Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.6 Consolidated financial statements Notes Notes to to the the consolidated financial financial statements<br />

Impairment of goodwill<br />

Goodwill impairment losses are included in other operating expenses.<br />

Based on business expectations in 2009/2010 the annual impairment<br />

test did not indicate that goodwill might be impaired because the<br />

recoverable amounts of all cash generating units (CGUs) exceeded the<br />

respective carrying amounts.<br />

In the annual impairment test in 2010/2011, a more negative<br />

assessment of the economic situation and the connected surrounding<br />

conditions indicated that goodwill of the CGUs of the Stainless Global<br />

business area has to be impaired in the amount of €290 million<br />

because the recoverable amounts of the respective CGU were less than<br />

the respective carrying amounts. In the ThyssenKrupp Nirosta CGU<br />

which is a producer of stainless flat products, the impairment loss<br />

amounted to €166 million. The determination of the recoverable<br />

amount was derived from the value in use based on a discount rate of<br />

8.1%. Moreover, in the ThyssenKrupp Mexinox CGU which is bundling<br />

the Mexico business of stainless flat products, an impairment loss of<br />

€72 million had to be recognized. The determination of the recoverable<br />

amount was derived from the value in use based on a discount rate of<br />

9.3%. In the ThyssenKrupp Acciai Speciali Terni CGU which is also a<br />

producer of stainless flat products, the impairment loss amounted to<br />

€39 million. The determination of the recoverable amount was derived<br />

from the value in use based on a discount rate of 9.9%. The remaining<br />

impairment loss almost solely applies to the ThyssenKrupp Stainless<br />

International CGU. Additional adjustments are disclosed in Note 03.<br />

Impairment of other intangible assets<br />

Impairment losses of intangible assets other than goodwill are included<br />

in cost of sales.<br />

In 2009/2010 the Components Technology business area impaired in<br />

the Presta Steering and Camshafts operating units capitalized<br />

development costs of €5 million because the recognition criteria of IAS<br />

38 were no longer met.<br />

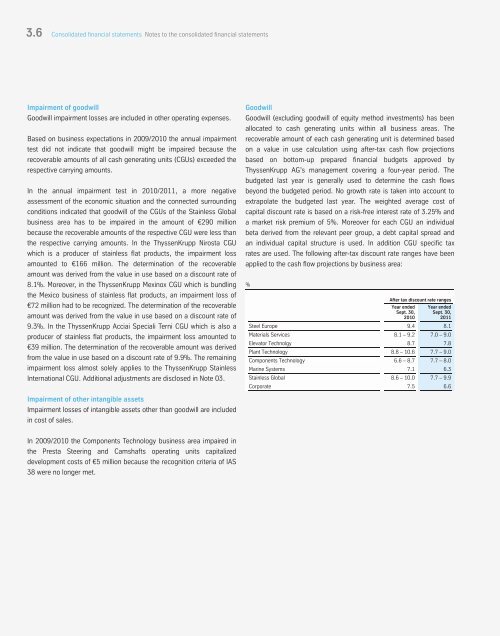

Goodwill<br />

Goodwill (excluding goodwill of equity method investments) has been<br />

allocated to cash generating units within all business areas. The<br />

recoverable amount of each cash generating unit is determined based<br />

on a value in use calculation using after-tax cash flow projections<br />

based on bottom-up prepared financial budgets approved by<br />

ThyssenKrupp AG’s management covering a four-year period. The<br />

budgeted last year is generally used to determine the cash flows<br />

beyond the budgeted period. No growth rate is taken into account to<br />

extrapolate the budgeted last year. The weighted average cost of<br />

capital discount rate is based on a risk-free interest rate of 3.25% and<br />

a market risk premium of 5%. Moreover for each CGU an individual<br />

beta derived from the relevant peer group, a debt capital spread and<br />

an individual capital structure is used. In addition CGU specific tax<br />

rates are used. The following after-tax discount rate ranges have been<br />

applied to the cash flow projections by business area:<br />

%<br />

154<br />

After tax discount rate ranges<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Steel Europe 9.4 8.1<br />

Materials Services 8.1 – 9.2 7.0 – 9.0<br />

Elevator Technolgy 8.7 7.8<br />

Plant Technology 8.8 – 10.6 7.7 – 9.0<br />

Components Technology 6.6 – 8.7 7.7 – 8.0<br />

Marine Systems 7.1 6.3<br />

Stainless Global 8.6 – 10.0 7.7 – 9.9<br />

Corporate 7.5 6.6