Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

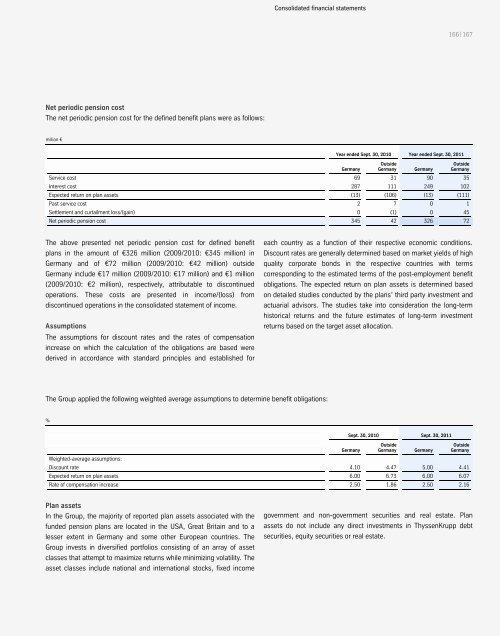

Net periodic pension cost<br />

The net periodic pension cost for the defined benefit plans were as follows:<br />

million €<br />

Consolidated financial statements<br />

166 | 167<br />

Year ended Sept. 30, 2010 Year ended Sept. 30, 2011<br />

Outside<br />

Outside<br />

Germany Germany Germany Germany<br />

Service cost 69 31 90 35<br />

Interest cost 287 111 249 102<br />

Expected return on plan assets (13) (106) (13) (111)<br />

Past service cost 2 7 0 1<br />

Settlement and curtailment loss/(gain) 0 (1) 0 45<br />

Net periodic pension cost 345 42 326 72<br />

The above presented net periodic pension cost for defined benefit<br />

plans in the amount of €326 million (2009/2010: €345 million) in<br />

Germany and of €72 million (2009/2010: €42 million) outside<br />

Germany include €17 million (2009/2010: €17 million) and €1 million<br />

(2009/2010: €2 million), respectively, attributable to discontinued<br />

operations. These costs are presented in income/(loss) from<br />

discontinued operations in the consolidated statement of income.<br />

Assumptions<br />

The assumptions for discount rates and the rates of compensation<br />

increase on which the calculation of the obligations are based were<br />

derived in accordance with standard principles and established for<br />

The Group applied the following weighted average assumptions to determine benefit obligations:<br />

%<br />

each country as a function of their respective economic conditions.<br />

Discount rates are generally determined based on market yields of high<br />

quality corporate bonds in the respective countries with terms<br />

corresponding to the estimated terms of the post-employment benefit<br />

obligations. The expected return on plan assets is determined based<br />

on detailed studies conducted by the plans’ third party investment and<br />

actuarial advisors. The studies take into consideration the long-term<br />

historical returns and the future estimates of long-term investment<br />

returns based on the target asset allocation.<br />

Sept. 30, 2010 Sept. 30, 2011<br />

Outside<br />

Germany Germany<br />

Outside<br />

Germany<br />

Germany<br />

Weighted-average assumptions:<br />

Discount rate 4.10 4.47 5.00 4.41<br />

Expected return on plan assets 6.00 6.73 6.00 6.07<br />

Rate of compensation increase 2.50 1.86 2.50 2.16<br />

Plan assets<br />

In the Group, the majority of reported plan assets associated with the<br />

funded pension plans are located in the USA, Great Britain and to a<br />

lesser extent in Germany and some other European countries. The<br />

Group invests in diversified portfolios consisting of an array of asset<br />

classes that attempt to maximize returns while minimizing volatility. The<br />

asset classes include national and international stocks, fixed income<br />

government and non-government securities and real estate. Plan<br />

assets do not include any direct investments in ThyssenKrupp debt<br />

securities, equity securities or real estate.