Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.6 Consolidated financial statements Notes Notes to to the the consolidated financial financial statements<br />

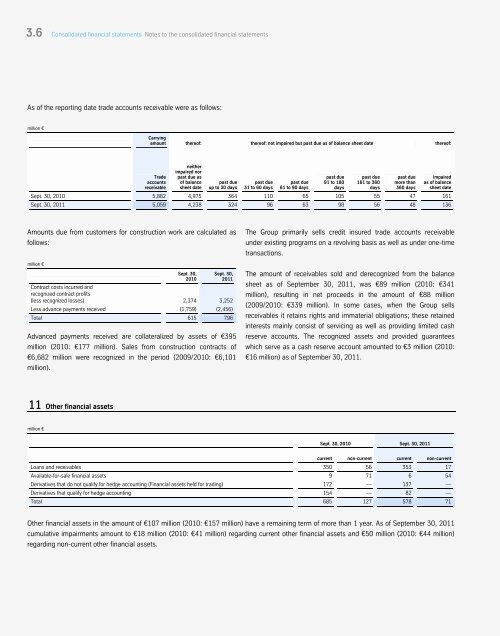

As of the reporting date trade accounts receivable were as follows:<br />

million €<br />

Carrying<br />

amount thereof: thereof: not impaired but past due as of balance sheet date thereof:<br />

Trade<br />

accounts<br />

receivable<br />

neither<br />

impaired nor<br />

past due as<br />

of balance<br />

sheet date<br />

past due<br />

up to 30 days<br />

past due<br />

31 to 60 days<br />

past due<br />

61 to 90 days<br />

past due<br />

91 to 180<br />

days<br />

past due<br />

181 to 360<br />

days<br />

past due<br />

more than<br />

360 days<br />

160<br />

impaired<br />

as of balance<br />

sheet date<br />

Sept. 30, 2010 5,882 4,975 364 110 65 105 55 47 161<br />

Sept. 30, 2011 5,059 4,238 324 96 63 98 56 48 136<br />

Amounts due from customers for construction work are calculated as<br />

follows:<br />

million €<br />

Sept. 30,<br />

2010<br />

Sept. 30,<br />

2011<br />

Contract costs incurred and<br />

recognized contract profits<br />

(less recognized losses) 2,374 3,252<br />

Less advance payments received (1,759) (2,456)<br />

Total 615 796<br />

Advanced payments received are collateralized by assets of €395<br />

million (2010: €177 million). Sales from construction contracts of<br />

€6,682 million were recognized in the period (2009/2010: €6,101<br />

million).<br />

11 Other financial assets<br />

million €<br />

The Group primarily sells credit insured trade accounts receivable<br />

under existing programs on a revolving basis as well as under one-time<br />

transactions.<br />

The amount of receivables sold and derecognized from the balance<br />

sheet as of September 30, 2011, was €89 million (2010: €341<br />

million), resulting in net proceeds in the amount of €88 million<br />

(2009/2010: €339 million). In some cases, when the Group sells<br />

receivables it retains rights and immaterial obligations; these retained<br />

interests mainly consist of servicing as well as providing limited cash<br />

reserve accounts. The recognized assets and provided guarantees<br />

which serve as a cash reserve account amounted to €3 million (2010:<br />

€16 million) as of September 30, 2011.<br />

Sept. 30, 2010 Sept. 30, 2011<br />

current non-current current non-current<br />

Loans and receivables 350 56 353 17<br />

Available-for-sale financial assets 9 71 6 54<br />

Derivatives that do not qualify for hedge accounting (Financial assets held for trading) 172 — 137 —<br />

Derivatives that qualify for hedge accounting 154 — 82 —<br />

Total 685 127 578 71<br />

Other financial assets in the amount of €107 million (2010: €157 million) have a remaining term of more than 1 year. As of September 30, 2011<br />

cumulative impairments amount to €18 million (2010: €41 million) regarding current other financial assets and €50 million (2010: €44 million)<br />

regarding non-current other financial assets.