Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

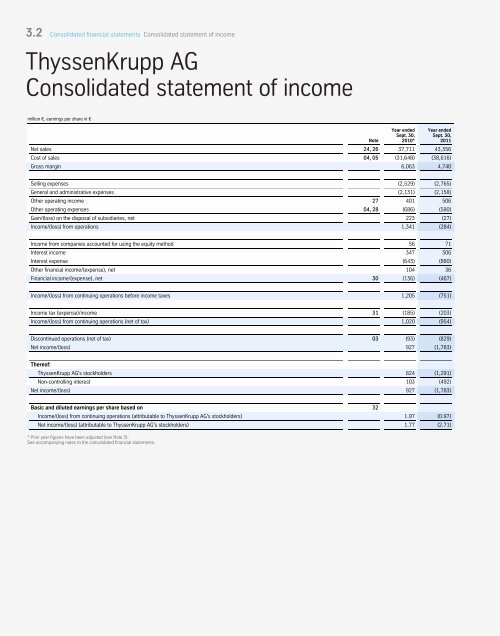

3.2 Consolidated financial statements Consolidated statement of of income income<br />

ThyssenKrupp AG<br />

Consolidated statement of income<br />

million €, earnings per share in €<br />

Year ended Year ended<br />

Sept. 30, Sept. 30,<br />

Note 2010*<br />

2011<br />

Net sales 24, 26 37,711 43,356<br />

Cost of sales 04, 05 (31,648) (38,616)<br />

Gross margin 6,063 4,740<br />

Selling expenses (2,529) (2,765)<br />

General and administrative expenses (2,131) (2,158)<br />

Other operating income 27 401 506<br />

Other operating expenses 04, 28 (686) (580)<br />

Gain/(loss) on the disposal of subsidiaries, net 223 (27)<br />

Income/(loss) from operations 1,341 (284)<br />

Income from companies accounted for using the equity method 56 71<br />

Interest income 347 306<br />

Interest expense (643) (880)<br />

Other financial income/(expense), net 104 36<br />

Financial income/(expense), net 30 (136) (467)<br />

Income/(loss) from continuing operations before income taxes 1,205 (751)<br />

Income tax (expense)/income 31 (185) (203)<br />

Income/(loss) from continuing operations (net of tax) 1,020 (954)<br />

Discontinued operations (net of tax) 03 (93) (829)<br />

Net income/(loss) 927 (1,783)<br />

Thereof:<br />

ThyssenKrupp AG's stockholders 824 (1,291)<br />

Non-controlling interest 103 (492)<br />

Net income/(loss) 927 (1,783)<br />

Basic and diluted earnings per share based on 32<br />

Income/(loss) from continuing operations (attributable to ThyssenKrupp AG's stockholders) 1.97 (0.97)<br />

Net income/(loss) (attributable to ThyssenKrupp AG's stockholders) 1.77 (2.71)<br />

* Prior year figures have been adjusted (see Note 3).<br />

See accompanying notes to the consolidated financial statements.<br />

130