Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

23 Related parties<br />

Based on the notification received in accordance with German<br />

Securities Trade Act (WpHG) Art. 21 as of December 21, 2006, the<br />

Alfried Krupp von Bohlen und Halbach Foundation holds an interest of<br />

25.10% in ThyssenKrupp AG; based on a voluntary notification of the<br />

Foundation as of October 05, 2011, the interest in ThyssenKrupp AG<br />

amounts to 25.33% as of September 30, 2011. Outside the services<br />

and considerations provided for in the by-laws (Article 21 of the Articles<br />

of Association of ThyssenKrupp AG), there are no other significant<br />

delivery and service relations except for the following transactions. In<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

2006/2007, a Group subsidiary received a €2 million elevator<br />

modernization contract from an entity belonging to the Alfried Krupp<br />

von Bohlen und Halbach Foundation. Based on this contract, a Group<br />

subsidiary realized sales of €0.1 million in 2009/2010.<br />

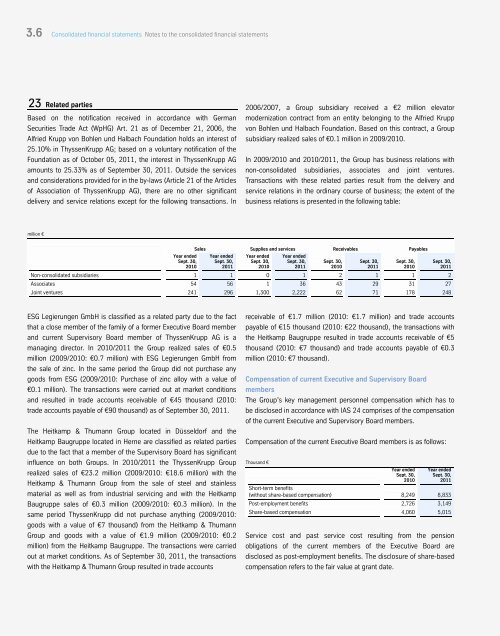

In 2009/2010 and 2010/2011, the Group has business relations with<br />

non-consolidated subsidiaries, associates and joint ventures.<br />

Transactions with these related parties result from the delivery and<br />

service relations in the ordinary course of business; the extent of the<br />

business relations is presented in the following table:<br />

Sales Supplies and services Receivables Payables<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Non-consolidated subsidiaries 1 1 0 1 2 1 1 2<br />

Associates 54 56 1 36 43 29 31 27<br />

Joint ventures 241 296 1,300 2,222 62 71 178 248<br />

ESG Legierungen GmbH is classified as a related party due to the fact<br />

that a close member of the family of a former Executive Board member<br />

and current Supervisory Board member of ThyssenKrupp AG is a<br />

managing director. In 2010/2011 the Group realized sales of €0.5<br />

million (2009/2010: €0.7 million) with ESG Legierungen GmbH from<br />

the sale of zinc. In the same period the Group did not purchase any<br />

goods from ESG (2009/2010: Purchase of zinc alloy with a value of<br />

€0.1 million). The transactions were carried out at market conditions<br />

and resulted in trade accounts receivable of €45 thousand (2010:<br />

trade accounts payable of €90 thousand) as of September 30, 2011.<br />

The Heitkamp & Thumann Group located in Düsseldorf and the<br />

Heitkamp Baugruppe located in Herne are classified as related parties<br />

due to the fact that a member of the Supervisory Board has significant<br />

influence on both Groups. In 2010/2011 the ThyssenKrupp Group<br />

realized sales of €23.2 million (2009/2010: €18.6 million) with the<br />

Heitkamp & Thumann Group from the sale of steel and stainless<br />

material as well as from industrial servicing and with the Heitkamp<br />

Baugruppe sales of €0.3 million (2009/2010: €0.3 million). In the<br />

same period ThyssenKrupp did not purchase anything (2009/2010:<br />

goods with a value of €7 thousand) from the Heitkamp & Thumann<br />

Group and goods with a value of €1.9 million (2009/2010: €0.2<br />

million) from the Heitkamp Baugruppe. The transactions were carried<br />

out at market conditions. As of September 30, 2011, the transactions<br />

with the Heitkamp & Thumann Group resulted in trade accounts<br />

Sept. 30,<br />

2010<br />

Sept. 30,<br />

2011<br />

Sept. 30,<br />

2010<br />

Sept. 30,<br />

2011<br />

receivable of €1.7 million (2010: €1.7 million) and trade accounts<br />

payable of €15 thousand (2010: €22 thousand), the transactions with<br />

the Heitkamp Baugruppe resulted in trade accounts receivable of €5<br />

thousand (2010: €7 thousand) and trade accounts payable of €0.3<br />

million (2010: €7 thousand).<br />

Compensation of current Executive and Supervisory Board<br />

members<br />

The Group’s key management personnel compensation which has to<br />

be disclosed in accordance with IAS 24 comprises of the compensation<br />

of the current Executive and Supervisory Board members.<br />

Compensation of the current Executive Board members is as follows:<br />

Thousand €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Short-term benefits<br />

(without share-based compensation) 8,249 8,833<br />

Post-employment benefits 2,726 3,149<br />

Share-based compensation 4,060 5,015<br />

Service cost and past service cost resulting from the pension<br />

obligations of the current members of the Executive Board are<br />

disclosed as post-employment benefits. The disclosure of share-based<br />

compensation refers to the fair value at grant date.