanding share<br />

options or warrants. The number of shares calculated is compared with the number of shares that would have<br />

been issued assuming the exercise of the share options or warrants. The difference is added to the denominator<br />

as an issue of ordinary shares for no consideration. This calculation serves to determine the “bonus” element<br />

to the ordinary shares outstanding for the purpose of computing the dilution. No adjustment is made to net<br />

profit for the financial year for the share options and warrants calculation.<br />

184<br />

annual<br />

report<br />

<strong>2012</strong>