Adapting to Climate Change: Assessing the World Bank Group ...

Adapting to Climate Change: Assessing the World Bank Group ...

Adapting to Climate Change: Assessing the World Bank Group ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

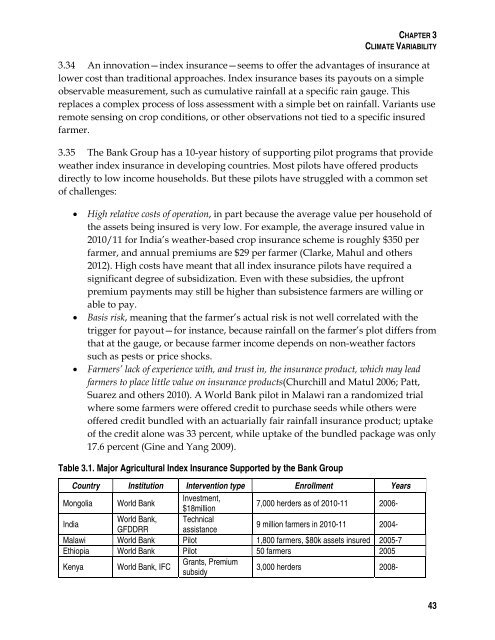

CHAPTER 3CLIMATE VARIABILITY3.34 An innovation—index insurance—seems <strong>to</strong> offer <strong>the</strong> advantages of insurance atlower cost than traditional approaches. Index insurance bases its payouts on a simpleobservable measurement, such as cumulative rainfall at a specific rain gauge. Thisreplaces a complex process of loss assessment with a simple bet on rainfall. Variants useremote sensing on crop conditions, or o<strong>the</strong>r observations not tied <strong>to</strong> a specific insuredfarmer.3.35 The <strong>Bank</strong> <strong>Group</strong> has a 10-year his<strong>to</strong>ry of supporting pilot programs that providewea<strong>the</strong>r index insurance in developing countries. Most pilots have offered productsdirectly <strong>to</strong> low income households. But <strong>the</strong>se pilots have struggled with a common se<strong>to</strong>f challenges:High relative costs of operation, in part because <strong>the</strong> average value per household of<strong>the</strong> assets being insured is very low. For example, <strong>the</strong> average insured value in2010/11 for India’s wea<strong>the</strong>r-based crop insurance scheme is roughly $350 perfarmer, and annual premiums are $29 per farmer (Clarke, Mahul and o<strong>the</strong>rs2012). High costs have meant that all index insurance pilots have required asignificant degree of subsidization. Even with <strong>the</strong>se subsidies, <strong>the</strong> upfrontpremium payments may still be higher than subsistence farmers are willing orable <strong>to</strong> pay.Basis risk, meaning that <strong>the</strong> farmer’s actual risk is not well correlated with <strong>the</strong>trigger for payout—for instance, because rainfall on <strong>the</strong> farmer’s plot differs fromthat at <strong>the</strong> gauge, or because farmer income depends on non-wea<strong>the</strong>r fac<strong>to</strong>rssuch as pests or price shocks.Farmers’ lack of experience with, and trust in, <strong>the</strong> insurance product, which may leadfarmers <strong>to</strong> place little value on insurance products(Churchill and Matul 2006; Patt,Suarez and o<strong>the</strong>rs 2010). A <strong>World</strong> <strong>Bank</strong> pilot in Malawi ran a randomized trialwhere some farmers were offered credit <strong>to</strong> purchase seeds while o<strong>the</strong>rs wereoffered credit bundled with an actuarially fair rainfall insurance product; uptakeof <strong>the</strong> credit alone was 33 percent, while uptake of <strong>the</strong> bundled package was only17.6 percent (Gine and Yang 2009).Table 3.1. Major Agricultural Index Insurance Supported by <strong>the</strong> <strong>Bank</strong> <strong>Group</strong>Country Institution Intervention type Enrollment YearsMongolia <strong>World</strong> <strong>Bank</strong>Investment,$18million7,000 herders as of 2010-11 2006-India<strong>World</strong> <strong>Bank</strong>, TechnicalGFDDRR assistance9 million farmers in 2010-11 2004-Malawi <strong>World</strong> <strong>Bank</strong> Pilot 1,800 farmers, $80k assets insured 2005-7Ethiopia <strong>World</strong> <strong>Bank</strong> Pilot 50 farmers 2005Kenya <strong>World</strong> <strong>Bank</strong>, IFCGrants, Premiumsubsidy3,000 herders 2008-43