Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

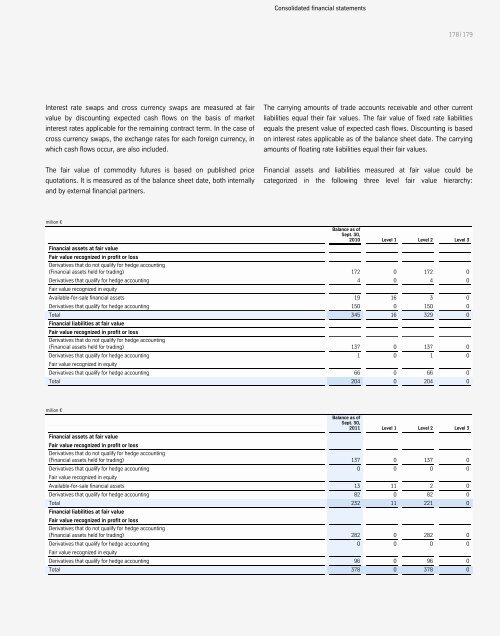

Interest rate swaps and cross currency swaps are measured at fair<br />

value by discounting expected cash flows on the basis of market<br />

interest rates applicable for the remaining contract term. In the case of<br />

cross currency swaps, the exchange rates for each foreign currency, in<br />

which cash flows occur, are also included.<br />

The fair value of commodity futures is based on published price<br />

quotations. It is measured as of the balance sheet date, both internally<br />

and by external financial partners.<br />

Consolidated financial statements<br />

178 | 179<br />

The carrying amounts of trade accounts receivable and other current<br />

liabilities equal their fair values. The fair value of fixed rate liabilities<br />

equals the present value of expected cash flows. Discounting is based<br />

on interest rates applicable as of the balance sheet date. The carrying<br />

amounts of floating rate liabilities equal their fair values.<br />

Financial assets and liabilities measured at fair value could be<br />

categorized in the following three level fair value hierarchy:<br />

million €<br />

Balance as of<br />

Sept. 30,<br />

2010 Level 1 Level 2 Level 3<br />

Financial assets at fair value<br />

Fair value recognized in profit or loss<br />

Derivatives that do not qualify for hedge accounting<br />

(Financial assets held for trading) 172 0 172 0<br />

Derivatives that qualify for hedge accounting<br />

Fair value recognized in equity<br />

4 0 4 0<br />

Available-for-sale financial assets 19 16 3 0<br />

Derivatives that qualify for hedge accounting 150 0 150 0<br />

Total<br />

Financial liabilities at fair value<br />

Fair value recognized in profit or loss<br />

Derivatives that do not qualify for hedge accounting<br />

345 16 329 0<br />

(Financial assets held for trading) 137 0 137 0<br />

Derivatives that qualify for hedge accounting<br />

Fair value recognized in equity<br />

1 0 1 0<br />

Derivatives that qualify for hedge accounting 66 0 66 0<br />

Total 204 0 204 0<br />

million €<br />

Balance as of<br />

Sept. 30,<br />

2011 Level 1 Level 2 Level 3<br />

Financial assets at fair value<br />

Fair value recognized in profit or loss<br />

Derivatives that do not qualify for hedge accounting<br />

(Financial assets held for trading) 137 0 137 0<br />

Derivatives that qualify for hedge accounting<br />

Fair value recognized in equity<br />

0 0 0 0<br />

Available-for-sale financial assets 13 11 2 0<br />

Derivatives that qualify for hedge accounting 82 0 82 0<br />

Total<br />

Financial liabilities at fair value<br />

Fair value recognized in profit or loss<br />

Derivatives that do not qualify for hedge accounting<br />

232 11 221 0<br />

(Financial assets held for trading) 282 0 282 0<br />

Derivatives that qualify for hedge accounting<br />

Fair value recognized in equity<br />

0 0 0 0<br />

Derivatives that qualify for hedge accounting 96 0 96 0<br />

Total 378 0 378 0