Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.6 Consolidated financial statements Notes Notes to to the the consolidated financial financial statements<br />

06 Investment property<br />

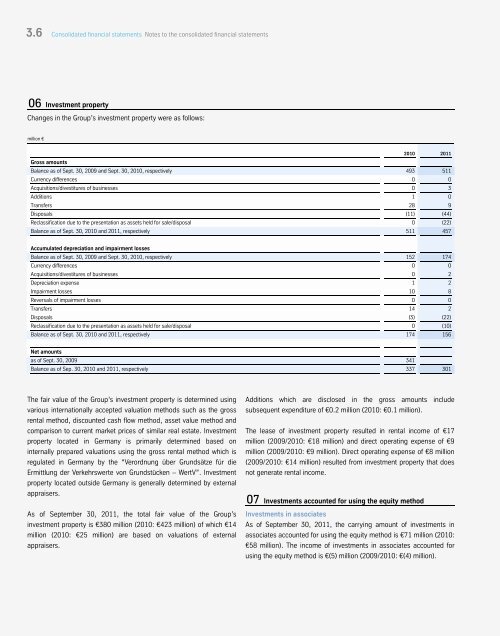

Changes in the Group’s investment property were as follows:<br />

million €<br />

Gross amounts<br />

158<br />

2010 2011<br />

Balance as of Sept. 30, 2009 and Sept. 30, 2010, respectively 493 511<br />

Currency differences 0 0<br />

Acquisitions/divestitures of businesses 0 3<br />

Additions 1 0<br />

Transfers 28 9<br />

Disposals (11) (44)<br />

Reclassification due to the presentation as assets held for sale/disposal 0 (22)<br />

Balance as of Sept. 30, 2010 and 2011, respectively 511 457<br />

Accumulated depreciation and impairment losses<br />

Balance as of Sept. 30, 2009 and Sept. 30, 2010, respectively 152 174<br />

Currency differences 0 0<br />

Acquisitions/divestitures of businesses 0 2<br />

Depreciation expense 1 2<br />

Impairment losses 10 8<br />

Reversals of impairment losses 0 0<br />

Transfers 14 2<br />

Disposals (3) (22)<br />

Reclassification due to the presentation as assets held for sale/disposal 0 (10)<br />

Balance as of Sept. 30, 2010 and 2011, respectively 174 156<br />

Net amounts<br />

as of Sept. 30, 2009 341<br />

Balance as of Sep. 30, 2010 and 2011, respectively 337 301<br />

The fair value of the Group’s investment property is determined using<br />

various internationally accepted valuation methods such as the gross<br />

rental method, discounted cash flow method, asset value method and<br />

comparison to current market prices of similar real estate. Investment<br />

property located in Germany is primarily determined based on<br />

internally prepared valuations using the gross rental method which is<br />

regulated in Germany by the “Verordnung über Grundsätze für die<br />

Ermittlung der Verkehrswerte von Grundstücken – WertV”. Investment<br />

property located outside Germany is generally determined by external<br />

appraisers.<br />

As of September 30, 2011, the total fair value of the Group’s<br />

investment property is €380 million (2010: €423 million) of which €14<br />

million (2010: €25 million) are based on valuations of external<br />

appraisers.<br />

Additions which are disclosed in the gross amounts include<br />

subsequent expenditure of €0.2 million (2010: €0.1 million).<br />

The lease of investment property resulted in rental income of €17<br />

million (2009/2010: €18 million) and direct operating expense of €9<br />

million (2009/2010: €9 million). Direct operating expense of €8 million<br />

(2009/2010: €14 million) resulted from investment property that does<br />

not generate rental income.<br />

07 Investments accounted for using the equity method<br />

Investments in associates<br />

As of September 30, 2011, the carrying amount of investments in<br />

associates accounted for using the equity method is €71 million (2010:<br />

€58 million). The income of investments in associates accounted for<br />

using the equity method is €(5) million (2009/2010: €(4) million).