Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

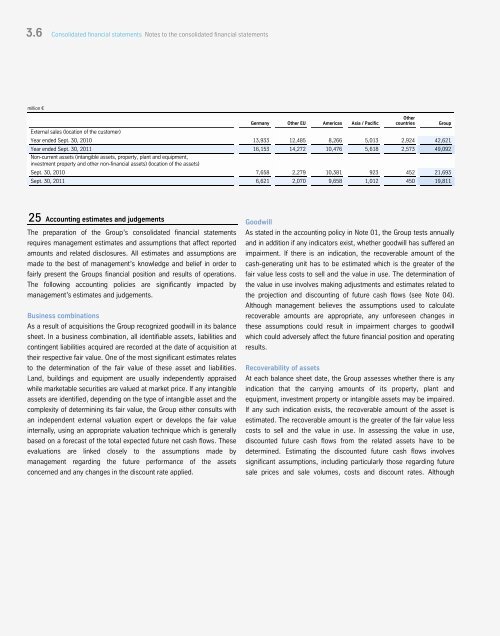

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

million €<br />

External sales (location of the customer)<br />

Germany Other EU Americas Asia / Pacific<br />

Other<br />

countries Group<br />

Year ended Sept. 30, 2010 13,933 12,485 8,266 5,013 2,924 42,621<br />

Year ended Sept. 30, 2011 16,153 14,272 10,476 5,618 2,573 49,092<br />

Non-current assets (intangible assets, property, plant and equipment,<br />

investment property and other non-financial assets) (location of the assets)<br />

Sept. 30, 2010 7,658 2,279 10,381 923 452 21,693<br />

Sept. 30, 2011 6,621 2,070 9,658 1,012 450 19,811<br />

25 Accounting estimates and judgements<br />

The preparation of the Group’s consolidated financial statements<br />

requires management estimates and assumptions that affect reported<br />

amounts and related disclosures. All estimates and assumptions are<br />

made to the best of management’s knowledge and belief in order to<br />

fairly present the Groups financial position and results of operations.<br />

The following accounting policies are significantly impacted by<br />

management’s estimates and judgements.<br />

Business combinations<br />

As a result of acquisitions the Group recognized goodwill in its balance<br />

sheet. In a business combination, all identifiable assets, liabilities and<br />

contingent liabilities acquired are recorded at the date of acquisition at<br />

their respective fair value. One of the most significant estimates relates<br />

to the determination of the fair value of these asset and liabilities.<br />

Land, buildings and equipment are usually independently appraised<br />

while marketable securities are valued at market price. If any intangible<br />

assets are identified, depending on the type of intangible asset and the<br />

complexity of determining its fair value, the Group either consults with<br />

an independent external valuation expert or develops the fair value<br />

internally, using an appropriate valuation technique which is generally<br />

based on a forecast of the total expected future net cash flows. These<br />

evaluations are linked closely to the assumptions made by<br />

management regarding the future performance of the assets<br />

concerned and any changes in the discount rate applied.<br />

Goodwill<br />

As stated in the accounting policy in Note 01, the Group tests annually<br />

and in addition if any indicators exist, whether goodwill has suffered an<br />

impairment. If there is an indication, the recoverable amount of the<br />

cash-generating unit has to be estimated which is the greater of the<br />

fair value less costs to sell and the value in use. The determination of<br />

the value in use involves making adjustments and estimates related to<br />

the projection and discounting of future cash flows (see Note 04).<br />

Although management believes the assumptions used to calculate<br />

recoverable amounts are appropriate, any unforeseen changes in<br />

these assumptions could result in impairment charges to goodwill<br />

which could adversely affect the future financial position and operating<br />

results.<br />

Recoverability of assets<br />

At each balance sheet date, the Group assesses whether there is any<br />

indication that the carrying amounts of its property, plant and<br />

equipment, investment property or intangible assets may be impaired.<br />

If any such indication exists, the recoverable amount of the asset is<br />

estimated. The recoverable amount is the greater of the fair value less<br />

costs to sell and the value in use. In assessing the value in use,<br />

discounted future cash flows from the related assets have to be<br />

determined. Estimating the discounted future cash flows involves<br />

significant assumptions, including particularly those regarding future<br />

sale prices and sale volumes, costs and discount rates. Although