Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

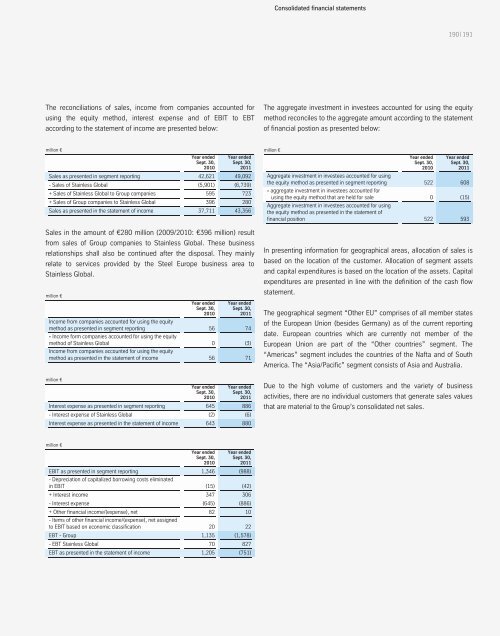

The reconciliations of sales, income from companies accounted for<br />

using the equity method, interest expense and of EBIT to EBT<br />

according to the statement of income are presented below:<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Sales as presented in segment reporting 42,621 49,092<br />

- Sales of Stainless Global (5,901) (6,739)<br />

+ Sales of Stainless Global to Group companies 595 723<br />

+ Sales of Group companies to Stainless Global 396 280<br />

Sales as presented in the statement of income 37,711 43,356<br />

Sales in the amount of €280 million (2009/2010: €396 million) result<br />

from sales of Group companies to Stainless Global. These business<br />

relationships shall also be continued after the disposal. They mainly<br />

relate to services provided by the Steel Europe business area to<br />

Stainless Global.<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Income from companies accounted for using the equity<br />

method as presented in segment reporting 56 74<br />

- Income form companies accounted for using the equity<br />

method of Stainless Global 0 (3)<br />

Income from companies accounted for using the equity<br />

method as presented in the statement of income 56 71<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Interest expense as presented in segment reporting 645 886<br />

- Interest expense of Stainless Global (2) (6)<br />

Interest expense as presented in the statement of income 643 880<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

EBIT as presented in segment reporting<br />

- Depreciation of capitalized borrowing costs eliminated<br />

1,346 (988)<br />

in EBIT (15) (42)<br />

+ Interest income 347 306<br />

- Interest expense (645) (886)<br />

+ Other financial income/(expense), net<br />

- Items of other financial income/(expense), net assigned<br />

82 10<br />

to EBIT based on economic classification 20 22<br />

EBT - Group 1,135 (1,578)<br />

- EBT Stainless Global 70 827<br />

EBT as presented in the statement of income 1,205 (751)<br />

Consolidated financial statements<br />

190 | 191<br />

The aggregate investment in investees accounted for using the equity<br />

method reconciles to the aggregate amount according to the statement<br />

of financial postion as presented below:<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Aggregate investment in investees accounted for using<br />

the equity method as presented in segment reporting 522 608<br />

- aggregate investment in investees accounted for<br />

using the equity method that are held for sale 0 (15)<br />

Aggregate investment in investees accounted for using<br />

the equity method as presented in the statement of<br />

financial position 522 593<br />

In presenting information for geographical areas, allocation of sales is<br />

based on the location of the customer. Allocation of segment assets<br />

and capital expenditures is based on the location of the assets. Capital<br />

expenditures are presented in line with the definition of the cash flow<br />

statement.<br />

The geographical segment “Other EU” comprises of all member states<br />

of the European Union (besides Germany) as of the current reporting<br />

date. European countries which are currently not member of the<br />

European Union are part of the “Other countries” segment. The<br />

“Americas” segment includes the countries of the Nafta and of South<br />

America. The “Asia/Pacific” segment consists of Asia and Australia.<br />

Due to the high volume of customers and the variety of business<br />

activities, there are no individual customers that generate sales values<br />

that are material to the Group’s consolidated net sales.