Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

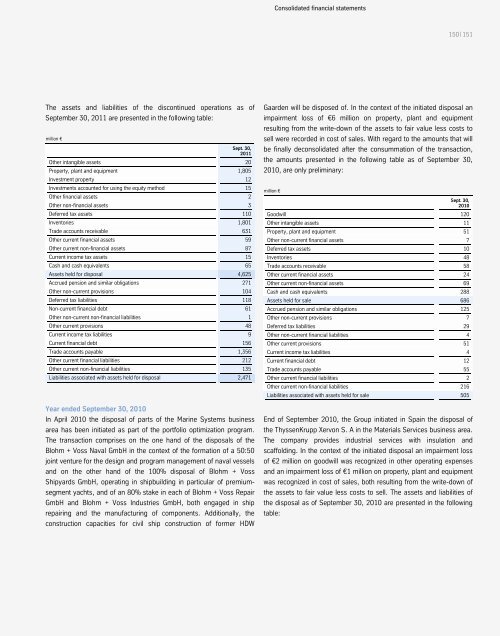

The assets and liabilities of the discontinued operations as of<br />

September 30, 2011 are presented in the following table:<br />

million €<br />

Sept. 30,<br />

2011<br />

Other intangible assets 20<br />

Property, plant and equipment 1,805<br />

Investment property 12<br />

Investments accounted for using the equity method 15<br />

Other financial assets 2<br />

Other non-financial assets 3<br />

Deferred tax assets 110<br />

Inventories 1,801<br />

Trade accounts receivable 631<br />

Other current financial assets 59<br />

Other current non-financial assets 87<br />

Current income tax assets 15<br />

Cash and cash equivalents 65<br />

Assets held for disposal 4,625<br />

Accrued pension and similar obligations 271<br />

Other non-current provisions 104<br />

Deferred tax liabilities 118<br />

Non-current financial debt 61<br />

Other non-current non-financial liabilities 1<br />

Other current provisions 48<br />

Current income tax liabilities 9<br />

Current financial debt 156<br />

Trade accounts payable 1,356<br />

Other current financial liabilities 212<br />

Other current non-financial liabilities 135<br />

Liabilities associated with assets held for disposal 2,471<br />

Year ended September 30, 2010<br />

In April 2010 the disposal of parts of the Marine Systems business<br />

area has been initiated as part of the portfolio optimization program.<br />

The transaction comprises on the one hand of the disposals of the<br />

Blohm + Voss Naval GmbH in the context of the formation of a 50:50<br />

joint venture for the design and program management of naval vessels<br />

and on the other hand of the 100% disposal of Blohm + Voss<br />

Shipyards GmbH, operating in shipbuilding in particular of premiumsegment<br />

yachts, and of an 80% stake in each of Blohm + Voss Repair<br />

GmbH and Blohm + Voss Industries GmbH, both engaged in ship<br />

repairing and the manufacturing of components. Additionally, the<br />

construction capacities for civil ship construction of former HDW<br />

Consolidated financial statements<br />

150 | 151<br />

Gaarden will be disposed of. In the context of the initiated disposal an<br />

impairment loss of €6 million on property, plant and equipment<br />

resulting from the write-down of the assets to fair value less costs to<br />

sell were recorded in cost of sales. With regard to the amounts that will<br />

be finally deconsolidated after the consummation of the transaction,<br />

the amounts presented in the following table as of September 30,<br />

2010, are only preliminary:<br />

million €<br />

Goodwill<br />

Sept. 30,<br />

2010<br />

120<br />

Other intangible assets 11<br />

Property, plant and equipment 51<br />

Other non-current financial assets 7<br />

Deferred tax assets 10<br />

Inventories 48<br />

Trade accounts receivable 58<br />

Other current financial assets 24<br />

Other current non-financial assets 69<br />

Cash and cash equivalents 288<br />

Assets held for sale 686<br />

Accrued pension and similar obligations 125<br />

Other non-current provisions 7<br />

Deferred tax liabilities 29<br />

Other non-current financial liabilities 4<br />

Other current provisions 51<br />

Current income tax liabilities 4<br />

Current financial debt 12<br />

Trade accounts payable 55<br />

Other current financial liabilities 2<br />

Other current non-financial liabilities 216<br />

Liabilities associated with assets held for sale 505<br />

End of September 2010, the Group initiated in Spain the disposal of<br />

the ThyssenKrupp Xervon S. A in the Materials Services business area.<br />

The company provides industrial services with insulation and<br />

scaffolding. In the context of the initiated disposal an impairment loss<br />

of €2 million on goodwill was recognized in other operating expenses<br />

and an impairment loss of €1 million on property, plant and equipment<br />

was recognized in cost of sales, both resulting from the write-down of<br />

the assets to fair value less costs to sell. The assets and liabilities of<br />

the disposal as of September 30, 2010 are presented in the following<br />

table: