Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management report on the Group<br />

2.4 Management report on the Group Financial position<br />

Page 52<br />

Page 52<br />

Net financial debt<br />

86 | 87<br />

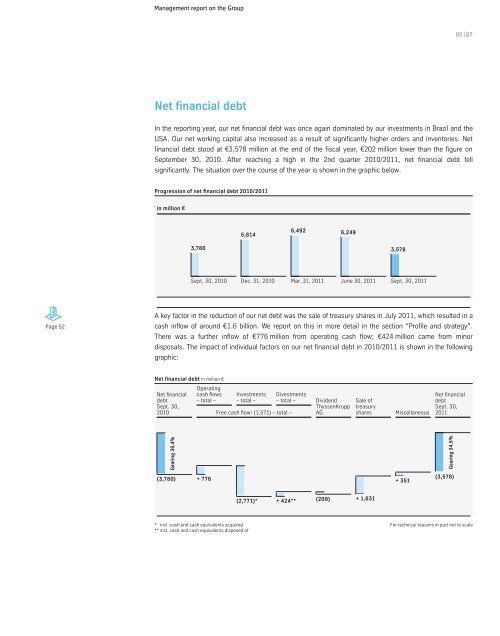

In the reporting year, our net financial debt was once again dominated by our investments in Brazil and the<br />

USA. Our net working capital also increased as a result of significantly higher orders and inventories. Net<br />

financial debt stood at €3,578 million at the end of the fiscal year, €202 million lower than the figure on<br />

September 30, 2010. After reaching a high in the 2nd quarter 2010/2011, net financial debt fell<br />

significantly. The situation over the course of the year is shown in the graphic below.<br />

Progression of net financial debt 2010/2011<br />

in million €<br />

3,780<br />

5,814<br />

6,492 6,249<br />

A key factor in in the reduction of our net debt was the the sale of treasury shares shares in July July 2011, which which resulted in a<br />

cash inflow of around €1.6 billion. We report on this in more detail in the section “Profile and strategy”.<br />

There was a further inflow of €776 million from operating cash flow; €424 million came from minor<br />

disposals. The impact of individual factors on our net financial debt in 2010/2011 is shown in the following<br />

graphic:<br />

Net financial debt in million €<br />

Net financial<br />

debt<br />

Sept. 30,<br />

2010<br />

Gearing 36.4%<br />

3,578<br />

Sept. 30, 2010 Dec. 31, 2010 Mar. 31, 2011 June 30, 2011 Sept. 30, 2011<br />

Operating<br />

cash flows<br />

– total –<br />

(3,780) + 776<br />

Investments<br />

– total –<br />

Free cash flow: (1,571) – total –<br />

Divestments<br />

– total – Dividend<br />

ThyssenKrupp<br />

AG<br />

(2,771)* + 424** (209) + 1,631<br />

Sale of<br />

treasury<br />

shares Miscellaneous<br />

Net financial<br />

debt<br />

Sept. 30,<br />

2011<br />

* incl. cash and cash equivalents acquired For technical reasons in part not to scale<br />

** incl. cash and cash equivalents disposed of<br />

+ 351<br />

Gearing 34.5%<br />

(3,578)