Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2.2 Management report on the Group Consolidated results of operations<br />

2.2 Management report on the Group Consolidated results of operations<br />

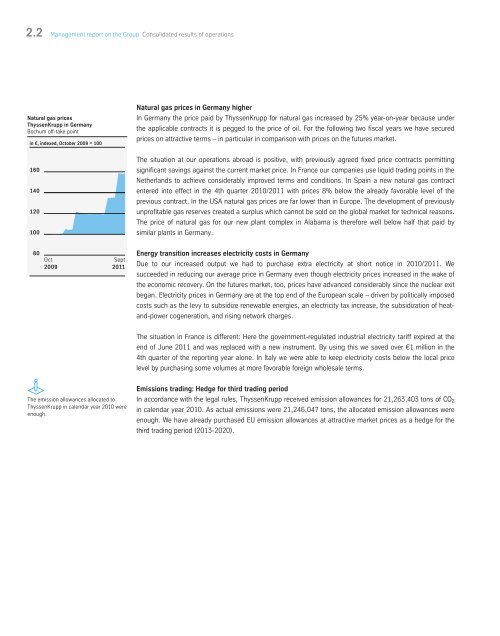

Natural gas prices<br />

ThyssenKrupp in Germany<br />

Bochum off-take point<br />

in €, indexed, October 2009 = 100<br />

160<br />

140<br />

120<br />

100<br />

80<br />

Oct<br />

2009<br />

Sept<br />

2011<br />

The emission allowances allocated to to<br />

ThyssenKrupp in in calendar year 2010 were<br />

were enough.<br />

enough.<br />

Natural gas prices in Germany higher<br />

In Germany the price paid by ThyssenKrupp for natural gas increased by 25% year-on-year because under<br />

the applicable contracts it is pegged to the price of oil. For the following two fiscal years we have secured<br />

prices on attractive terms – in particular in comparison with prices on the futures market.<br />

The situation at our operations abroad is positive, with previously agreed fixed price contracts permitting<br />

significant savings against the current market price. In France our companies use liquid trading points in the<br />

Netherlands to achieve considerably improved terms and conditions. In Spain a new natural gas contract<br />

entered into effect in the 4th quarter 2010/2011 with prices 8% below the already favorable level of the<br />

previous contract. In the USA natural gas prices are far lower than in Europe. The development of previously<br />

unprofitable gas reserves created a surplus which cannot be sold on the global market for technical reasons.<br />

The price of natural gas for our new plant complex in Alabama is therefore well below half that paid by<br />

similar plants in Germany.<br />

Energy transition increases electricity costs in Germany<br />

Due to our increased output we had to purchase extra electricity at short notice in 2010/2011. We<br />

succeeded in reducing our average price in Germany even though electricity prices increased in the wake of<br />

the economic recovery. On the futures market, too, prices have advanced considerably since the nuclear exit<br />

began. Electricity prices in Germany are at the top end of the European scale – driven by politically imposed<br />

costs such as the levy to subsidize renewable energies, an electricity tax increase, the subsidization of heatand-power<br />

cogeneration, and rising network charges.<br />

The situation in France is different: Here the government-regulated industrial electricity tariff expired at the<br />

end of June 2011 and was replaced with a new instrument. By using this we saved over €1 million in the<br />

4th quarter of the reporting year alone. In Italy we were able to keep electricity costs below the local price<br />

level by purchasing some volumes at more favorable foreign wholesale terms.<br />

Emissions trading: Hedge for third trading period<br />

In accordance with the legal rules, ThyssenKrupp received emission allowances for 21,263,403 tons of CO2<br />

in calendar year 2010. As actual emissions were 21,246,047 tons, the allocated emission allowances were<br />

enough. We have already purchased EU emission allowances at attractive market prices as a hedge for the<br />

third trading period (2013-2020).<br />

70