Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

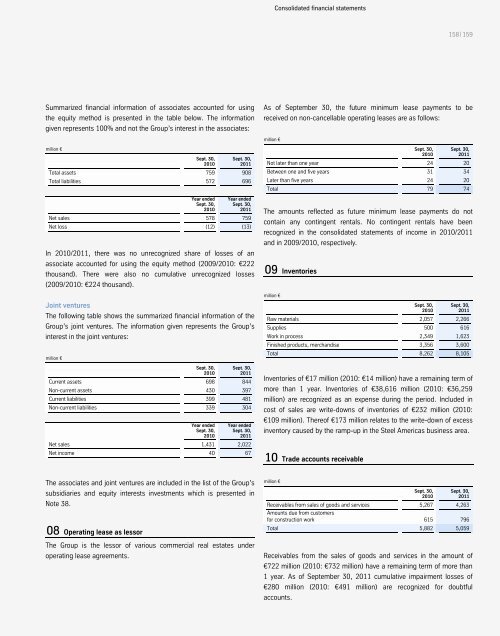

Summarized financial information of associates accounted for using<br />

the equity method is presented in the table below. The information<br />

given represents 100% and not the Group’s interest in the associates:<br />

million €<br />

Sept. 30,<br />

2010<br />

Sept. 30,<br />

2011<br />

Total assets 759 908<br />

Total liabilities 572 696<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Net sales 578 759<br />

Net loss (12) (13)<br />

In 2010/2011, there was no unrecognized share of losses of an<br />

associate accounted for using the equity method (2009/2010: €222<br />

thousand). There were also no cumulative unrecognized losses<br />

(2009/2010: €224 thousand).<br />

Joint ventures<br />

The following table shows the summarized financial information of the<br />

Group’s joint ventures. The information given represents the Group’s<br />

interest in the joint ventures:<br />

million €<br />

Sept. 30,<br />

2010<br />

Sept. 30,<br />

2011<br />

Current assets 698 844<br />

Non-current assets 430 397<br />

Current liabilities 399 481<br />

Non-current liabilities 339 304<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Net sales 1,431 2,022<br />

Net income 40 67<br />

The associates and joint ventures are included in the list of the Group’s<br />

subsidiaries and equity interests investments which is presented in<br />

Note 38.<br />

08 Operating lease as lessor<br />

The Group is the lessor of various commercial real estates under<br />

operating lease agreements.<br />

Consolidated financial statements<br />

158 | 159<br />

As of September 30, the future minimum lease payments to be<br />

received on non-cancellable operating leases are as follows:<br />

million €<br />

Sept. 30,<br />

2010<br />

Sept. 30,<br />

2011<br />

Not later than one year 24 20<br />

Between one and five years 31 34<br />

Later than five years 24 20<br />

Total 79 74<br />

The amounts reflected as future minimum lease payments do not<br />

contain any contingent rentals. No contingent rentals have been<br />

recognized in the consolidated statements of income in 2010/2011<br />

and in 2009/2010, respectively.<br />

09 Inventories<br />

million €<br />

Sept. 30,<br />

2010<br />

Sept. 30,<br />

2011<br />

Raw materials 2,057 2,266<br />

Supplies 500 616<br />

Work in process 2,349 1,623<br />

Finished products, merchandise 3,356 3,600<br />

Total 8,262 8,105<br />

Inventories of €17 million (2010: €14 million) have a remaining term of<br />

more than 1 year. Inventories of €38,616 million (2010: €36,259<br />

million) are recognized as an expense during the period. Included in<br />

cost of sales are write-downs of inventories of €232 million (2010:<br />

€109 million). Thereof €173 million relates to the write-down of excess<br />

inventory caused by the ramp-up in the Steel Americas business area.<br />

10 Trade accounts receivable<br />

million €<br />

Sept. 30,<br />

2010<br />

Sept. 30,<br />

2011<br />

Receivables from sales of goods and services<br />

Amounts due from customers<br />

5,267 4,263<br />

for construction work 615 796<br />

Total 5,882 5,059<br />

Receivables from the sales of goods and services in the amount of<br />

€722 million (2010: €732 million) have a remaining term of more than<br />

1 year. As of September 30, 2011 cumulative impairment losses of<br />

€280 million (2010: €491 million) are recognized for doubtful<br />

accounts.