Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.6 Consolidated financial statements Notes Notes to to the the consolidated financial financial statements<br />

Notes to the consolidated statement of income<br />

26 Net sales<br />

Net sales include revenues resulting from the rendering of services of<br />

€9,308 million (2009/2010: €9,127 million) as well as sales from<br />

construction contracts of €6,682 million (2009/2010: €6,101 million).<br />

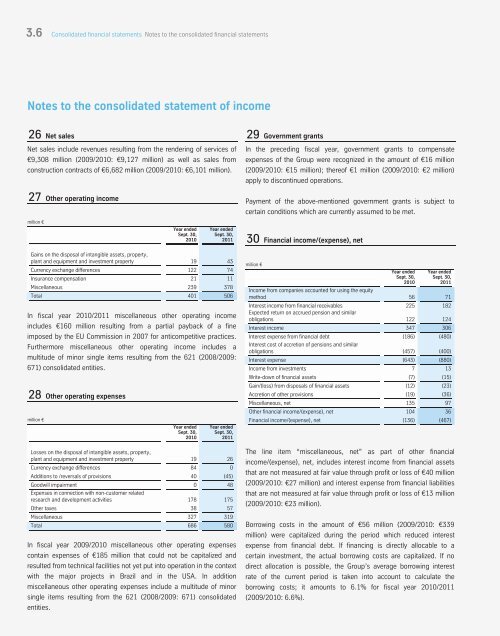

27 Other operating income<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Gains on the disposal of intangible assets, property,<br />

plant and equipment and investment property 19 43<br />

Currency exchange differences 122 74<br />

Insurance compensation 21 11<br />

Miscellaneous 239 378<br />

Total 401 506<br />

In fiscal year 2010/2011 miscellaneous other operating income<br />

includes €160 million resulting from a partial payback of a fine<br />

imposed by the EU Commission in 2007 for anticompetitive practices.<br />

Furthermore miscellaneous other operating income includes a<br />

multitude of minor single items resulting from the 621 (2008/2009:<br />

671) consolidated entities.<br />

28 Other operating expenses<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Losses on the disposal of intangible assets, property,<br />

plant and equipment and investment property 19 26<br />

Currency exchange differences 84 0<br />

Additions to /reversals of provisions 40 (45)<br />

Goodwill impairment<br />

Expenses in connection with non-customer related<br />

0 48<br />

research and development activities 178 175<br />

Other taxes 38 57<br />

Miscellaneous 327 319<br />

Total 686 580<br />

In fiscal year 2009/2010 miscellaneous other operating expenses<br />

contain expenses of €185 million that could not be capitalized and<br />

resulted from technical facilities not yet put into operation in the context<br />

with the major projects in Brazil and in the USA. In addition<br />

miscellaneous other operating expenses include a multitude of minor<br />

single items resulting from the 621 (2008/2009: 671) consolidated<br />

entities.<br />

29 Government grants<br />

In the preceding fiscal year, government grants to compensate<br />

expenses of the Group were recognized in the amount of €16 million<br />

(2009/2010: €15 million); thereof €1 million (2009/2010: €2 million)<br />

apply to discontinued operations.<br />

Payment of the above-mentioned government grants is subject to<br />

certain conditions which are currently assumed to be met.<br />

30 Financial income/(expense), net<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

194<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Income from companies accounted for using the equity<br />

method 56 71<br />

Interest income from financial receivables<br />

Expected return on accrued pension and similar<br />

225 182<br />

obligations 122 124<br />

Interest income 347 306<br />

Interest expense from financial debt<br />

Interest cost of accretion of pensions and similar<br />

(186) (480)<br />

obligations (457) (400)<br />

Interest expense (643) (880)<br />

Income from investments 7 13<br />

Write-down of financial assets (7) (15)<br />

Gain/(loss) from disposals of financial assets (12) (23)<br />

Accretion of other provisions (19) (36)<br />

Miscellaneous, net 135 97<br />

Other financial income/(expense), net 104 36<br />

Financial income/(expense), net (136) (467)<br />

The line item “miscellaneous, net” as part of other financial<br />

income/(expense), net, includes interest income from financial assets<br />

that are not measured at fair value through profit or loss of €40 million<br />

(2009/2010: €27 million) and interest expense from financial liabilities<br />

that are not measured at fair value through profit or loss of €13 million<br />

(2009/2010: €23 million).<br />

Borrowing costs in the amount of €56 million (2009/2010: €339<br />

million) were capitalized during the period which reduced interest<br />

expense from financial debt. If financing is directly allocable to a<br />

certain investment, the actual borrowing costs are capitalized. If no<br />

direct allocation is possible, the Group’s average borrowing interest<br />

rate of the current period is taken into account to calculate the<br />

borrowing costs; it amounts to 6.1% for fiscal year 2010/2011<br />

(2009/2010: 6.6%).