Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

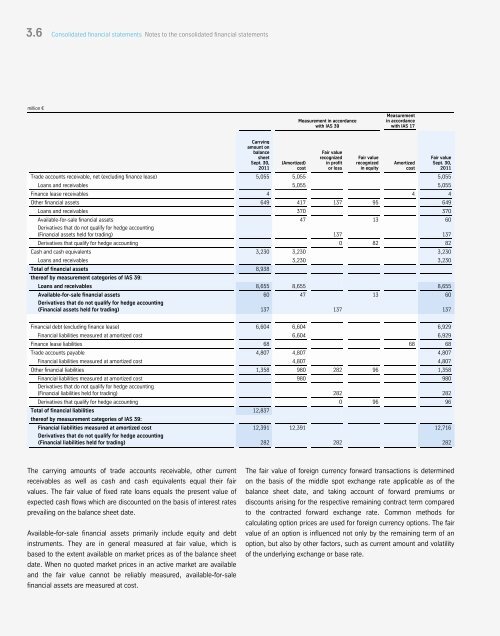

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

million €<br />

Carrying<br />

amount on<br />

balance<br />

sheet<br />

Sept. 30,<br />

2011<br />

(Amortized)<br />

cost<br />

Measurement in accordance<br />

with IAS 39<br />

Fair value<br />

recognized<br />

in profit<br />

or loss<br />

Fair value<br />

recognized<br />

in equity<br />

Measurement<br />

in accordance<br />

with IAS 17<br />

Amortized<br />

cost<br />

Trade accounts receivable, net (excluding finance lease) 5,055 5,055 5,055<br />

Loans and receivables 5,055 5,055<br />

Finance lease receivables 4 4 4<br />

Other financial assets 649 417 137 95 649<br />

Loans and receivables 370 370<br />

178<br />

Fair value<br />

Sept. 30,<br />

2011<br />

Available-for-sale financial assets 47 13 60<br />

Derivatives that do not qualify for hedge accounting<br />

(Financial assets held for trading) 137 137<br />

Derivatives that qualify for hedge accounting 0 82 82<br />

Cash and cash equivalents 3,230 3,230 3,230<br />

Loans and receivables 3,230 3,230<br />

Total of financial assets 8,938<br />

thereof by measurement categories of IAS 39:<br />

Loans and receivables 8,655 8,655 8,655<br />

Available-for-sale financial assets 60 47 13 60<br />

Derivatives that do not qualify for hedge accounting<br />

(Financial assets held for trading) 137 137 137<br />

Financial debt (excluding finance lease) 6,604 6,604 6,929<br />

Financial liabilities measured at amortized cost 6,604 6,929<br />

Finance lease liabilities 68 68 68<br />

Trade accounts payable 4,807 4,807 4,807<br />

Financial liabilities measured at amortized cost 4,807 4,807<br />

Other financial liabilities 1,358 980 282 96 1,358<br />

Financial liabilities measured at amortized cost 980 980<br />

Derivatives that do not qualify for hedge accounting<br />

(Financial liabilities held for trading) 282 282<br />

Derivatives that qualify for hedge accounting 0 96 96<br />

Total of financial liabilities 12,837<br />

thereof by measurement categories of IAS 39:<br />

Financial liabilities measured at amortized cost 12,391 12,391 12,716<br />

Derivatives that do not qualify for hedge accounting<br />

(Financial liabilities held for trading) 282 282 282<br />

The carrying amounts of trade accounts receivable, other current<br />

receivables as well as cash and cash equivalents equal their fair<br />

values. The fair value of fixed rate loans equals the present value of<br />

expected cash flows which are discounted on the basis of interest rates<br />

prevailing on the balance sheet date.<br />

Available-for-sale financial assets primarily include equity and debt<br />

instruments. They are in general measured at fair value, which is<br />

based to the extent available on market prices as of the balance sheet<br />

date. When no quoted market prices in an active market are available<br />

and the fair value cannot be reliably measured, available-for-sale<br />

financial assets are measured at cost.<br />

The fair value of foreign currency forward transactions is determined<br />

on the basis of the middle spot exchange rate applicable as of the<br />

balance sheet date, and taking account of forward premiums or<br />

discounts arising for the respective remaining contract term compared<br />

to the contracted forward exchange rate. Common methods for<br />

calculating option prices are used for foreign currency options. The fair<br />

value of an option is influenced not only by the remaining term of an<br />

option, but also by other factors, such as current amount and volatility<br />

of the underlying exchange or base rate.