Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

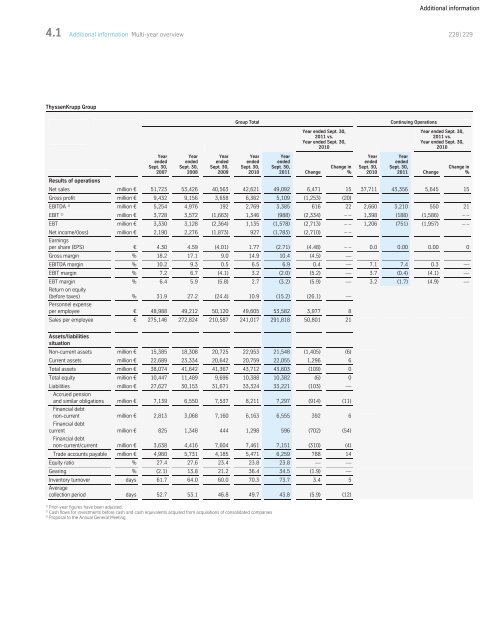

4.1 Additional information Multi-year overview<br />

ThyssenKrupp Group<br />

Results of operations<br />

Year<br />

ended<br />

Sept. 30,<br />

2007<br />

Year<br />

ended<br />

Sept. 30,<br />

2008<br />

Year<br />

ended<br />

Sept. 30,<br />

2009<br />

Group Total Continuing Operations<br />

Year<br />

ended<br />

Sept. 30,<br />

2010<br />

Year<br />

ended<br />

Sept. 30,<br />

2011 Change<br />

Year ended Sept. 30,<br />

2011 vs.<br />

Year ended Sept. 30,<br />

2010<br />

Change in<br />

%<br />

Year<br />

ended<br />

Sept. 30,<br />

2010<br />

Year<br />

ended<br />

Sept. 30,<br />

2011 Change<br />

Additional information<br />

228 | 229<br />

Year ended Sept. 30,<br />

2011 vs.<br />

Year ended Sept. 30,<br />

2010<br />

Net sales million € 51,723 53,426 40,563 42,621 49,092 6,471 15 37,711 43,356 5,645 15<br />

Gross profit million € 9,432 9,156 3,658 6,362 5,109 (1,253) (20)<br />

EBITDA 1) million € 5,254 4,976 192 2,769 3,385 616 22 2,660 3,210 550 21<br />

EBIT 1) million € 3,728 3,572 (1,663) 1,346 (988) (2,334) – – 1,398 (188) (1,586) – –<br />

EBT million € 3,330 3,128 (2,364) 1,135 (1,578) (2,713) – – 1,206 (751) (1,957) – –<br />

Change in<br />

%<br />

Net income/(loss) million € 2,190 2,276 (1,873) 927 (1,783) (2,710) – –<br />

Earnings<br />

per share (EPS) € 4.30 4.59 (4.01) 1.77 (2.71) (4.48) – – 0.0 0.00 0.00 0<br />

Gross margin % 18.2 17.1 9.0 14.9 10.4 (4.5) —<br />

EBITDA margin % 10.2 9.3 0.5 6.5 6.9 0.4 — 7.1 7.4 0.3 —<br />

EBIT margin % 7.2 6.7 (4.1) 3.2 (2.0) (5.2) — 3.7 (0.4) (4.1) —<br />

EBT margin % 6.4 5.9 (5.8) 2.7 (3.2) (5.9) — 3.2 (1.7) (4.9) —<br />

Return on equity<br />

(before taxes) % 31.9 27.2 (24.4) 10.9 (15.2) (26.1) —<br />

Personnel expense<br />

per employee € 48,988 49,212 50,120 49,605 53,582 3,977 8<br />

Sales per employee € 275,146 272,824 210,587 241,017 291,818 50,801 21<br />

Assets/liabilities<br />

situation<br />

Non-current assets million € 15,385 18,308 20,725 22,953 21,548 (1,405) (6)<br />

Current assets million € 22,689 23,334 20,642 20,759 22,055 1,296 6<br />

Total assets million € 38,074 41,642 41,367 43,712 43,603 (109) 0<br />

Total equity million € 10,447 11,489 9,696 10,388 10,382 (6) 0<br />

Liabilities million € 27,627 30,153 31,671 33,324 33,221 (103) —<br />

Accrued pension<br />

and similar obligations million € 7,139 6,550 7,537 8,211 7,297 (914) (11)<br />

Financial debt<br />

non-current million € 2,813 3,068 7,160 6,163 6,555 392 6<br />

Financial debt<br />

current million € 825 1,348 444 1,298 596 (702) (54)<br />

Financial debt<br />

non-current/current million € 3,638 4,416 7,604 7,461 7,151 (310) (4)<br />

Trade accounts payable million € 4,960 5,731 4,185 5,471 6,259 788 14<br />

Equity ratio % 27.4 27.6 23.4 23.8 23.8 — —<br />

Gearing % (2.1) 13.8 21.2 36.4 34.5 (1.9) —<br />

Inventory turnover days 61.7 64.0 60.0 70.3 73.7 3.4 5<br />

Average<br />

collection period days 52.7 53.1 46.8 49.7 43.8 (5.9) (12)<br />

1) Prior-year figures have been adjusted.<br />

2) Cash flows for investments before cash and cash equivalents acquired from acquisitions of consolidated companies<br />

3) Proposal to the Annual General Meeting