Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.6 Consolidated financial statements Notes Notes to to the the consolidated financial financial statements<br />

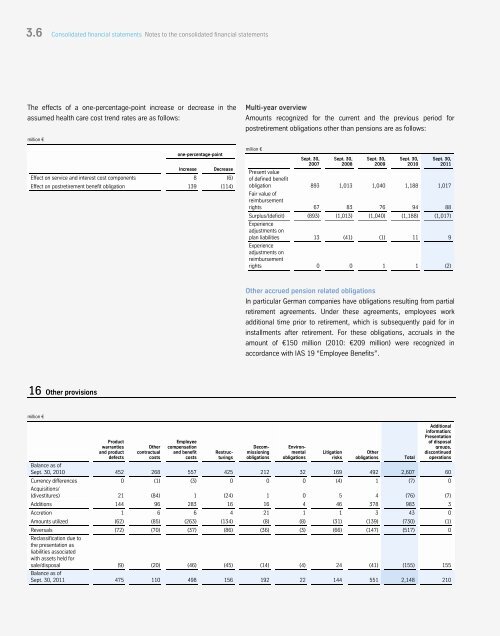

The effects of a one-percentage-point increase or decrease in the<br />

assumed health care cost trend rates are as follows:<br />

million €<br />

one-percentage-point<br />

Increase Decrease<br />

Effect on service and interest cost components 8 (6)<br />

Effect on postretirement benefit obligation 139 (114)<br />

16 Other provisions<br />

million €<br />

Product<br />

warranties<br />

and product<br />

defects<br />

Other<br />

contractual<br />

costs<br />

Employee<br />

compensation<br />

and benefit<br />

costs<br />

Restructurings<br />

Multi-year overview<br />

Amounts recognized for the current and the previous period for<br />

postretirement obligations other than pensions are as follows:<br />

million €<br />

Sept. 30,<br />

2007<br />

Sept. 30,<br />

2008<br />

Sept. 30,<br />

2009<br />

Sept. 30,<br />

2010<br />

170<br />

Sept. 30,<br />

2011<br />

Present value<br />

of defined benefit<br />

obligation<br />

Fair value of<br />

reimbursement<br />

893 1,013 1,040 1,188 1,017<br />

rights 67 83 76 94 88<br />

Surplus/(deficit)<br />

Experience<br />

adjustments on<br />

(893) (1,013) (1,040) (1,188) (1,017)<br />

plan liabilities<br />

Experience<br />

adjustments on<br />

reimbursement<br />

13 (41) (1) 11 9<br />

rights 0 0 1 1 (2)<br />

Other accrued pension related obligations<br />

In particular German companies have obligations resulting from partial<br />

retirement agreements. Under these agreements, employees work<br />

additional time prior to retirement, which is subsequently paid for in<br />

installments after retirement. For these obligations, accruals in the<br />

amount of €150 million (2010: €209 million) were recognized in<br />

accordance with IAS 19 “Employee Benefits”.<br />

Decommissioning<br />

obligations<br />

Environmental<br />

obligations<br />

Litigation<br />

risks<br />

Other<br />

obligations Total<br />

Additional<br />

information:<br />

Presentation<br />

of disposal<br />

groups,<br />

discontinued<br />

operations<br />

Balance as of<br />

Sept. 30, 2010 452 268 557 425 212 32 169 492 2,607 60<br />

Currency differences<br />

Acquisitions/<br />

0 (1) (3) 0 0 0 (4) 1 (7) 0<br />

(divestitures) 21 (84) 1 (24) 1 0 5 4 (76) (7)<br />

Additions 144 96 283 16 16 4 46 378 983 3<br />

Accretion 1 6 6 4 21 1 1 3 43 0<br />

Amounts utilized (62) (85) (263) (134) (8) (8) (31) (139) (730) (1)<br />

Reversals<br />

Reclassification due to<br />

the presentation as<br />

liabilities associated<br />

with assets held for<br />

(72) (70) (37) (86) (36) (3) (66) (147) (517) 0<br />

sale/disposal<br />

Balance as of<br />

(9) (20) (46) (45) (14) (4) 24 (41) (155) 155<br />

Sept. 30, 2011 475 110 498 156 192 22 144 551 2,148 210